When is the Economy Going to Reopen?

The good news about the outlook for the economy and commercial real estate as of early June is that we are likely at a turning point for consumer spending and business activity. The stay-at-home orders and business closures in response to the spread of COVID-19 are easing across most cities and states, and sales are likely to increase as stores reopen in June.

The bad news is that the early stages of recovery will be tentative and uneven. Many shoppers and employees will be cautious about going back to stores, gyms, restaurants or the workplace even after restrictions are lifted, and may remain hesitant as long as the pace of new cases is high and there is no vaccine or treatment. There will likely be local and regional setbacks as virus cases flare up again, requiring renewed tightening of social distancing measures.

Furthermore, the tidal wave of layoffs and business failures has caused economic damage that will take time to resolve. The speed and size of the rise of unemployment in just two months is unprecedented, with the unemployment rate going from 3.5% in February to 14.7% in April. Many of these workers may return to their old jobs, and indeed, the job market staged a small rebound in May with a 2.5 million increase in payroll employment and decrease in the unemployment rate, to 13.3%. Others will not go back to work right away, however, either because their position has been eliminated or because their employer closed permanently. Firms that have closed permanently will eventually be replaced in the marketplace, but the process of organizing a new business and arranging financing also takes time.

Fortunately, the economy will have some help getting back on its feet. The response by policymakers in lowering interest rates, passing trillions of dollars of stimulus spending, and setting up credit facilities to lend to companies to retain their workers has been unprecedented in speed, scope, and size.

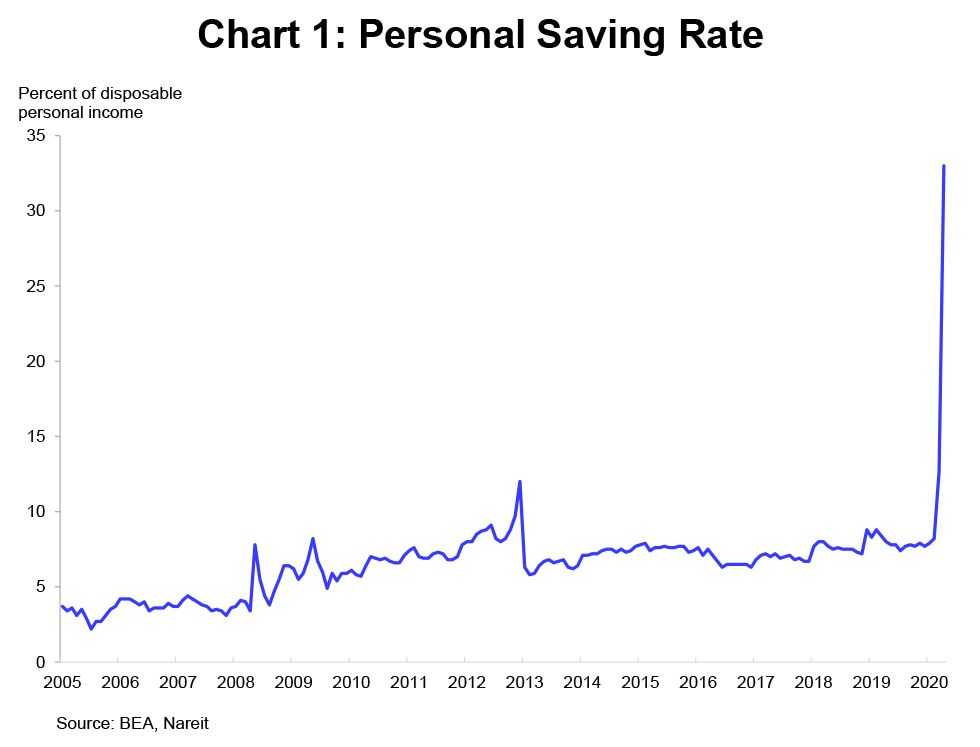

There will be some additional spending power coming from the private sector, too. Consumer spending has fallen much further than disposable personal income, as many of those who are still employed have slashed their discretionary purchases. The saving rate more than quadrupled in recent months, from 7.7% in January to 33% in April. Collectively, with the higher saving rate plus stimulus payments consumers have accumulated an additional $2 trillion in their bank accounts in the past few months, and this pent-up spending power may help the economy revive as stores reopen.

What’s the Outlook for the Commercial Real Estate Market?

