Key Takeaways

- In 2023, more institutional investors will likely consider REITs as part of portfolio completion strategies to gain geographic diversification or sector diversification, or to enhance their portfolios’ ESG attributes.

- REITs offer sector diversification by giving investors better access to property sectors that house the modern economy, such as cell towers, data centers, self-storage, health care, industrial, and logistics.

- REITs offer geographic diversification; there are a total of 865 listed REITs in more than 40 countries and regions, with a combined equity market capitalization of $2.5 trillion.

- REITs enhance portfolios’ ESG attributes because they provide access to best-in-class performers in environmental stewardship, social responsibility, and good governance.

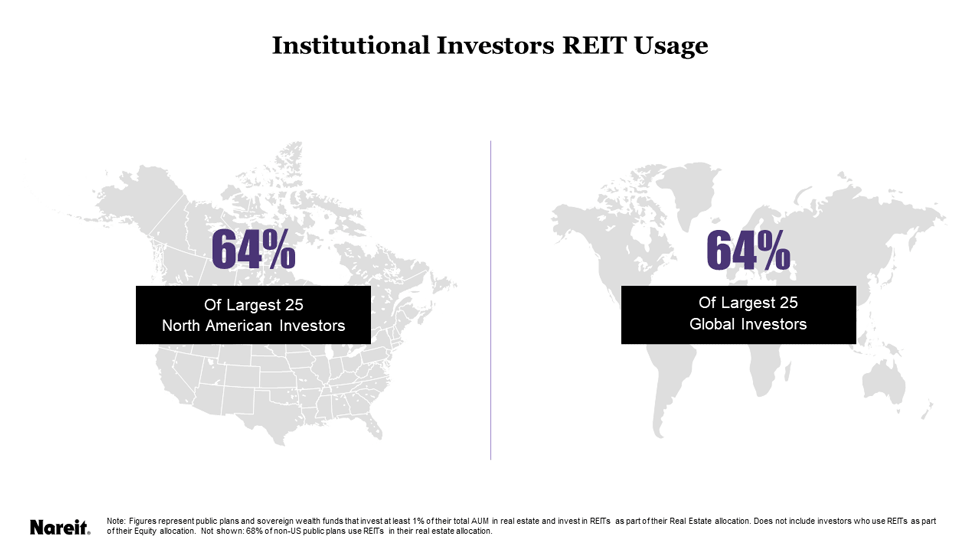

Nearly Two-Thirds of Top North American and Global Plans Use REITs in Their Real Estate Allocation

REITs are widely used in the real estate strategies of nearly two-thirds of the largest and most sophisticated institutional real estate investors in the United States and globally. Approximately 64% of the top 25 largest defined benefit and sovereign plans in both North America and the world as a whole use REITs to optimize their real estate investment portfolios. Taken together, these top U.S. and global plans have, on average, $430 billion in total assets under management with an average real estate portfolio of more than $30 billion.

REITs have long been recognized as playing a key role in helping institutional investors meet their real estate allocation objectives by taking advantage of relative valuation opportunities and improving their portfolios’ overall risk/return profile. Research by Nareit and CEM Benchmarking, Inc. shows that REIT returns have consistently outperformed private real estate by around 2% per year and, because of the timing differences between public and private real estate, provide “temporal” diversification.

Institutional investors also increasingly understand that investing with REITs allows allocators to be nimbler and more targeted in overweighting or underweighting specific sectors or geographic regions.

In 2023, we expect to see more institutional investors considering REITs as part of portfolio completion strategies. The term “portfolio completion” is used to indicate that REITs are being used in a key investment role to optimize, or complete, an aspect of a real estate portfolio.

This could encompass: geographic diversification, by using non-U.S. REITs and listed real estate; sector diversification, to get access to modern economy sectors that tend to be better covered by REITs than private real estate; and ESG enhancement, by increasing a portfolio’s ESG attributes.

REITs Offer Geographic Diversification

As of December 2021, there are 865 listed REITs with a combined equity market capitalization of approximately $2.5 trillion in more than 40 countries and regions around the world. Investors can easily diversify the geographic footprint of their real estate portfolio using REITs and listed real estate without the need to build out dedicated international teams or an on-the-ground presence.

