Forest carbon projects are likely to be a key component of future growth for Weyerhaeuser’s (NYSE: WY) Natural Climate Solutions business due to rising interest in the voluntary carbon market as a means for companies to reduce and offset their emissions and reach net-zero commitments, says the REIT’s Chief Development Officer Russell Hagen.

Hagen says Weyerhaeuser’s nearly 11 million acres of timberland, located primarily in the South, Washington, Oregon, and Maine, puts it in a “unique and unmatched” position to create enduring value through the creation and sale of voluntary carbon credits, in addition to renewable energy development, carbon capture and storage, and mitigation banking and conservation.

In 2021, Weyerhaeuser set a goal to generate $100 million of adjusted EBITDA from its Natural Climate Solutions business by the end of 2025. Hagen says that as it gets closer to that date, he’s confident the REIT will meet the initial target and is well positioned to continue to grow well beyond $100 million.

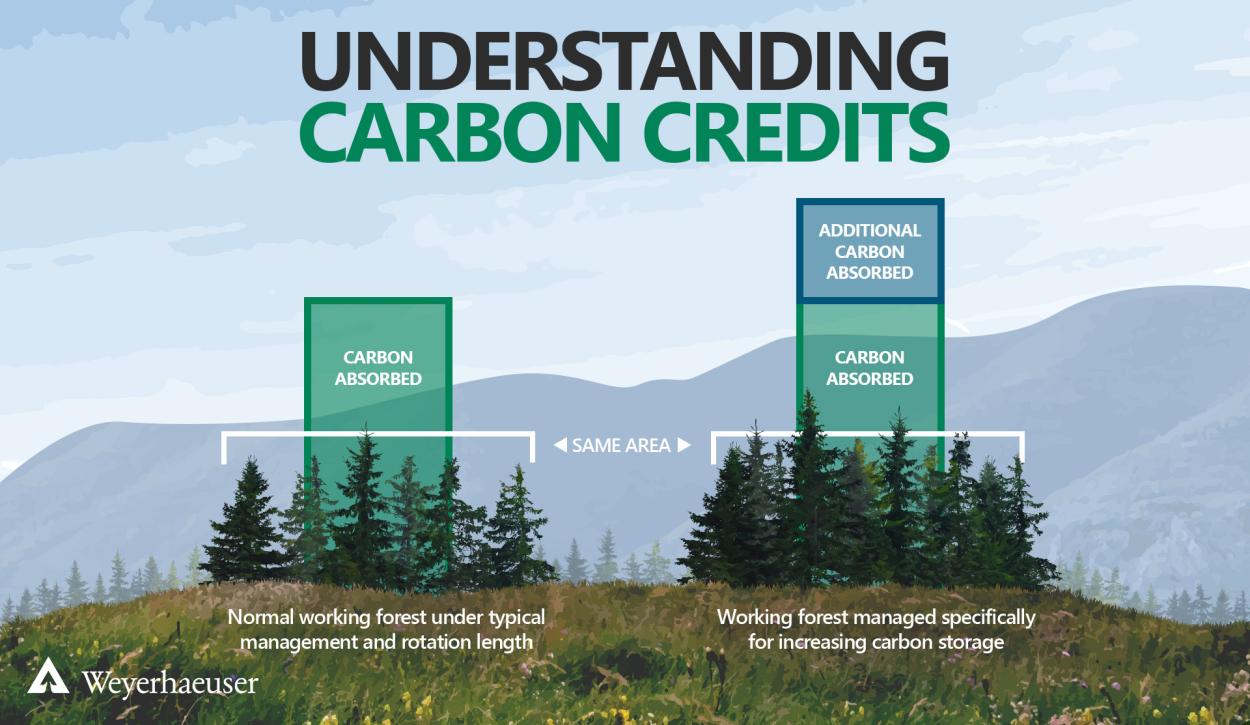

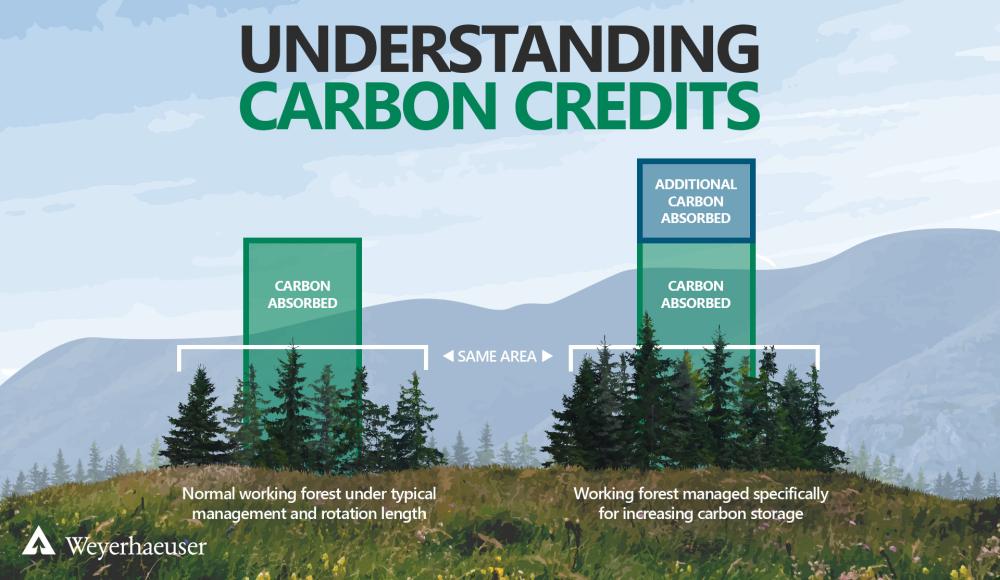

While Weyerhaeuser is working diligently on all aspects of its Natural Climate Solutions business, Hagen says forest carbon has received the most attention in recent months. In December 2023, Weyerhaeuser announced its first transaction in the voluntary carbon market through the sale of nearly 32,000 carbon credits (one credit is equal to one metric ton of carbon dioxide equivalent), from its Improved Forest Management (IFM) pilot project in Maine. IFM involves boosting carbon sequestration levels on a designated timberland site through methods that increase the overall volume and productivity of the land.

Focus on Integrity

Prior to launching the Maine project, Weyerhaeuser had looked at various development strategies, protocols, and methodologies. The company decided that the best approach was one that was compatible with its ability to “bring only the highest integrity projects to the market because we're going to be able to do this across our portfolio in very select areas multiple times over the next number of years,” Hagen says.

As a result, Weyerhaeuser decided to keep the project development in-house. Although that extended things from a timeline perspective, it meant “we could stand behind the credits and ensure that they're the highest quality,” Hagen says, especially as Weyerhaeuser plans to hold its timberlands indefinitely.

“As we talk to buyers of the credits, they're confident that we will continue to be the ones running this project over its entire lifetime,” Hagen says. That’s important, given that the lifetime of the project can run to 40 years.

Hagen, who previously served as Weyerhaeuser’s CFO, adds that “whenever you're doing a capital allocation exercise, particularly for carbon offsets, which is a relatively new market, it better be right. It has to be additional, measurable, and verifiable, because it has to stand up to financial audit and disclosure standards.”