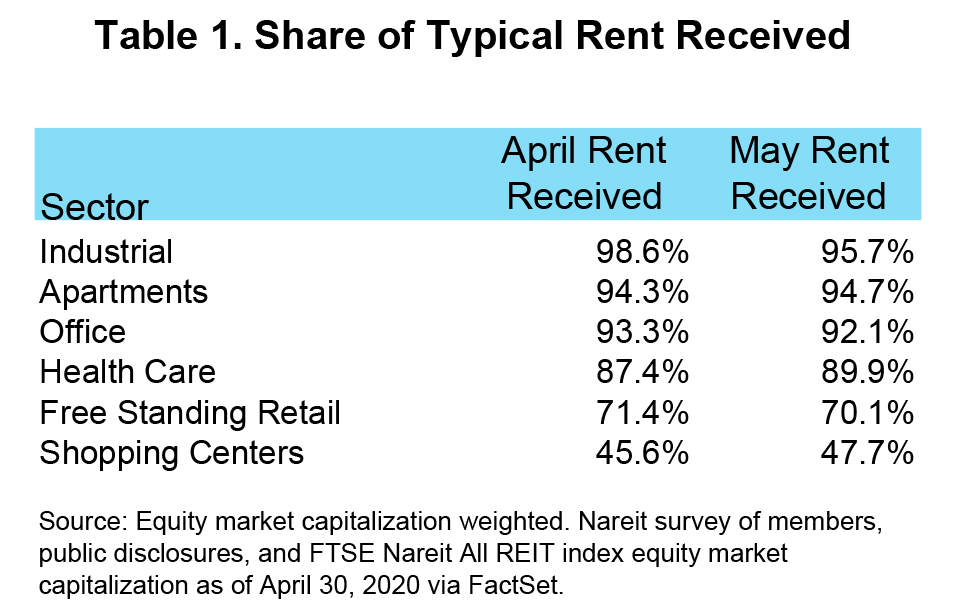

Tenants’ troubles during the COVID-19 pandemic have quickly become problems for the property owners as well, as many tenants have struggled to pay their rent on time, have closed store locations, or gone out of business completely. The degree of difficulties varies widely according to property type. A Nareit survey of its REIT members found that in the retail sector in April and May, shopping centers had received less than 50% of their typical rents, and free standing retail received about 70% (regional malls experienced a large shortfall in receipts, but the survey did not receive enough responses to publish results for the sector). Other property sectors, however, collected a far higher proportion of typical rents, with the office, apartment, and industrial sectors reporting greater than 90% of normal receipts.

The COVID-19 crisis has caused a weakening in demand for leased commercial space that was noticeable in data for the first quarter, even though the crisis only intensified in the final weeks of the quarter. Vacancy rates moved higher for the office, apartment, industrial, and retail property sectors. Net absorption, i.e. growth of demand, in the office market was 3.5 million square feet, the lowest since 2010, and net absorption of retail properties was negative for the first time since 2009. The industrial and apartment markets experienced a bit stronger demand, but net absorption fell short of completions of new buildings, causing vacancy rates to move higher.

Rent growth slowed with the softening of demand. Rents were still higher, however, on both a sequential quarter-over-quarter basis and also versus one year ago. Economic and business conditions worsened sharply in April and May and rents may well decline in the second quarter.

The weakening in demand and rents will weigh on prices of commercial real estate. Prices rose steadily in recent years, with increases averaging 7.8% from 2015 through 2019, according to data from CoStar. Prices of multifamily properties rose more rapidly, averaging 9.1%, reflecting shortages of apartments and other housing in most major cities. After this decade-long increase, prices of multifamily properties were 80% higher in March 2020 than in December 2007. Prices of properties excluding multifamily rose a bit more slowly, averaging 6.8% from 2015 through 2019, and as of March were 25% higher than December 2007.

Price increases of this magnitude raise concerns that rich valuations could be vulnerable to sizable declines in the months ahead. Indeed, cap rates declined steadily over the past decade and in early 2020 were below the lows reached in 2007. A fair amount of this decline, however, reflects the low-yield environment and decline in interest rates over this period. Cap rate spreads to the 10-year Treasury yield, which reflect the return over the risk-free rate for investing in commercial real estate, range from 475 bps in the apartment sector to 600 bps in retail properties, much wider than they were in the 2000s. This suggests that valuations are not as vulnerable during this crisis as simply looking at cap rates might indicate.

How has COVID-19 Impacted REIT Performance in 2020?

