FTSE EPRA/Nareit Global Real Estate Index Series

The FTSE EPRA/Nareit Global Real Estate Index, the broadest index of global stock exchange-listed REITs and property companies in both developed and emerging countries, includes 480 constituents with a combined float-adjusted equity market capitalization of $1.3 trillion as of Sept. 11, 2020.

The FTSE EPRA/Nareit Developed Index, the index of global stock exchange-listed REITs and property companies in developed countries includes 341 constituents with a combined float-adjusted equity market capitalization of $1.2 trillion, as of Sept. 11, 2020.

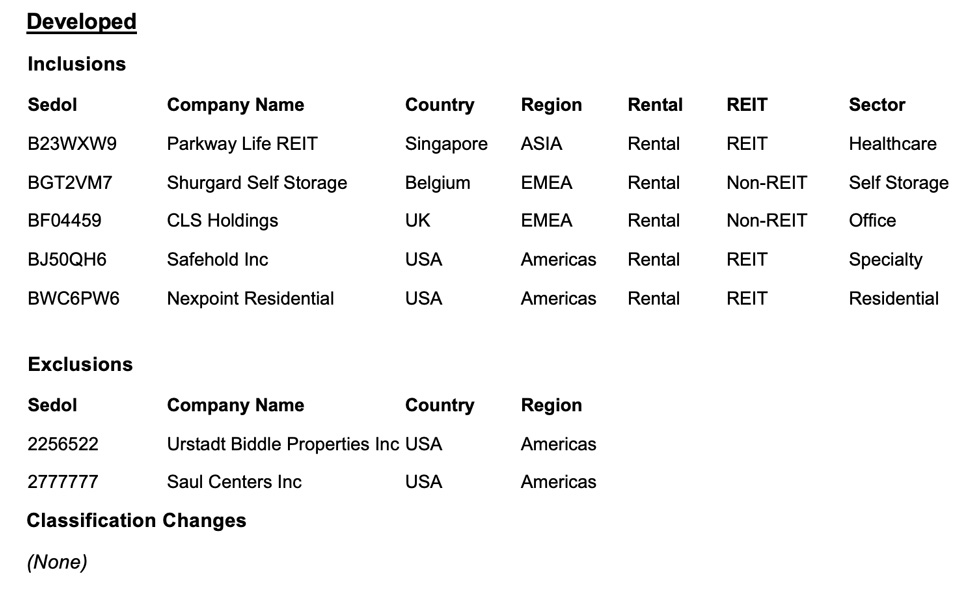

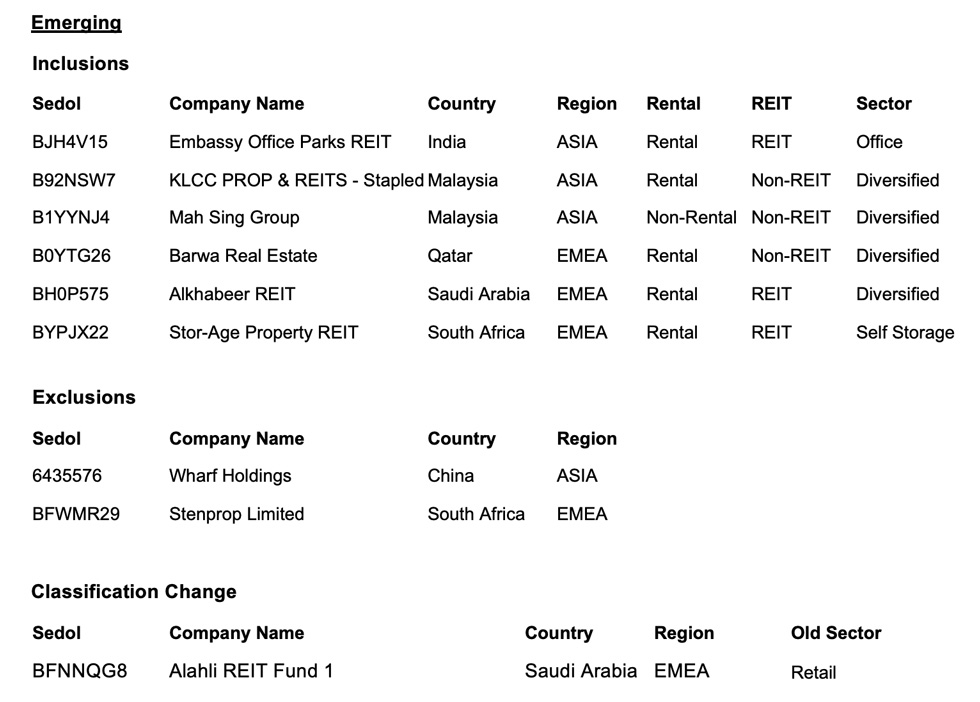

On Sept. 3, 2020, representatives from FTSE Russell, EPRA, and Nareit met with members of the FTSE EPRA/Nareit Regional Advisory Committees for the regularly scheduled fourth-quarter review of index constituents. The following additions, deletions and classification changes were agreed to and will be applied after the close of business on Friday, Sept. 18, 2020:

FTSE Nareit U.S. Real Estate Index Series

As of Sept. 11, 2020, the FTSE Nareit All REITs Index, the broadest index of listed REITs in the FTSE Nareit U.S. Real Estate Index Series, included 221 constituents with a combined total equity market capitalization of $1.2 trillion. Of the 221 REITs in the FTSE Nareit All REITs Index, 30 firms were constituents of the S&P 500; 38 firms were constituents of the S&P 400; and 56 firms were constituents of the S&P 600.

On Sept. 2, 2020, representatives from FTSE Russell and Nareit met with members of the FTSE Nareit U.S. Real Estate Index Advisory Committee for the regularly scheduled fourth-quarter review of index constituents. The following additions, deletions and classification changes were agreed to and will be applied after the close of business on Friday, Sept. 18, 2020:

Inclusions

(None)

Exclusions

(None)

Classification Changes

Jernigan Capital (reclassified from Mortgage Commercial Financing to Equity Self Storage)