WILSHIRE FUNDS MANAGEMENT STUDY PRESENTS NEW APPROACH TO INCOME-ORIENTED RETIREMENT PLANNING

Increasing Allocations to Income Assets, Including REITs, Boosted Income Return by Nearly 40%

WASHINGTON, DC, October 26 – With assets totaling approximately $7 trillion, defined contribution plans, such as 401(k) plans, are the investment platforms millions of Americans are relying on to fund their retirements, and target date funds, the fastest growing investment option within defined contribution plans, are the investment of choice for retirement savers.

While target date funds are designed to steadily reduce portfolio risk as retirement approaches, they may fall short in generating the current income individuals in retirement need. A typical retirement-stage portfolio has an income return of only about 2 percent per year.

However, new research from Wilshire Funds Management, sponsored by NAREIT and based on portfolio optimizations using 40 years of investment return data through 2015, showed that adding a range of high income-generating assets (including REITs) to a traditional retirement-stage portfolio could boost income returns by nearly 40 percent, while providing comparable total returns and no increase in risk.

Wilshire’s research is based on a variation of the Mean-Variance Optimization (MVO) method for portfolio modelling. While traditional Mean-Variance Optimization models are designed to determine optimum levels of various portfolio assets that will produce a maximum total return for a specified level of risk, Wilshire’s Income-Oriented Mean-Variance Optimization (IOMVO) model also incorporates a requirement for a specified level of income return.

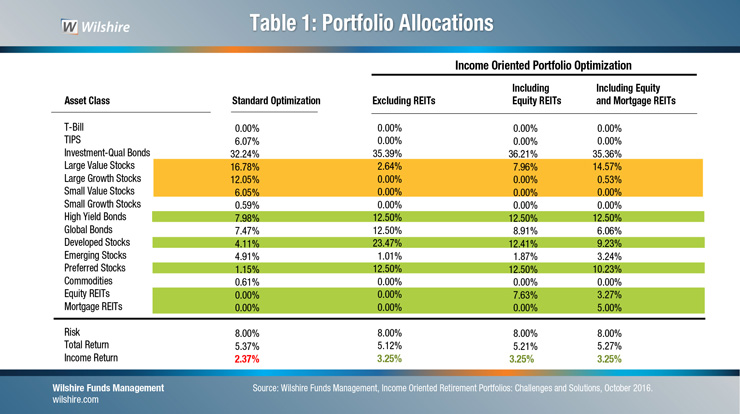

Wilshire found that a traditional MVO-modeled portfolio that delivered a 2.37 percent annual income return and a 5.37 percent annual total return with an 8 percent level of portfolio risk could be enhanced with IOMVO modelling to deliver a greater annual income return of 3.25 percent and a comparable 5.27 percent annual total return with the same 8 percent level of risk.

Comparing the asset allocations between the traditional and income-oriented portfolios:

- Equity allocations were reduced from 35 percent of the MVO portfolio to between 3 percent and 15 percent of the IOMVO portfolio.

- High-yield bonds and preferred stocks became key parts of the IOMVO portfolio. The allocation to these assets increased from 9 percent to between 22.7 percent and 25 percent.

- Non-U.S. developed market stock allocations rose from 4 percent of the MVO portfolio to between 9 percent and 23.5 percent of the IOMVO portfolio.

- REIT allocations rose from zero in the MVO portfolio to approximately 8 percent of the IOMVO portfolio. REITs were an important component of the income-oriented portfolio because they provided strong total returns, diversification benefits and consistent income.

“An investment strategy that generates income is critical for many retirees,” said Wilshire Funds Management Chief Investment Officer Joshua Emanuel. “Depending on the income needs of the investor, portfolios that generate less income may require retirees to dig deeper and more frequently into their savings to fund their expenses, potentially resulting in the depletion of their assets while they are still living.

“Income-oriented portfolios with significant allocations to assets like REITs, high-yield bonds, preferred stocks and non-U.S. developed stocks may help investors meet the challenge of producing retirement income with less reliance on their savings,” Emanuel said.

TO LEARN MORE ABOUT THE WILSHIRE STUDY, “Income-Oriented Retirement Portfolios: Challenges and Solutions, 2016” and download the full report, visit reit.com/reitsandretirement .

ABOUT WILSHIRE ASSOCIATES AND WILSHIRE FUNDS MANAGEMENT

Wilshire Associates Incorporated (“Wilshire®”), a leading global, independent investment consulting and services firm, provides consulting services, analytics solutions, and innovative investment products to plan sponsors, investment managers, and financial intermediaries. Based in Santa Monica, California, Wilshire provides services to clients in more than 20 countries representing more than 500 organizations with assets totaling approximately US $7 trillion.*

Wilshire Funds Management, the global investment management business unit of Wilshire, is dedicated to helping our clients distinguish themselves in today’s highly competitive financial services industry. Wilshire Funds Management’s services leverage Wilshire’s 30+ years of institutional consulting excellence. As a result, our clients gain access to market-tested investment strategies and programs that have a solid foundation in industry best practices.

*Client assets are as represented by Pensions & Investments (P&I), detailed in P&I’s “Largest Retirement Funds” and P&I’s “Largest Money Managers (U.S. institutional tax-exempt assets)” as of 9/30/15 and 12/31/15, and published 2/8/16 and 5/30/16, respectively.