REIT earnings fell in the first quarter of 2020 due to the stay-at-home orders and business shutdowns. Funds from operations (FFO) of all equity REITs were down 9.0% from the prior quarter, to $15 billion (see the Nareit T-Tracker®). The impact of the COVID-19 crisis varied widely, however, with FFO of lodging/resorts declining 67.2%, and regional malls down 11.6%. Industrial REITs, on the other hand, reported FFO up 21.7% as a surge in ecommerce purchases bolstered demand for logistics facilities, and single-family home rental REITs saw a 7.0% increase in FFO.

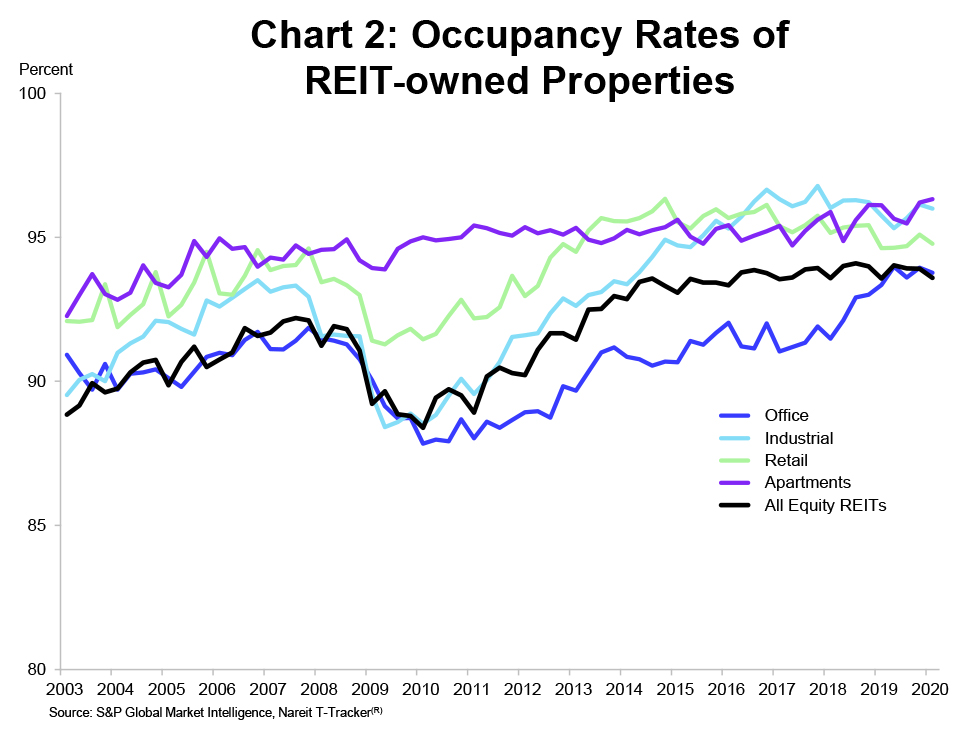

The pandemic did not have much impact on operating results in the first quarter. Occupancy rates of REITowned properties remained high at 93.6%, down slightly from the record high of 94.1% reached in 2018. Occupancy in the apartment REIT sector rose to a new record high of 96.3%. Occupancy rates are likely to decline in the months ahead, but the strong starting point may limit the damage from these declines.

The financial results and operating performance in the first quarter, of course, are backward-looking measures that say little about how REITs may fare as the impact of the COVID-19 crisis continues to spread through the economy.