Weyerhaeuser works with third party auditors for independent project verification before it submits an application to ACR to certify its carbon projects and to issue the credits.

The REIT also partners with carbon management firm Carbon Direct for technical scientific advisory services and for marketing of the carbon credits. Carbon Direct evaluates Weyerhaeuser projects against its Criteria for High-Quality Carbon Dioxide Removal, which provide science-based benchmarks to drive climate action at scale.

Steeper-Than-Expected Learning Curve

As to why Maine was chosen for the first IFM project, Hagen points to “a unique set of conditions where we could change the forest management to grow additional carbon pools through IFM, while also serving our existing customers.”

For any IFM project, “we're looking for areas where we can complement our timber revenues with our carbon credit revenues,” Hagen says.

He stresses that all IFM projects must represent real, measurable changes to the REIT’s business operations in order to capture additional carbon, deliver long-term climate benefits, and be based on a transparent methodology. “We believe these principles are essential to help build a trusted market.”

Hagen admits that the learning curve for the Maine IFM project was steeper than expected. “We underestimated the level of complexity. It took a lot of technical expertise and coordination to do it right.”

The process involved building a strong forest carbon development team, Hagen explains. Weyerhaeuser was able to tap existing expertise within the company, but it took time to build that team with carbon-project specific expertise. “Now, as we move into the next projects that we've announced in the South, we have this deep bench of talent, which is going to serve us well as we scale the business,” he says.

Scope of Market

Hagen says the voluntary carbon market is still relatively small today, with a value of around $1 billion to $2 billion a year. However, the market could be worth upward of $50 billion by 2030, according to McKinsey.

“Any time you have an emerging market, you have growing pains. And you've definitely seen some growing pains over the last couple of years, but a lot of the work that's being done to increase transparency and scale is going to greatly benefit the development of the market,” Hagen says.

He notes that voluntary carbon credits were a lively topic of discussion at the COP28 summit in December 2023. “From a demand side, there's strong interest in high quality projects that demonstrate real benefits that can be independently verified.”

For the voluntary carbon market to evolve, though, and generate a high velocity of trading, Hagen sees the need for more transparency and more alignment across methodologies and registries. “That’s something that is evolving. And we are encouraged by the standards that are being set” in order to realize the full benefit of working forests as natural climate solutions, he adds.

Find additional Timberland REIT Stories here: