Highlights

- 168 million Americans live in households that own REIT stocks.

- 50% of households own REITs.

Download this research as a PDF.

January 2024 - This research note estimates the number of American households and Americans who own REIT stocks directly or indirectly through mutual funds, ETFs, or target date funds. We estimate that approximately 168 million Americans, or roughly 50% of American house-holds, are invested in REIT stocks. The key sources of data for this analysis are the 2022 Federal Reserve Board Survey of Consumer Finances (SCF), the 2023 Employment Benefit Research Institute (EBRI) data on 401 (k) equity allocations, census population and household counts, census household income statistics, and Morningstar Direct data on asset weighted REIT exposures by investment product type.

Defining the Share of Households with Equity Ownership

The SCF[1] reports household equity exposure in one or more of these non-mutually exclusive channels: tax deferred retirement accounts (54.3% of households), direct stock (21.0%), direct holdings of pooled investment funds (11.5%), and other managed assets (6.2%). Taken together, the SCF reports that, nationwide, 58.0% of households have equity exposure through at least one of these channels. The predominant channel for equity exposure is tax deferred retirement accounts, a key assumption used below.

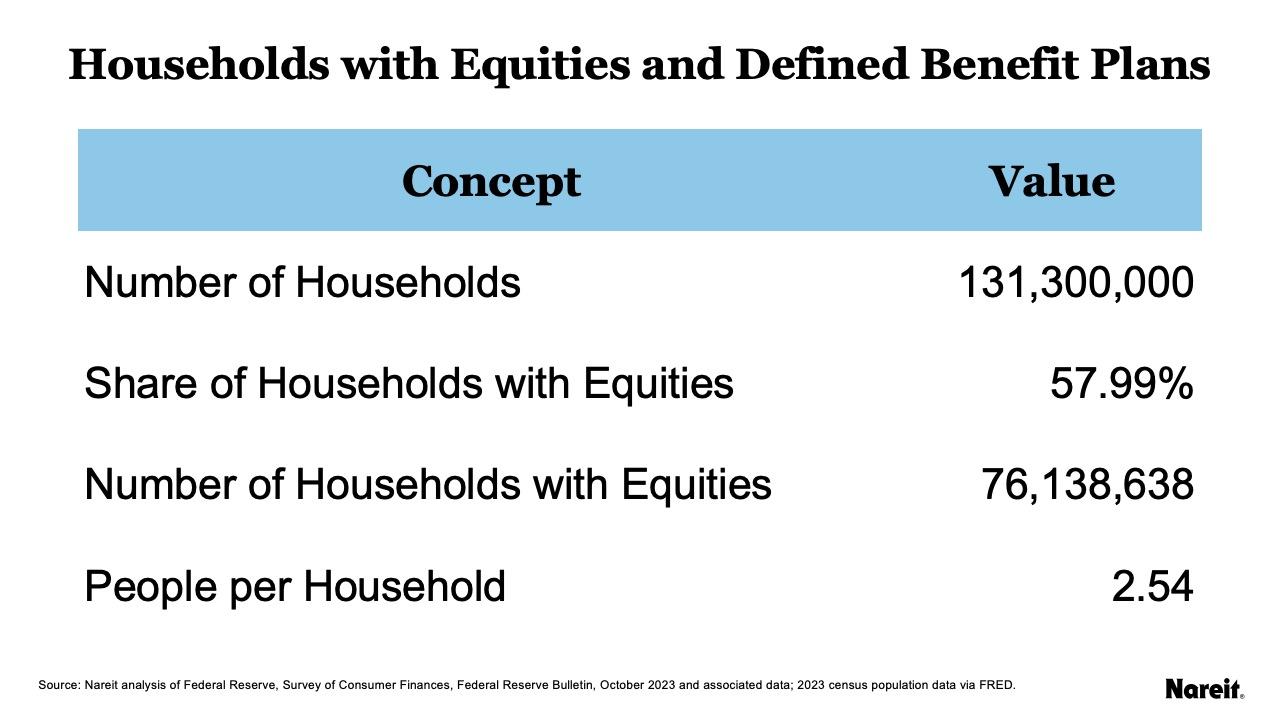

Table 1 shows the number of households and associated number of people per household as derived from SCF and Census data.

