A peer-reviewed, academic study, sponsored by Nareit, provides the first meaningful analysis comparing the sustainability performance of REITs and Private Equity Real Estate (PERE) funds, as well as an analysis of the relationship between sustainability reporting and the financial performance of REITs.

Download the executive summary. (PDF)

Highlights of the study include:

- REITs outperform private real estate in sustainability performance.

- REITs that disclose sustainability data outperform those that do not in a number of financial metrics.

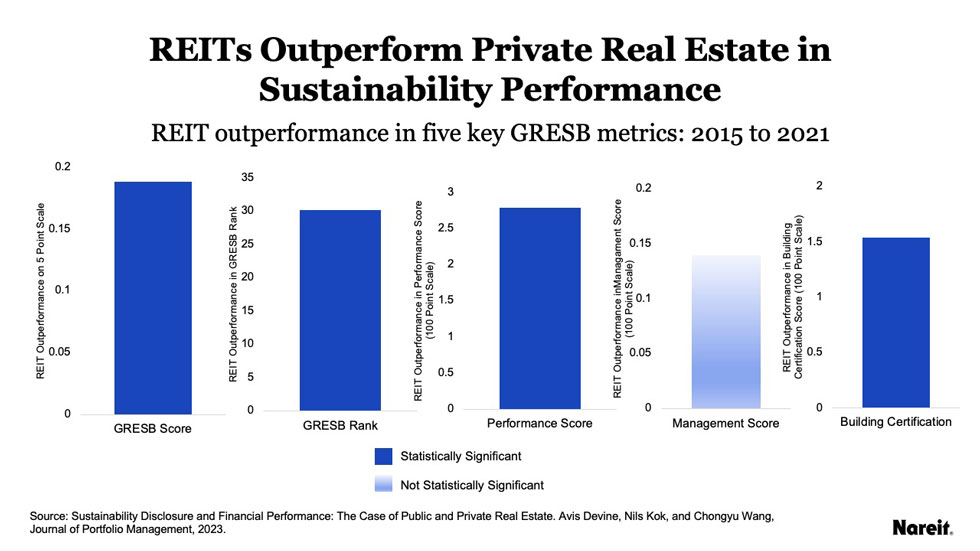

To compare REITs and PERE funds’ sustainability performance, the study analyzes the GRESB performance of a matched sample of REITs and NCREIF ODCE funds.

As the figure above shows over the sample period, REITs have statistically significant outperformance in four of the five measures of sustainability performance studied.

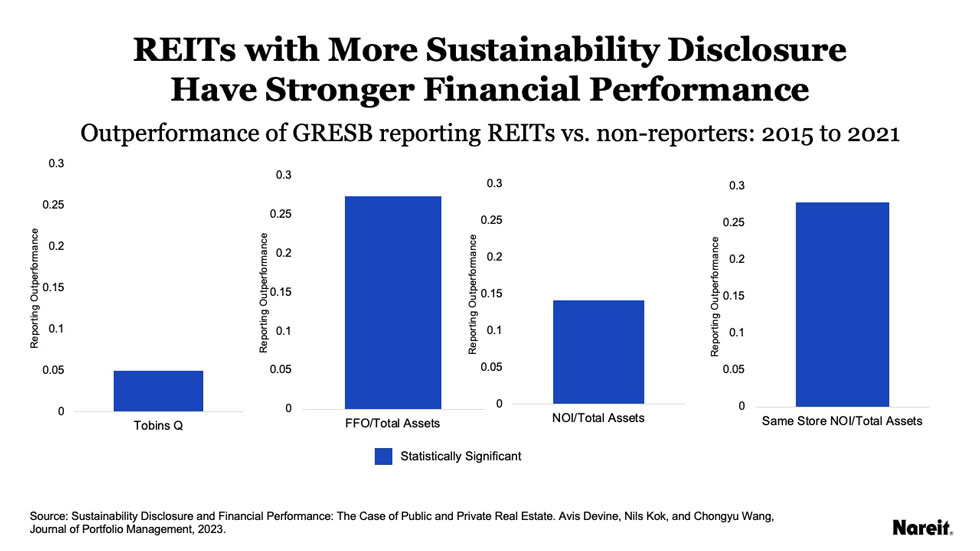

The study also considers the relationship between REIT operational and financial performance and sustainability disclosure. The study compares measures of financial performance between REITs that are GRESB participants and REITs that are non-participants as well as comparing performance and GRESB scores.

The results show that REITs that have higher levels of sustainability disclosure have stronger financial/operational performance, even after controlling for observable factors.

Listen to Nareit’s REIT Report episode with author Avis Devine.