This year marks the 65th anniversary of Congress enacting REIT legislation, which made it possible for everyone to benefit from the REIT approach to real estate investment in the United States. Today, U.S. REITs own assets that include residences, workplaces, shopping centers, entertainment destinations, health care, warehouses, storage, data infrastructure, and much more. REITs make positive contributions to local economies in the U.S. and around the world.

REITs’ growth and evolution over the past six decades reflect their dual focus on both the present and future; REITs know that their buildings and workforces must be flexible enough to meet the needs of today while simultaneously being resilient enough to address the challenges of tomorrow.

Nareit’s seventh-annual REIT Industry Sustainability Report illustrates this duality, showing how Nareit members are taking strides to make progress in everything from improving the resilience of their portfolios to mitigate financial risks to prioritizing people and providing transparency on business strategy and governance. The report includes findings tied to three overarching themes.

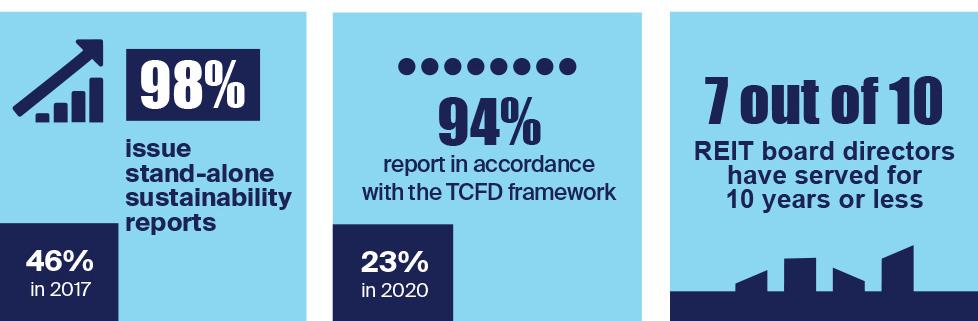

REITs Build Accountability

The REIT approach to real estate investment continues to provide inherent governance benefits, including the alignment of management and shareholder financial incentives.

REIT shareholders value the transparency of the REIT model. Transparency provides REIT stakeholders with an understanding of how REITs are managing external factors such as demographic shifts and technological advances. The report also illustrates how REIT governance provides shareholders confidence in the ability to manage sustainability and social responsibility needs and requirements.

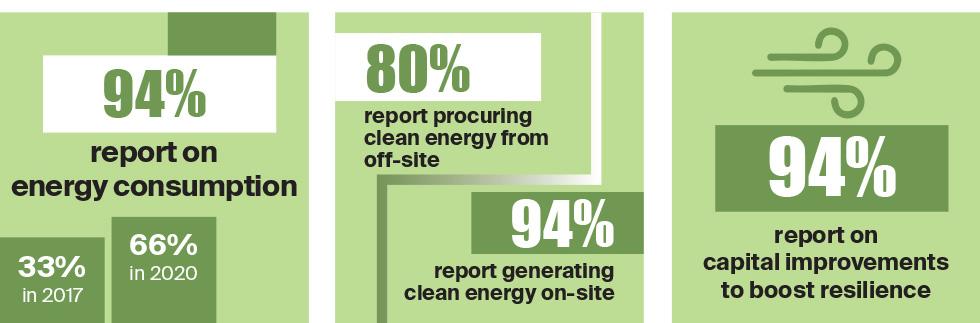

REITs Build Resilience

REITs are stewards of long-term investments in real assets and have a long history of owning and developing sustainable, resilient, and efficient real estate.

The buildings and communities we rely upon in our daily lives must be resilient over time, especially in the face of natural disasters, such as wildfires, hurricanes, floods, and heat waves. That's why it's critical that REITs understand their exposure to physical risks and enhance their risk resilience for all property types, from apartment and office buildings to data centers and warehouses. The report shows REITs’ progress on that front and demonstrates how REITs are focused on improving their energy efficiency and their access to a range of energy sources, contributing to their economic growth.

REITs Build Community

REITs are prioritizing people and meeting the needs of their employees, tenants, and the communities in which they operate.

Seeking stakeholder feedback and fostering wellbeing is critical to driving innovation, creativity, and productivity in REIT workforces, properties, and communities across the nation. This report details how REITs are implementing programs that are building the real estate workforce of tomorrow by refining practices to attract and retain top talent. In addition, REITs are giving back to the communities in which they operate by providing essential real estate and supporting corporate giving programs that target areas where REITs can positively impact their local communities.

The physical world, our society, and the rules and regulations that govern us will inevitably continue to evolve. As an industry, we’ll continue to learn and adjust as needed to remain responsible stewards of capital, employ innovative approaches to property ownership, deliver value to our tenants, and make positive contributions to the communities where we invest and operate.

Nareit will continue to support the REIT industry in driving value for the benefit of members; their shareholders, employees, and tenants; and the communities and broader society in which they operate.

Download the 2025 Report (PDF)

Nareit Sustainability

Nareit’s mission is to actively advocate for the REIT approach to real estate investment with policymakers and the global investment community. The mission includes supporting the real estate community in assessing, managing, and disclosing risks and opportunities tied to sustainability and social responsibility, and transparency around performance and governance practices. REIT industry sustainability-related programs and highlights are detailed throughout this report and at reit.com/sustainability.

About this Report

Nareit collects information publicly reported in 2024 by the top 100 REITs by market capitalization (market cap) as of Dec. 31, 2024. Unless otherwise noted, data is compiled and reported at the industry level as a percentage of market cap. All other REIT industry data, unless otherwise cited, is based on Nareit research as of yearend 2024.

The aggregated REIT industry sustainability data in this report can be downloaded here.

Information on data sources and methodology for the information in this report can be found in the REIT Sustainability Data Methodology Statement.