Estimating REIT Ownership Among Equity Owners

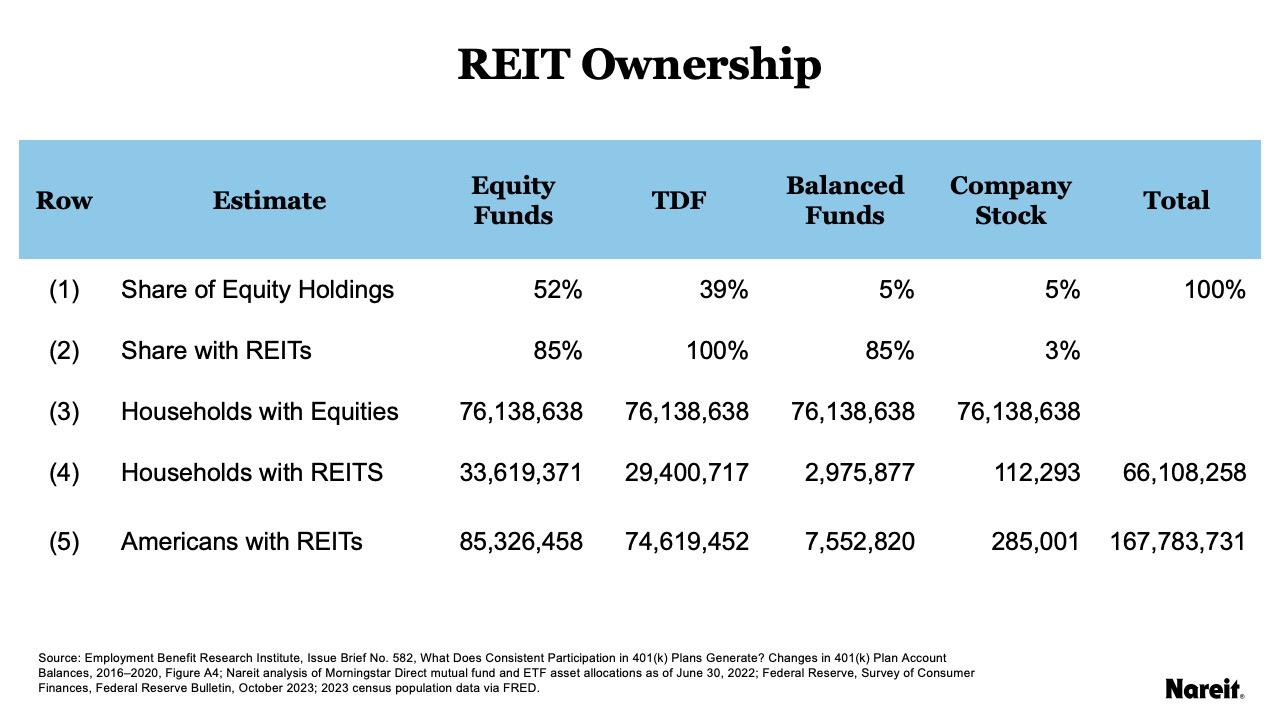

As noted, the dominant form of stock ownership is through a tax deferred retirement account, most typically through an employer sponsored 401(k) plan. EBRI estimates the average asset allocation in 401 (k) accounts. EBRI divides equity ownership vehicles into four categories, which are treated as mutually exclusive by EBRI and for this analysis. The four categories are equity funds, target date funds, balanced funds, and company stock. The shares are shown in row (1) of Table 2.

For each of these four fund types we can estimate the share of assets that have REIT exposure using Morningstar Direct data. This analysis is done on an asset-weighted basis and is shown in row (2) of Table 2.

- Generalist equity funds: 85% have some REIT exposure. For these purposes this is likely a conservative estimate because broad-based passive funds are more likely to have REIT exposure and are popular in 401(k) plans.

- Target date funds: Nearly 100% of target date funds have REIT exposure.

- Balanced funds: Assumed to be the same as generalist equity funds.

- Company stock: Assumed to be 3%. This approximates REITs’ share of equity market capitalization in the S&P 1500.

Multiplying the share of fund ownership by the share of funds with REITs by the number of households with equities and summing across fund types yields the total number of households with REITs. As shown in row (4) of Table 2, 66.1 million households (approximately 50% of households) have REITs. Finally, multiplying the number of households by the average number of people per household from Census data (2.54), yields approximately 168 million Americans in households with REIT ownership.