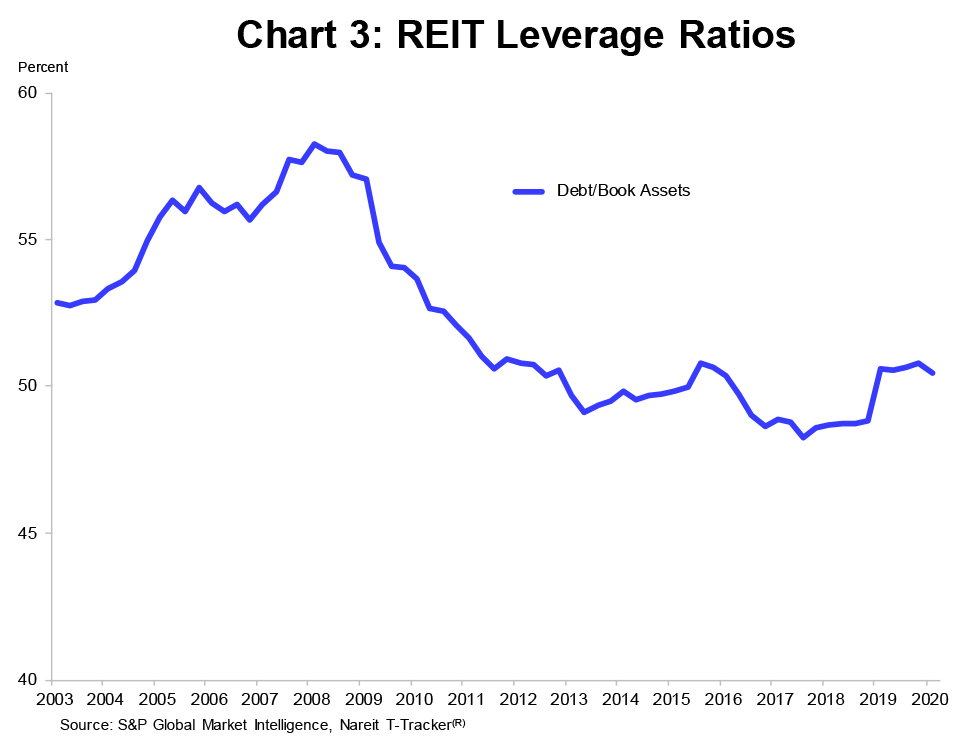

A better measure of the resilience of the REIT sector is the strength of their balance sheets and structure of their debt obligations. REITs raised $440 billion in equity capital from 2009 through 2019, reducing the industry’s weighted average leverage ratio by 10 percentage points, from 58% in 2008 to 48% in 2018. In addition, REITs have lengthened the average maturity of outstanding debt from less than 60 months in 2008, to over 82 months today. Lower leverage and longer, staggered debt maturities reduce the risks of a cash flow crunch in the months ahead and enhance REITs’ ability to weather the current crisis.

What have Sector Stock Market Returns Looked Like in 2020?

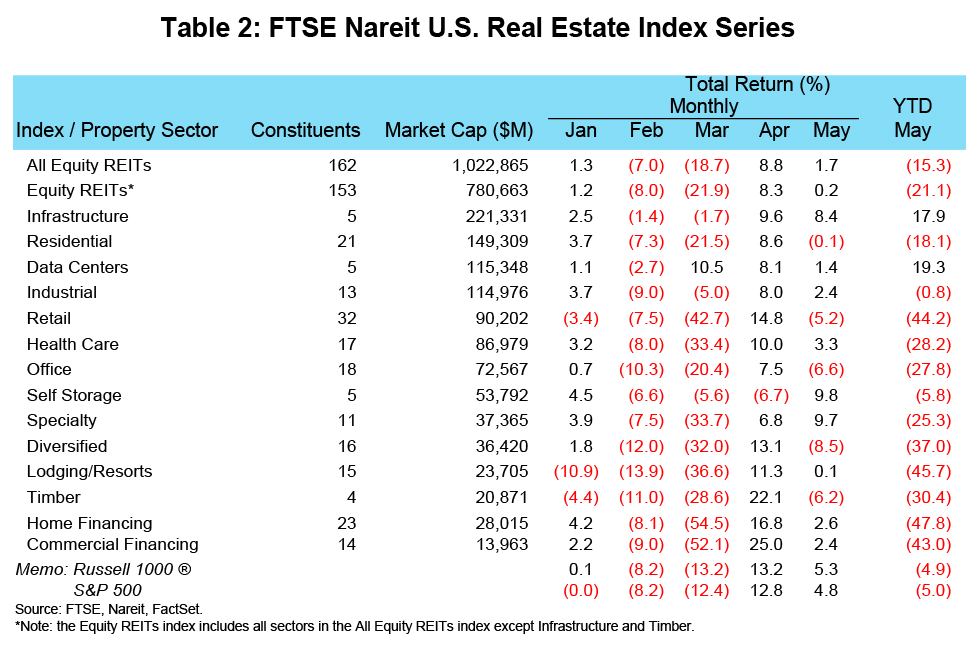

The early weeks of the stay-at-home orders and business shutdowns were accompanied by steep declines of share prices across all REIT sectors and, indeed, across nearly all other sectors of the stock market. The FTSE All Equity REITs index had a total return of negative 7.0% in February, slightly less than the minus 8.2% total return on both the Russell 1000 and the S&P 500. Lodging and resorts, which bore the initial brunt of the shutdown in travel, posted a negative 13.9% total return in February.

Stock price declines accelerated in March, as business closures spread quickly across the country. All equity REITs had a total return of negative 18.7%, worse than the negative 12.4% on the S&P 500. Several property sectors had declines of more than 30%, including retail (many store and malls were closed completely), lodging and resorts, and health care. mREITs lost more than half their value during the month of March.

