The REIT ESG Dashboard reflects publicly available ESG data derived from many sources including company publications, media, and government reporting released in the prior year (2022) for the 100 largest U.S. equity REITs by equity market cap in the reporting year (2021) – referred to as “REITs analyzed.” Additionally, the Dashboard includes data voluntarily submitted by REITs to the 2022 GRESB Real Estate Assessment – which is one of the principal global ESG benchmarks for real assets.

The 100 REITs analyzed in 2022 included approximately 93% of the listed equity REIT equity market cap as of Dec. 31, 2021. In 2022, 69 public REITs participated in the GRESB Real Estate Assessment, of which 53 were in the top 100 REITs analyzed.

Note: Charts within the Dashboard either reflect the number of REITs out of the 100 analyzed or the percentage of the REIT’s analyzed by equity market cap.

REITs Increasingly Reporting Sustainability Targets, Performance, and Policies

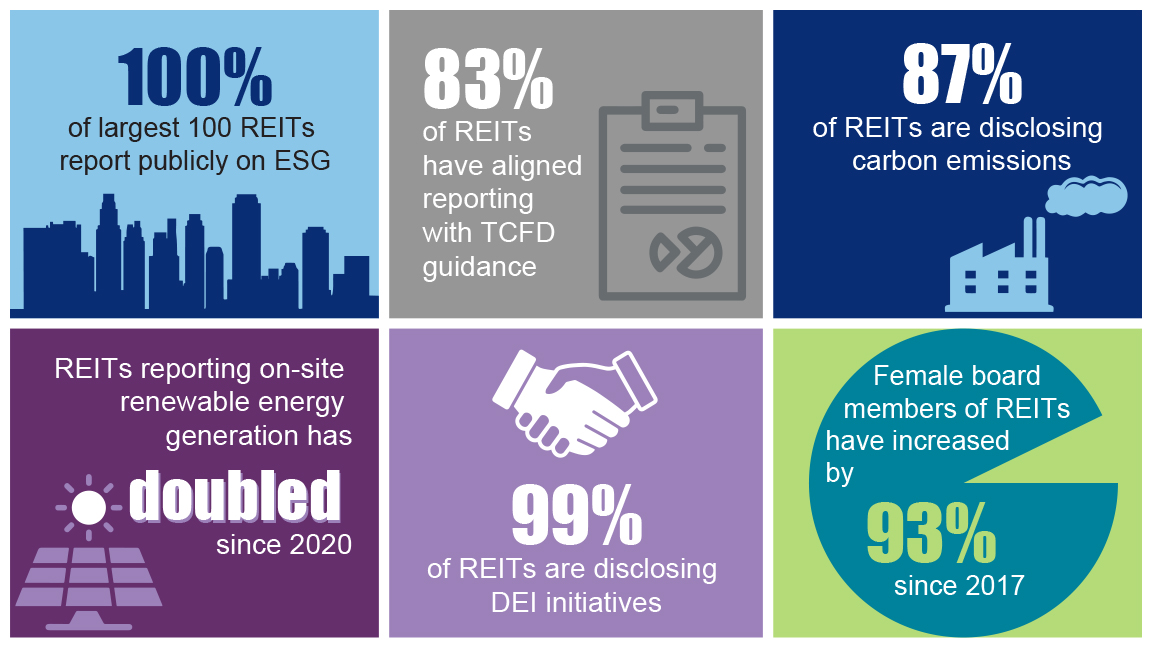

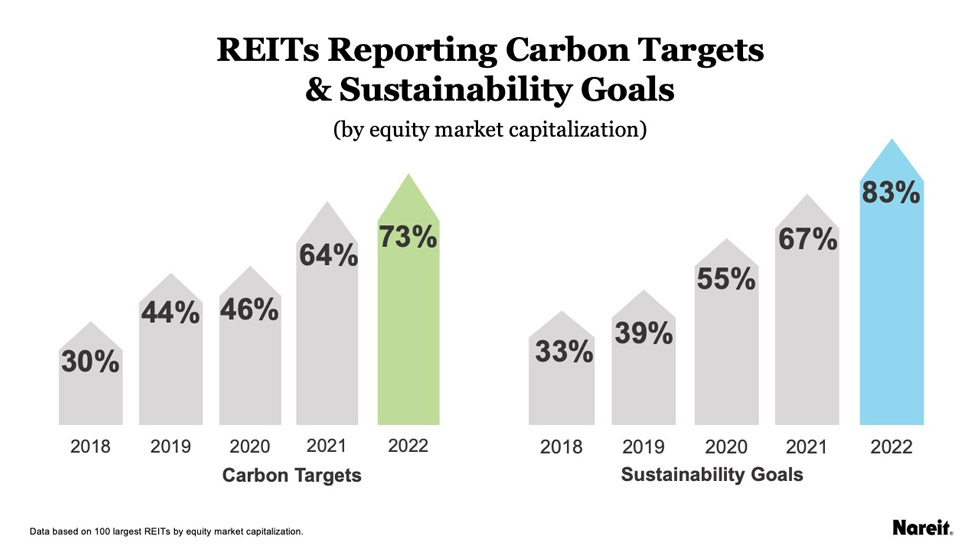

In addition to reporting sustainability strategy and performance, an increasing number of REITs are reporting carbon targets and sustainability goals. Of the REITs analyzed, 73% by market cap reported public carbon targets in 2022.

Of the 100 largest REITs by equity market cap, 70 REITs publicly reported additional environmental sustainability goals, such as renewable energy procurement, waste and water consumption, green development, and other KPIs.