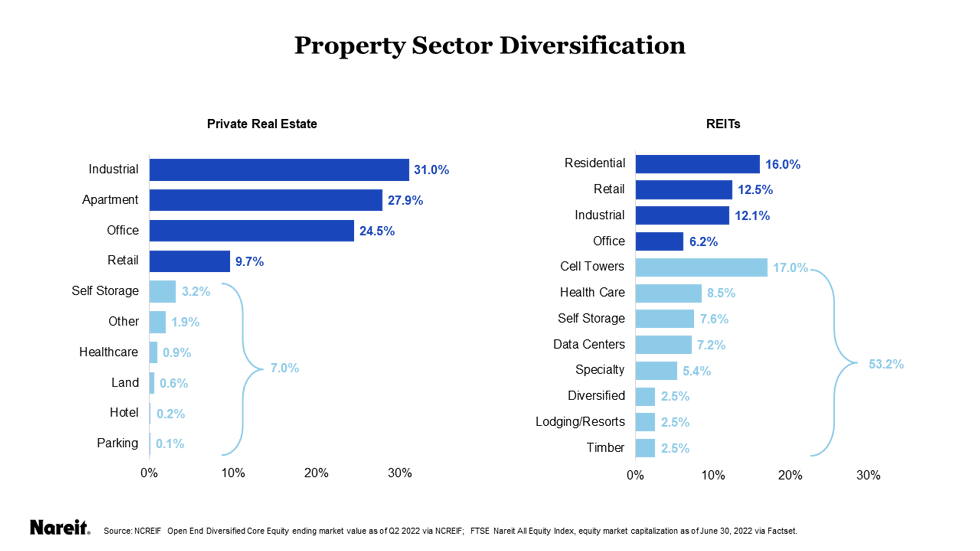

REITs Offer Property Sector Diversification

Many legacy institutional real estate portfolios are currently overweight office and retail, and correspondingly underweight in modern economy sectors. REITs can be very attractive to those investors looking to increase their exposure to newer, alternative economy sectors, including cell towers, health care, data centers, self-storage, and others.

The chart above demonstrates how REITs provide better access to these newer and alternative real estate sectors.

This diversification is a key factor as to why REITs are appealing to so many institutional investors that are looking to diversify the sectors and geographies of their real estate holdings.

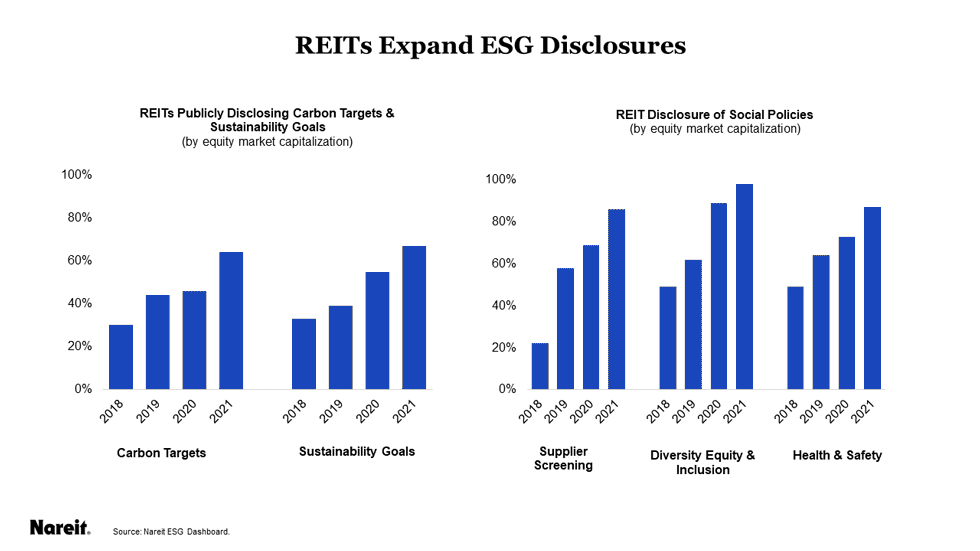

REITs Enhance ESG Attributes

Over the past decade, institutional investors have become increasingly concerned with the ESG profile of their investment portfolio. For these investors, REITs provide access to some of the best-in-class performers in each dimension of E, S, and G.

As the chart above indicates, REITs are setting targets to address sustainability and climate change and are increasing disclosure around key social issues.

REITs provide geographic diversification, sector diversification, and can enhance a portfolio’s ESG attributes. In 2023, more institutional investors will likely consider REITs as part of portfolio completion strategies because of these benefits.