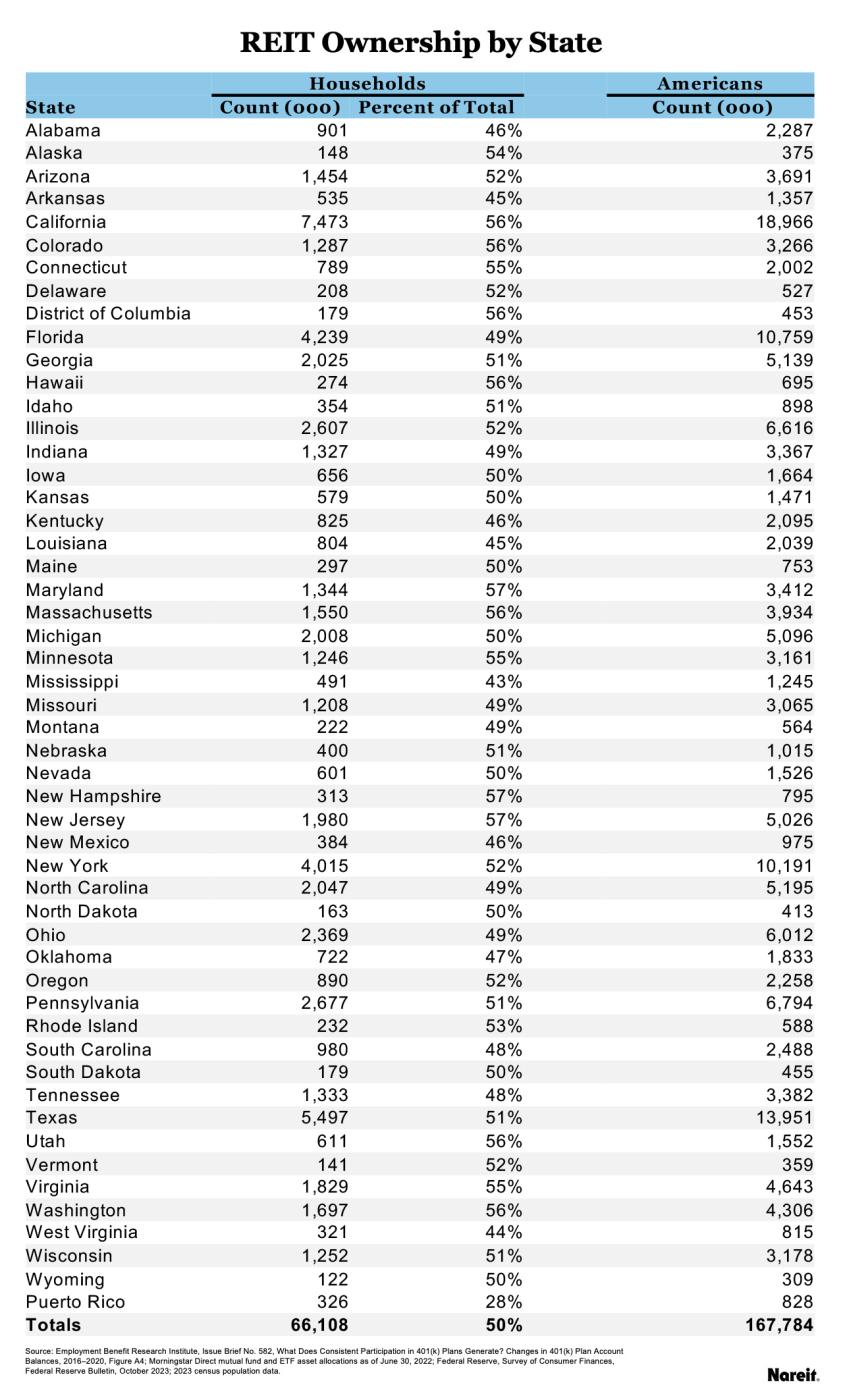

Ownership by State

These estimates are decomposed to the state level using the relationship between equity ownership and state household income distributions. Table 3 provides the estimates. State ownership is estimated by deriving the share of households with stock ownership in five household income categories (<$25,000, $25 to $50,000, $50 to $75,000, $75 to $100,000, and more than $100,000) using Fed SCF data. These ownership shares are then applied at the state level using census counts of households by income bracket. This yields an estimate of the number of households with equity ownership by state. The number of households with REIT ownership is derived by applying the same methodology used in Table 2.

[1] Federal Reserve, Survey of Consumer Finances, Federal Reserve Bulletin, October 2023.