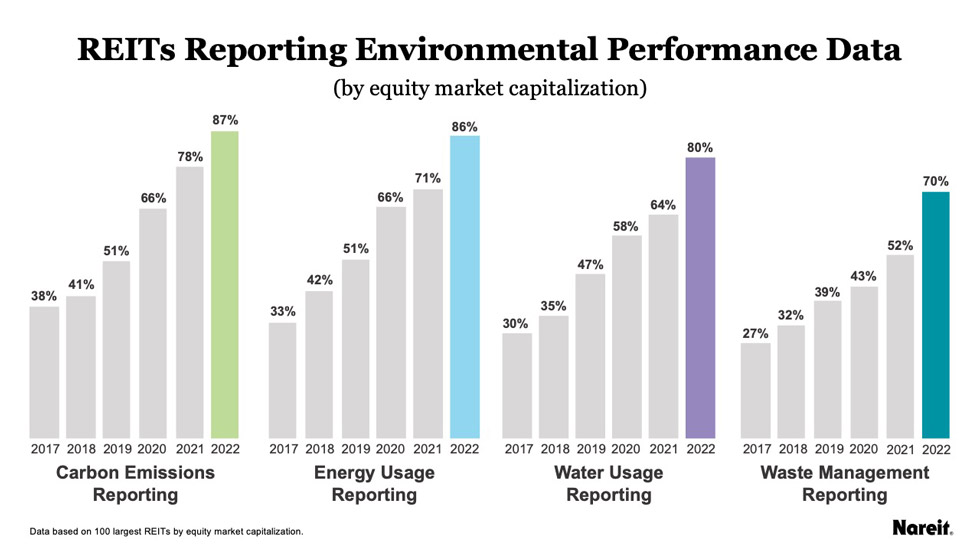

REITs are reporting on absolute carbon emissions, energy usage, and water consumption and waste, and in some cases, year-over-year change and change over a baseline. REIT reporting of carbon emissions and energy usage has shown great momentum since 2017, and REIT reporting of energy usage has increased to be on par with carbon emissions.

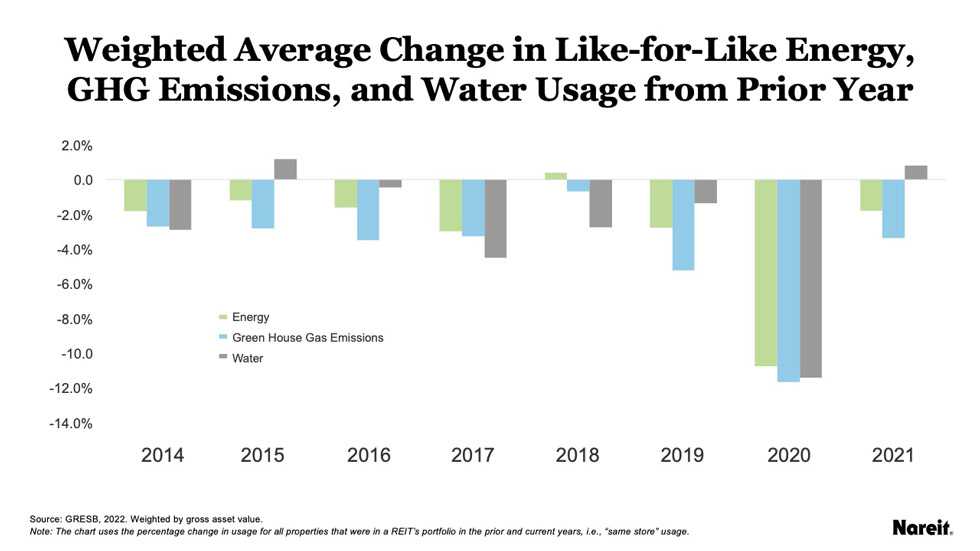

The most recent 2022 GRESB data shows that for the 69 REITs that voluntarily submitted data, energy consumption was down 1.8% in 2021, greenhouse gas emissions were down 3.4%, and water usage was flat even after large reductions in all three in 2020.

Not surprisingly, data reported for 2020 saw large declines in all three as the pandemic reduced usage of many property types. Energy consumption was down an average of 10.7% in 2020 from 2019, greenhouse gas emissions were down 11.6%, and water usage was down 11.4%. However, in 2021 REITs reported that they were able to not only maintain these improvements but create further reductions in energy (-1.8%) and greenhouse gas emissions (-3.4).

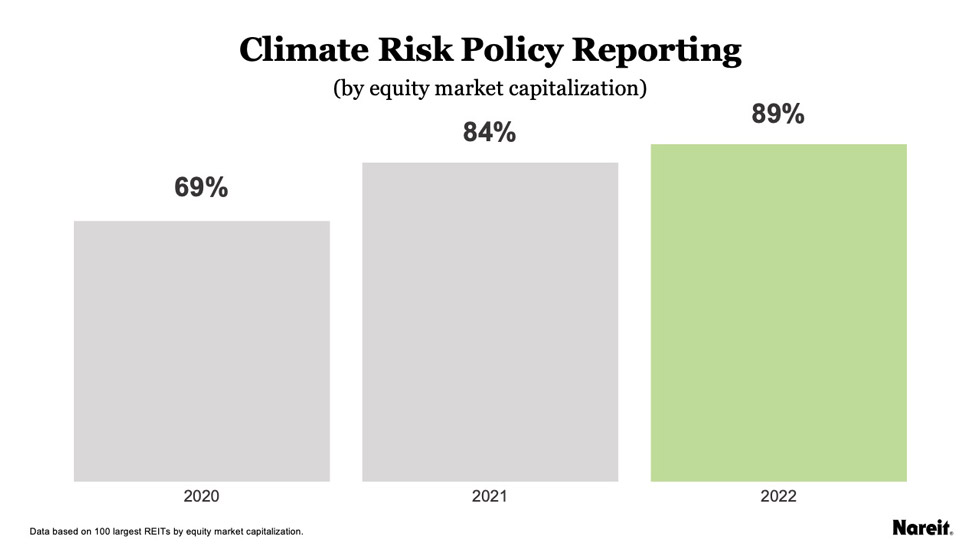

Along with an increase in carbon emission disclosures, 89% of REITs by equity market cap are reporting their policies for overseeing the risks and opportunities due to the impacts of climate change and the transition to a low-carbon economy, which may include board oversight, executive compensation tied to ESG performance, and/or assurance of climate related reporting.

REITs are Demonstrating Their Commitment to Sustainability at Their Properties

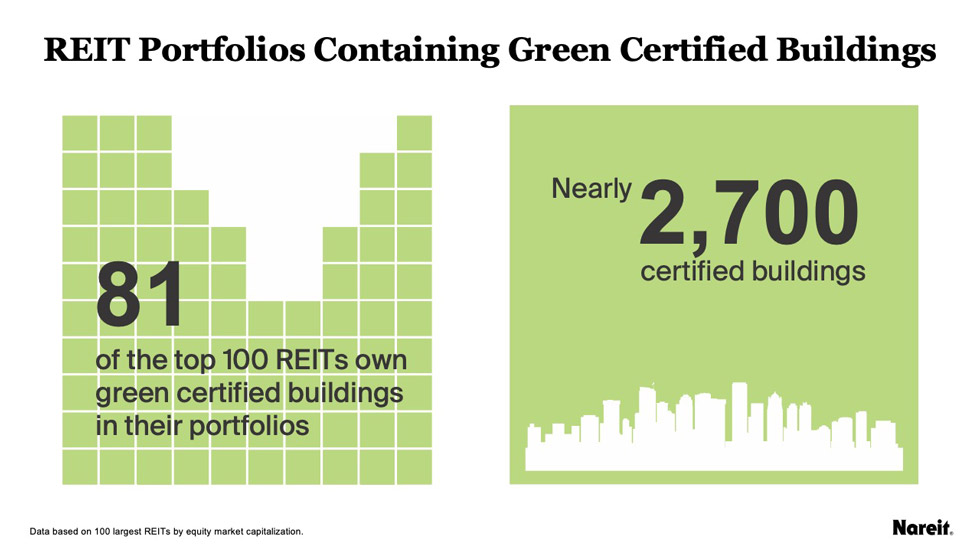

Green building certifications are a useful tool for building owners to demonstrate their commitment to operating sustainably. More than 80 of the top 100 REITs reported owning certified green buildings in 2022, compared to 75 in 2021 and 72 in 2020. Nearly 2,700 REIT-owned buildings have a green certification. In fact, REIT-owned properties are often leaders in adopting innovative sustainable building solutions.

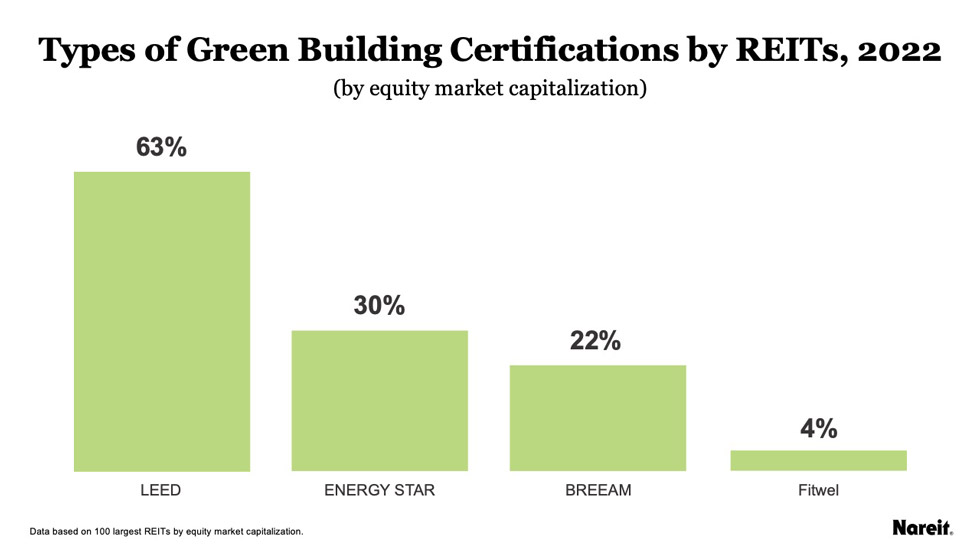

A majority of the top 100 largest REITs by equity market cap certify some of their buildings using the U.S. Green Building Council’s LEED rating system, with the office sector leading the way. Of the office REITs in the 100 analyzed companies, 97% by equity market cap have achieved LEED certifications.

The EPA’s ENERGY STAR Certification recognizes the top energy performing buildings and is available for some but not all property types. Additional certification schemes, like BRE’s BRREAM and the Center for Active Design’s Fitwel certification, are gaining market share by offering certification solutions to meet the needs of various real estate sectors.

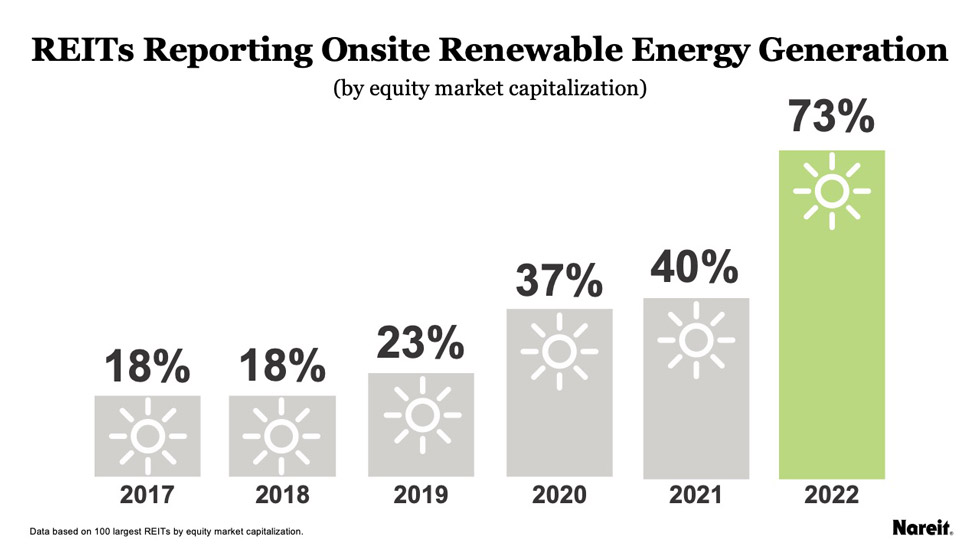

The share of the largest 100 REITs by equity market cap reporting onsite renewable energy generation has more than quadrupled in six years. In addition, in 2022, 20 REITs reported utilization of power purchase agreements, a way for companies to invest in third-party development of renewable energy infrastructure.

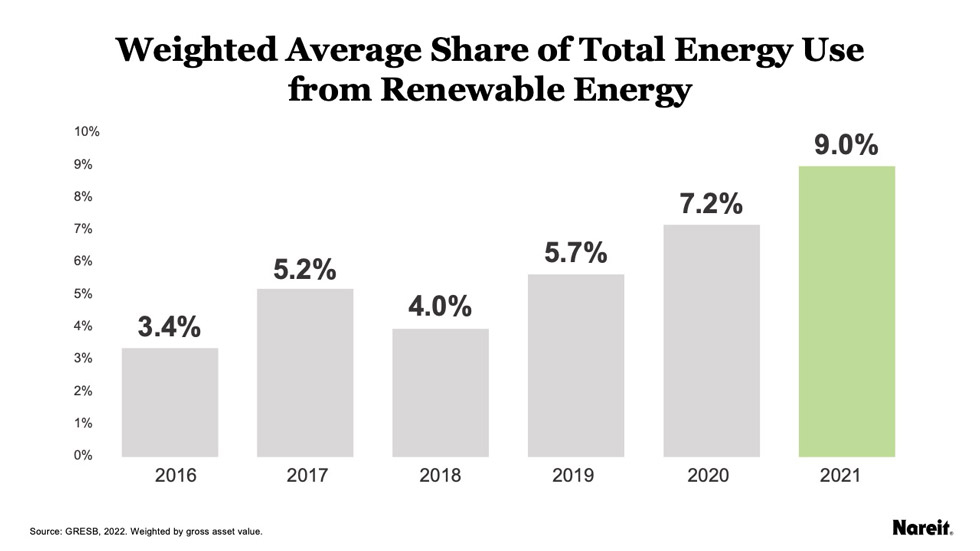

The overall increase in REITs reporting on renewable energy is demonstrated by the strides being made in sourcing more energy from renewable sources. The share of renewable energy has grown from 3.4% in 2017 to 9.0% in 2021 as reported by the 69 REITs who voluntarily reported to GRESB.

REITs Report Social Policies and Programs, and Governance of ESG Issues

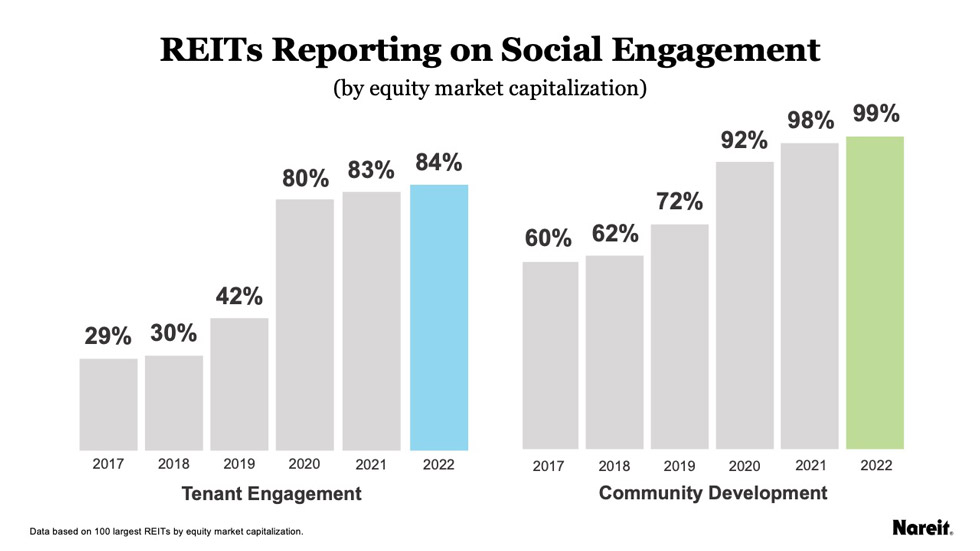

REITs have a history of incorporating social initiatives into their business models, resulting in a positive impact on their employees, communities, tenants, and other stakeholders. Social initiatives may include providing employee development opportunities, revitalizing neighborhoods within their communities, and supporting tenant needs.

In 2022, REITs continued to demonstrate their commitment to their communities. Of the REITs analyzed:

- 97 REITs reported data on their community development programs.

- 84 REITs reported on their charitable giving.

- 68 REITs reported on employee volunteerism.

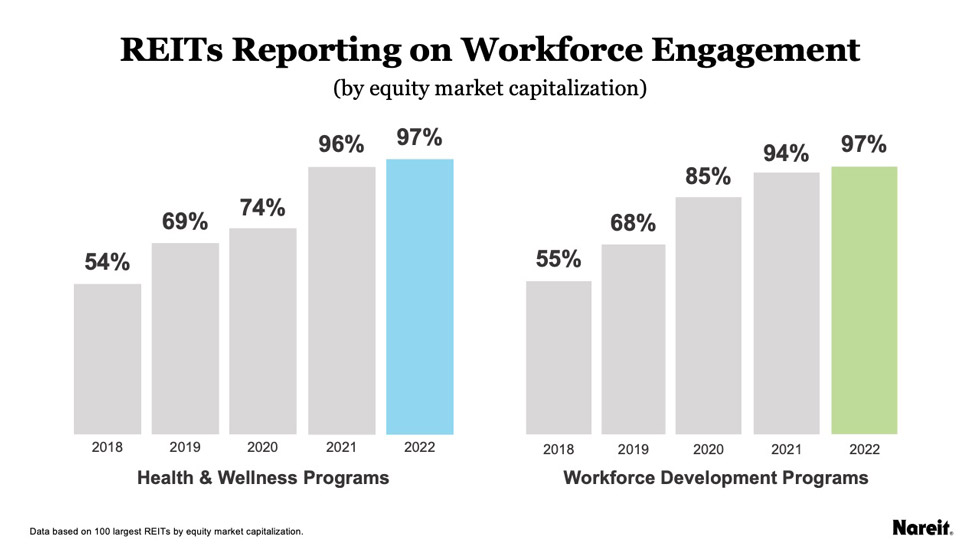

In 2022, like years prior, reporting of both health and wellness and workforce development programs continued to increase, with nearly all the largest 100 REITs publicly disclosing on these KPIs.

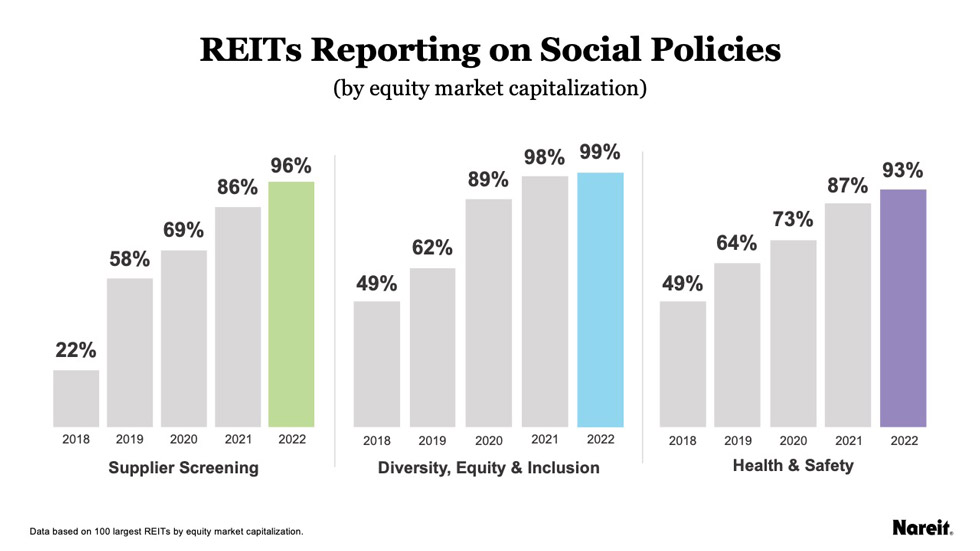

Policies related to supplier/vendor screening, diversity, inclusion, equal opportunity initiatives, and health and safety practices are being increasingly reported by REITs. Diversity, equity, and inclusion (DEI) continues to be a priority.

Nearly all the top 100 REITs by equity market cap (representing 99% by equity market cap) publicly disclosed their diversity, equity, and inclusion (DEI) initiatives. Notably, disclosure of supplier screening as a part of REITs’ social policies has increased from 22% in 2018 to 96% in 2022.

Nareit’s Dividends Through Diversity, Equity, and Inclusion Initiative, which is guided by Nareit’s DDEI CEO Council, has developed and supported a number of programs to help the industry increase its visibility and appeal to diverse individuals and businesses. To share progress to date, Nareit publishes a DEI in the REIT industry update (PDF) each year, which also articulates Nareit’s DDEI agenda.

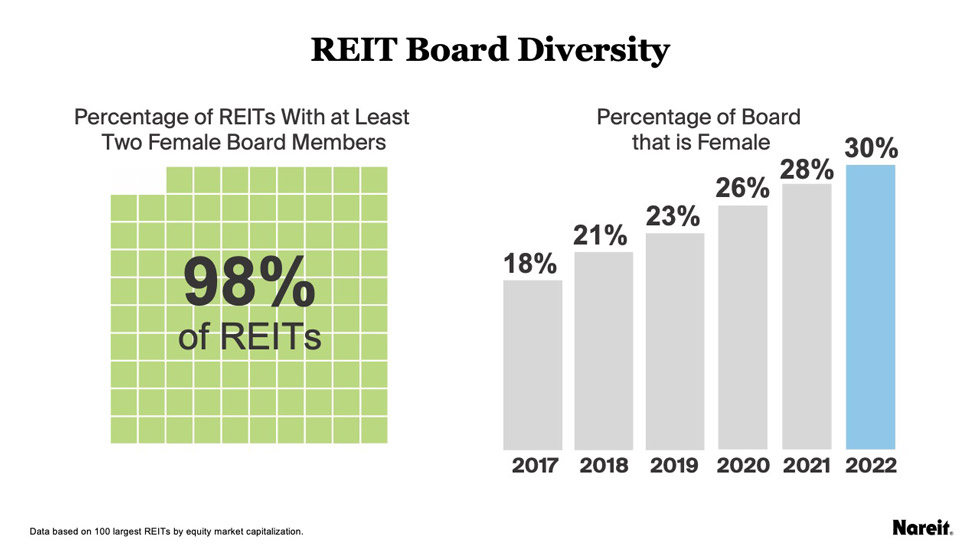

REITs are showing progress in gender diversity on their boards of directors. In 2022, all 100 of the largest equity REITs by equity market cap had at least one female board member, and 95 REITs had two or more female board members. Of the 100 companies analyzed, 33 companies also publicly reported on pay equity.

These disclosures are primarily reported in proxy statements, rather than stand-alone reports.

