The Ongoing Housing Crunch

Residential REITs enable people to live in a range of types of dwellings including apartments, single family houses, and manufactured homes. Residential REITs own more than 1.1 million apartment units and 157,000 single family rental houses, as well as manufactured home communities, RV parks, and marinas.

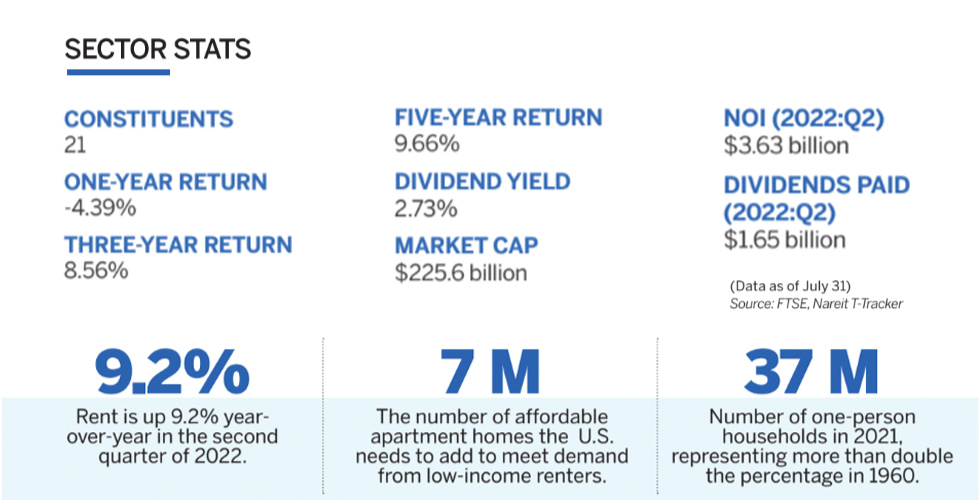

The ongoing housing crunch has helped REITs maintain strong operating performance through the past few years. As more adults choose to live alone, demand for housing continues to rise even without population growth. Occupancy rates for apartments have been at all-time highs—more than 96% in the first quarter of 2022. The latest earnings report shows residential REIT FFO was up 5.6% from the previous quarter and up 24.9% over the previous year in the first quarter of 2022.

Residential REITs finished 2021 with market returns up 58.3%, outpacing the FTSE All Equity REITs Index return by 17 percentage points. However, with tightening monetary policy and recession fears increasing, the property sector has not been spared the broad downturn in the stock market. Year-to-date returns for July 30 are down 14.6%.

New construction has continued to fall short of the demand for housing; thus, in the long-term, residential REITs face favorable conditions.