Not all of the impacts of the crisis have been negative. Data centers and infrastructure REITs have often risen during the COVID-19 crisis, as use of online communications and cell phone traffic boosts demand for the servers that house the internet and for the cell towers that transmit voice and data communications. Data centers posted a total return of 10.5% in March, while infrastructure was little changed.

There has been a slow partial recovery in April and May. In April, all sectors except self storage were in positive territory, and a majority of sectors were up in May as well. These increases have reversed more than half of the total year-to-date decline that had occurred in late March, and at the end of May the all equity REITs index had a year-to-date total return of negative 15.3%. The lodging and resort and retail sectors, and mREITs, remain deep in negative territory, while infrastructure and data centers are up 17.9% and 19.3%, respectively, by the end of May.

What is the Outlook for REITs in the Second Half of 2020?

There are many unknowns in the path ahead, none more important than the potential for setbacks in the fight against COVID-19 as the economy reopens, or the prospect for a vaccine or treatment in the medium-term

future. Regardless of what specific challenges arise in the months ahead, there are three factors that will play an important role in the outlook for the economy, commercial real estate and REITs:

• A well-capitalized banking system will help prevent another Great Depression and support economic recovery. The defining characteristic of the Great Depression was the collapse of the banking system and the bank runs that accompanied it. The Global Financial Crisis of 2008-2009 narrowly avoided a collapse of the banking system, and struggles to shore up major banks deepened and prolonged the financial crisis.

The banking system today, however, holds higher capital ratios to protect against credit losses. According to the FDIC, Tier 1 risk-based capital of U.S. commercial banks was 9.99% in 2008, but stood at 13.29% in 2019. A well-functioning banking system is important today in providing credit to the private sector as it struggles with cash flow shortages in the midst of the crisis, and will continue to be important in the future as the private sector looks for credit to finance the recovery from the crisis.

• A modest construction pipeline reduces risks of a glut of new buildings flooding the market. Heavy construction pipelines have exacerbated past real estate downturns. Because it takes several years to complete a major project, buildings that were started at the peak of the market continued to add new supply well into the downturn. In past decades, this construction pipeline has deepened the real estate downturn.

Construction activity (as a percent of the existing stock) was modest at the onset of this crisis. For example, in the office market, the projects under construction in 2019 equaled 2.0% of the existing

stock of office space, according to data from CoStar. This compares to over 3% in the late 1990s at the end of the dotcom boom, and above 6% just ahead of the office market bust in the mid-1980s. A lower supply pipeline of office buildings and also other property types in the year or two ahead will avoid compounding the market’s struggles from weak demand during the crisis.

• REITs’ strong balance sheets reduce exposures to financial distress and leave them well positioned for future opportunities. The lower leverage ratios discussed above have a number of benefits and may help REITs be resilient through the crisis. Their strong equity capital base reduces pressures to refinance or recapitalize during the crisis. This is in contrast to 2008-2009, when a number of REITs had to raise equity capital at severely depressed prices, diluting existing shareholders. Lower leverage today makes these risks much less likely.

Stronger balance sheets may also allow REITs to take advantage of favorable investment opportunities. In the aftermath of the financial crisis of 2008-2009, many REITs were able to acquire properties at low prices without much competition from other bidders. Many of today’s REITs will be in good position to do so should opportunities arise in the months ahead.

The economic damage caused by the COVID-19 pandemic is unprecedented, but the economy may be at a turning point and begin to recover in the second half of the year. The early months of the recovery will likely be slow and halting due to ongoing efforts to contain the virus, and there may be second waves of the virus in some areas that require more closures. In addition, layoffs and bankruptcies may have lasting effects on businesses and the economy. A strong policy response, including trillions of dollars of fiscal stimulus spending and Federal Reserve credit facilities, should help the economy gain traction as the year goes on.

Commercial real estate markets may continue to weaken through the summer months, lagging the upturn in the macroeconomy, as a slow recovery in business activity leaves many tenants still short on cash flows. Vacancy rates will rise in most property types, although the increase may be less severe than in some past downturns. Commercial property prices and rents are likely to edge lower but stabilize before year end.

REITs will likely experience further declines in FFO in the second quarter, and occupancy rates are likely to decline further. The REIT industry began this crisis from a strong position, however, with record earnings in 2019, high occupancy rates and strong balance sheets. Most REIT-owned properties are of high quality and their tenants often are financially more secure than those in many privately-owned properties, which may help shield both the tenants and also the REITs themselves from some of the economic damages caused by the pandemic. All of these factors should help REITs successfully weather the challenges ahead.