REITs Report on their ESG Efforts

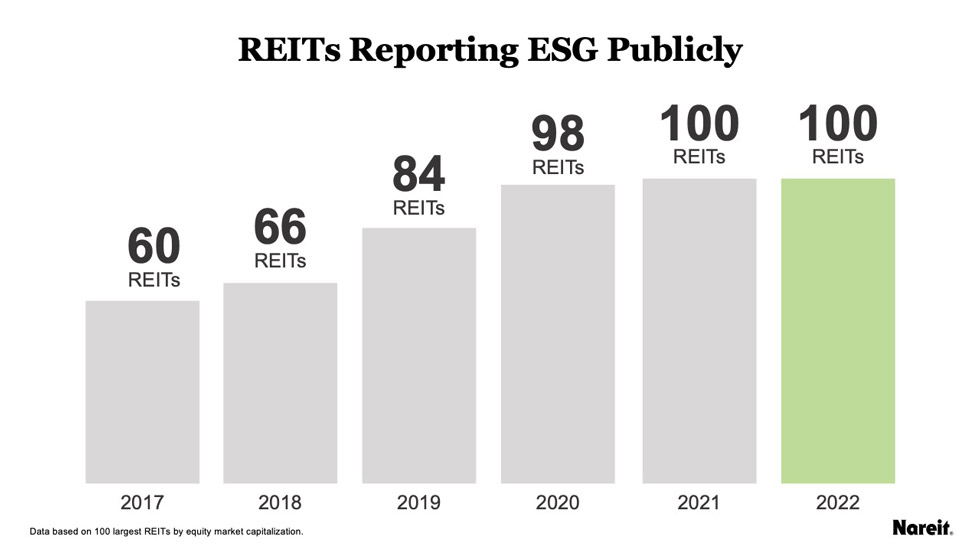

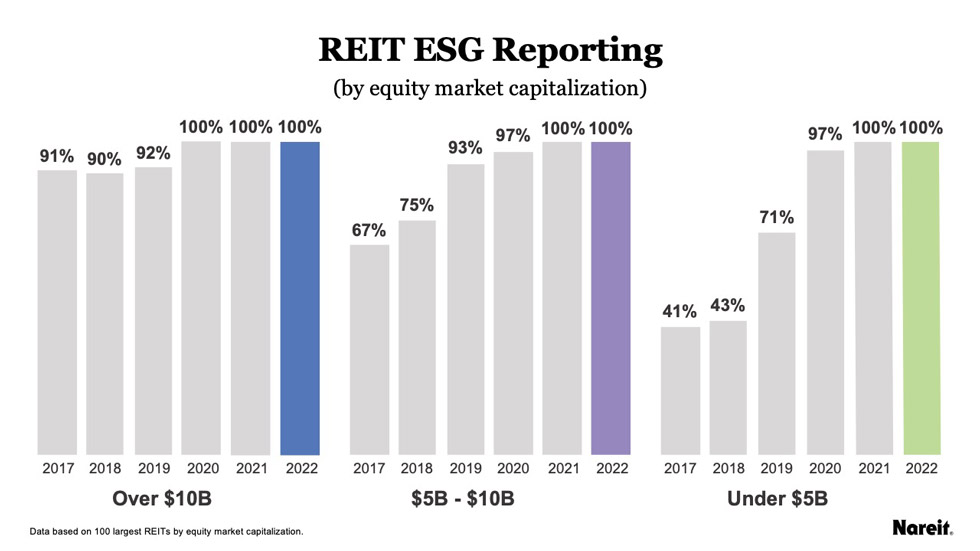

Public reporting of ESG has become a regular practice in the REIT industry. For the second year in a row, all the largest 100 REITs by equity market cap in 2022 are reporting their ESG efforts publicly, including on their company websites and in annual reports, proxy statements, and/or stand-alone sustainability reports.

REITs with an equity market cap under $5 billion demonstrated the greatest increase in ESG reporting, growing from just over 40% by equity market cap in 2017, to 100% in 2022. Nareit supports REIT member companies of all sizes looking to advance their sustainability initiatives through its JumpStart Virtual Class Series, REITworks Conference, and its resources, committees, and leadership councils.

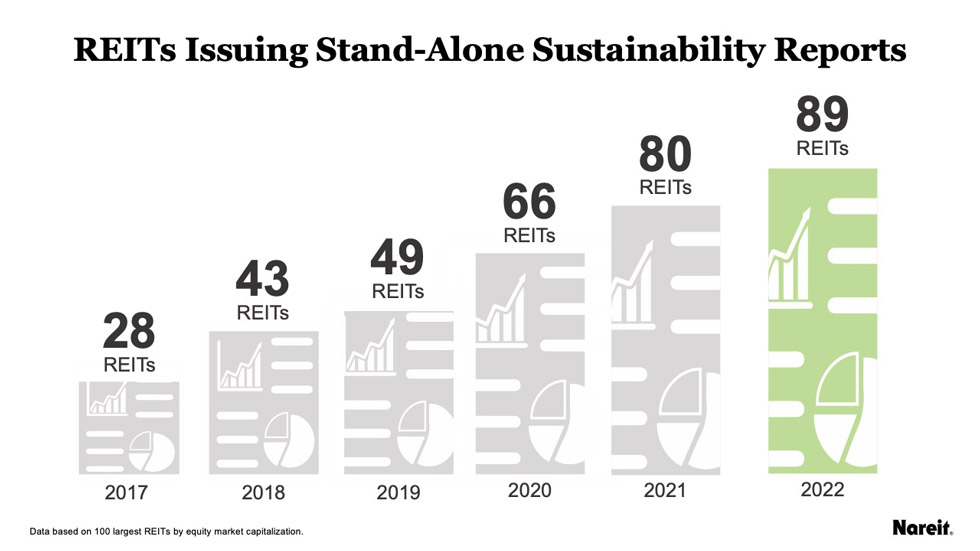

REITs are increasingly issuing stand-alone sustainability reports, with 89 of the largest 100 REITs by equity market cap issuing these reports in 2022, 68% of which align with the Global Reporting Initiative (GRI) standards.

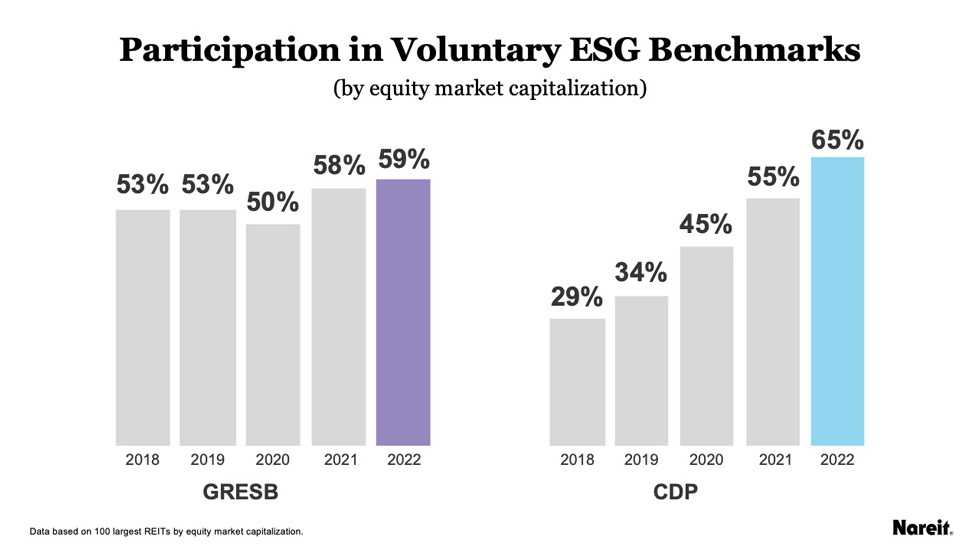

GRESB and the Carbon Disclosure Project (CDP) are voluntary rating systems that benchmark ESG disclosure and performance most used by REITs. REITs have also increased their use of CDP; 35 REITs used the CDP in 2021, up from 16 REITs in 2019.

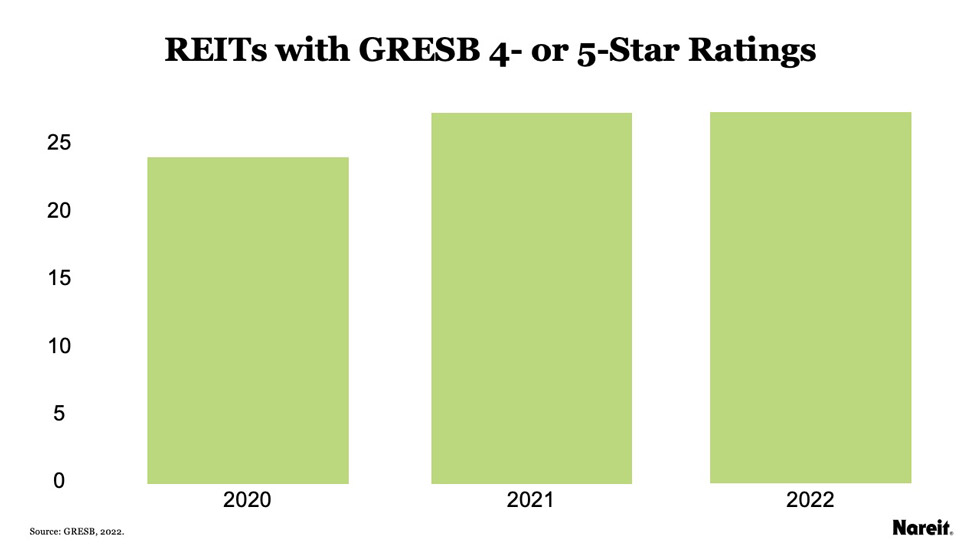

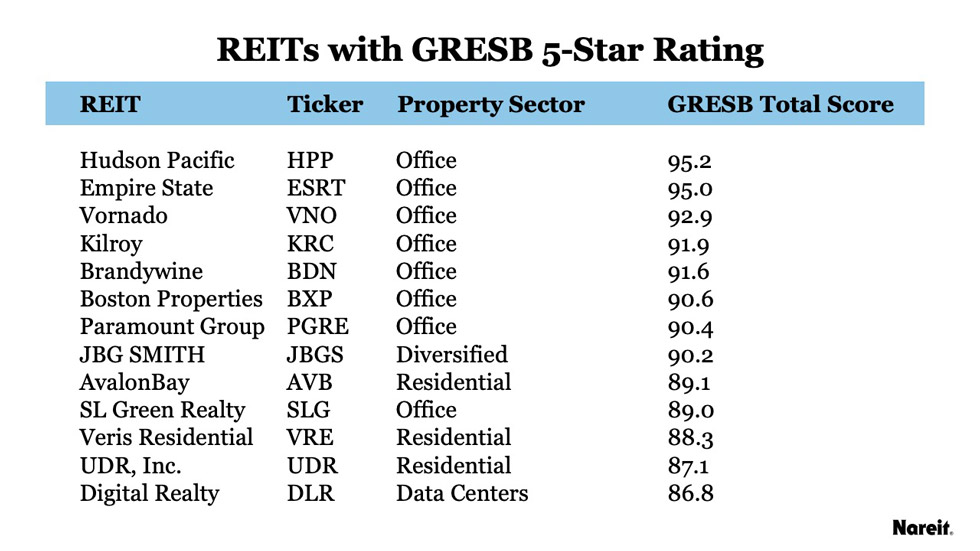

Of the 69 U.S. REITs that participate in GRESB 25 are demonstrating industry ESG leadership earning the 4-star or 5-star rating, which means they are in the top 40% of GRESB participants globally. REITs across several real estate sectors are earning the highest 5-star rating in GRESB.

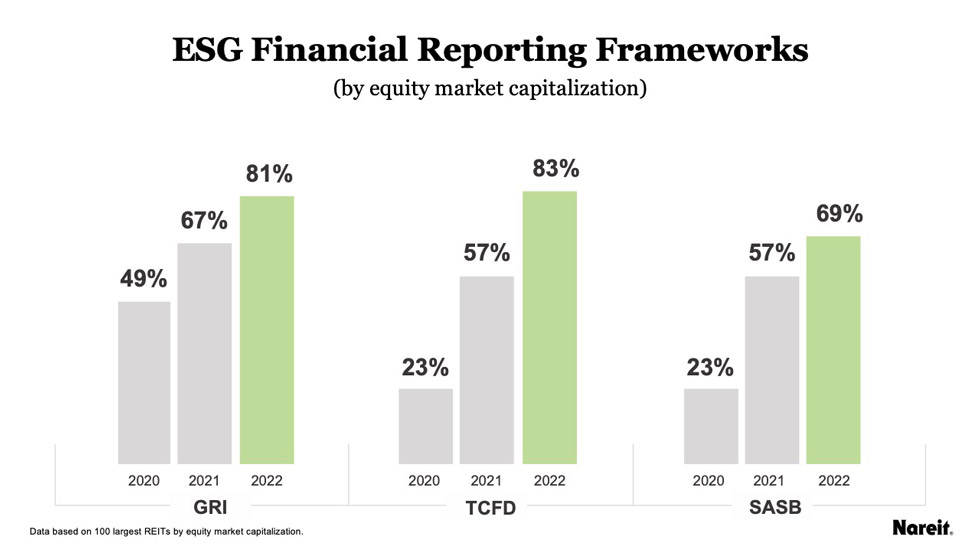

REITs alignment of ESG disclosures with financial reporting frameworks has risen significantly in the past year, as investor interest in financially relevant ESG issues, such as climate risk, increases. The Task Force on Climate-Related Financial Disclosures (TCFD) is the most popular framework among the top 100 REITs, with 66 reporting in 2021 representing 83% of the total equity market cap of the REITs analyzed. GRI (Global Reporting Initiative) and SASB (Sustainability Accounting Standards Board) have developed reporting standards that support businesses and organizations to communicate sustainability performance and provide investors decision useful information on the financial impacts of sustainability.

Other Resources:

- Nareit’s Practical Reference for ESG Implementation and Reporting (PDF). Published in 2021, this publication offers step-by-step guidance for addressing some of the most widely used KPIs in REIT ESG reporting.

- Nareit Guide to ESG Reporting Frameworks (PDF). Published in 2019, this guide provides an overview of the most reported ESG reporting frameworks in the marketplace and their most commonly used metrics in a single, user-friendly document.

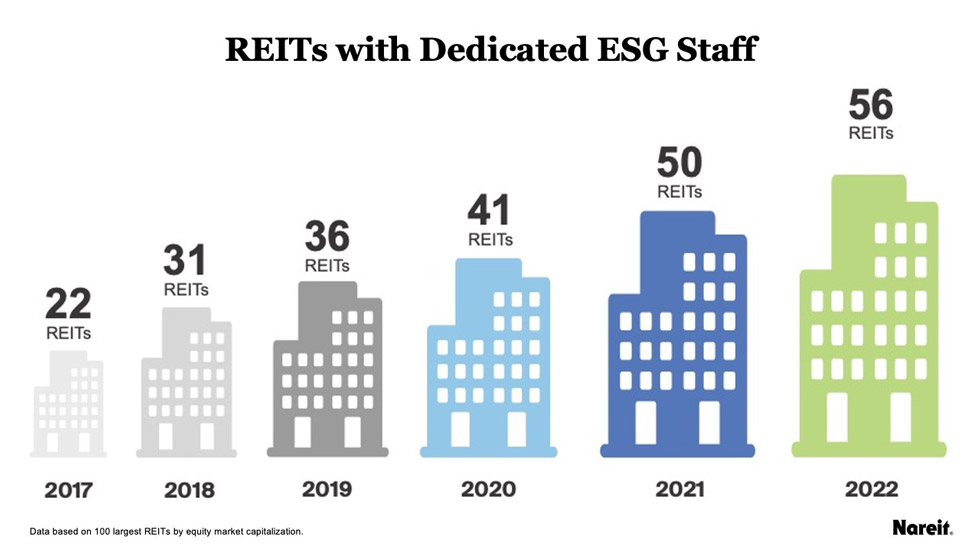

REITs are Increasing Their Staffing to Manage ESG Issues

As REITs have expanded their ESG initiatives and expectations for reporting and disclosure from investors and regulators continue to evolve, more companies are hiring staff dedicated to sustainability and social purpose. Between 2017 and 2022, 34 more companies reported having a full-time dedicated ESG staff position. The 56 REITs with dedicated ESG staff account for 77% of the equity market cap of the top 100 REITs. Many of the REITs without dedicated ESG staff implement ESG initiatives and prepare reporting and disclosure through sustainability committees as well as with guidance from outside consultants.

GeoPhy ESG Public Reporting

The 100 REITs for which ESG reporting data was tracked in 2022 included approximately 93% of the listed equity REIT equity market cap as of Dec. 31, 2021. These REITs owned 499,201 assets, including 49,198 buildings in the U.S. as of year-end 2021.

GRESB Real Estate Assessment

Real estate organizations voluntarily participate in the annual GRESB Real Estate benchmark assessment. In 2022, 69 public REITs, representing 56% of year-end 2022 equity market capitalization (equity market cap) in the U.S., participated in GRESB.

To Learn More

Visit REIT.com/sustainability for more information or to learn details about Nareit’s other resources and programs.

Sign up here to receive sustainability-related updates from Nareit.

Nareit Sustainability Staff Contacts

Jessica Long, Nareit Senior Vice President, Environmental Stewardship & Sustainability - jlong@nareit.com

Ayris Scales, Nareit Senior Vice President, Social Responsibility & Global Initiatives - ascales@nareit.com

- Disclaimer

-

This data collection and analysis for the ESG Dashboard was performed by GeoPhy , a tech company in the real estate domain, building a global platform for independent real estate data and information, using publicly available information from listed U.S. equity REITs including websites, annual reports, sustainability reports, 10-Ks, direct feeds, and certification schemes. This public information is subject to continuous change and therefore is not warranted by GeoPhy or Nareit as to its merchantability, completeness, accuracy or fitness for a particular purpose. The data and analysis are provided “as is” and reflect GeoPhy’s opinion at the date of publication only. Any reference to third party names, or third- party data, is for appropriate acknowledgement of its ownership and does not constitute a sponsorship, or endorsement, by such owner. When the ESG Dashboard refers to 2018, 2019, 2020, 2021, or 2022 results, it reflects data reported by REITs in 2018, 2019, 2020, 2021, or 2022 reflecting the prior fiscal year operations.

GRESB Disclaimer available at https://www.gresb.com/nl-en/gresb-terms-conditions/.

Nareit is not acting as an investment adviser, investment fiduciary, broker, dealer or other market participant, and no offer or solicitation to buy or sell any security or real estate investment is being made by the ESG Dashboard. The information in the ESG Dashboard is for informational purposes only and it is not intended to be a solicitation related to any particular company, nor does Nareit intend to provide investment, financial, legal or tax advice, and no information, services, or materials offered by or through the Dashboard shall be construed as such. This information is not intended by Nareit to serve as the basis for any investment decision.