Key Takeaways

- REITs are well-positioned for economic uncertainty in 2023 because of their strong balance sheets.

- Leverage is near historical lows and REITs have well-termed, well-structured debt.

- Lower leverage has led to lower expenses as a share of net operating income (NOI).

- REIT balance sheets put them in a strong position in 2023 to compete against more highly levered market participants for property purchases.

2023 will continue to bring economic uncertainty as the Federal Reserve continues to increase short term rates to lower inflation. Though a higher interest rate environment can create a difficult operating environment for real estate generally, REITs have positioned their balance sheets to be resilient in 2023. Since the end of the Global Financial Crisis (GFC), REITs have lowered their exposure to higher interest rates by reducing leverage and interest expense, using fixed rate debt, and increasing the term of the debt they hold.

REITs Have Historically Low Leverage

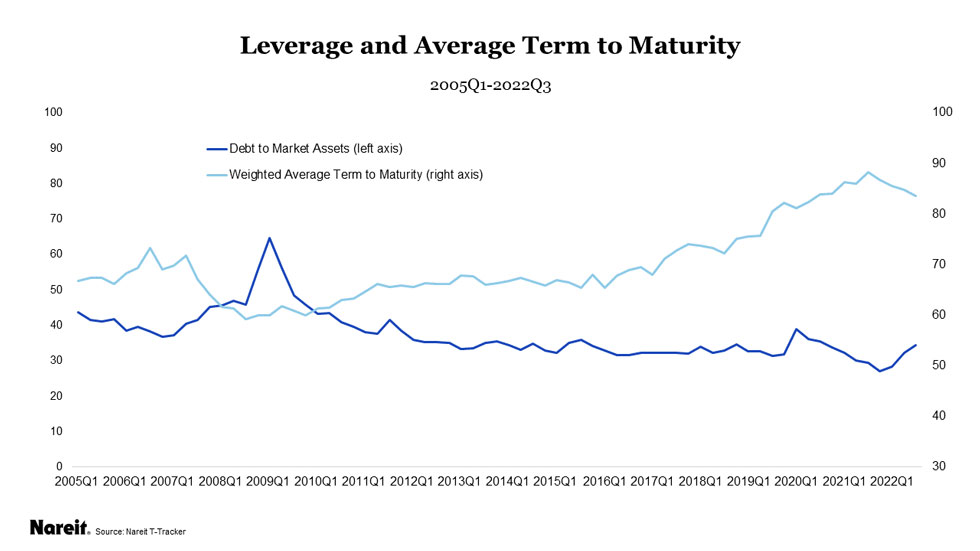

Leverage, as measured as debt-to-market assets, has stayed below 40% since 2011, and has stabilized in the low to mid 30% range since 2016. For example, as of the third quarter of 2022, leverage is at 34.5% with a weighted average term to maturity of 83.5 months, or more than seven years.

The chart above tracks these two measures since 2005. Leverage was increasing through the run up to the GFC and briefly spiked in 2009 at 64.7% when market values fell.

REITs Have Well-Termed, Well-Structured Debt

REITs have a long runway to manage leverage in the higher interest rate environment because they have used fixed rate debt to lock in low interest rates for long terms.

For example, during the same time frame illustrated in the above chart, the weighted average term to maturity increased significantly. The term of debt was just more than 59 months (almost five years) in 2005 and rose to its peak in 2021 of 89 months (almost seven and a half years). The term of debt has shortened slightly in 2022, as new debt issuance has been well below historic levels, but remains near all-time highs.

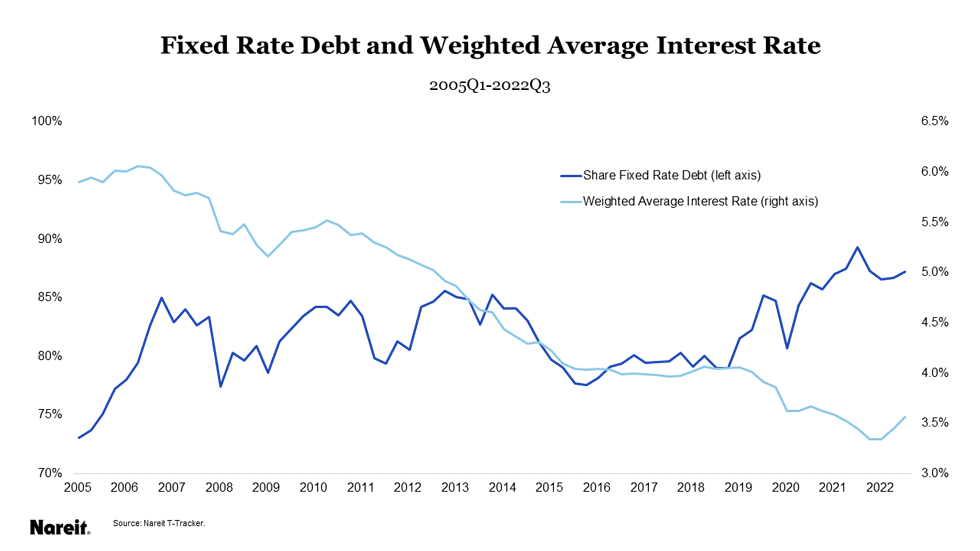

The chart above shows the fixed rate share of total debt since 2005 and the weighted average interest rate on the total debt outstanding. The share of fixed rate debt has increased from 73% in 2005 to more than 85% in 2021 and 2022. At the same time as REITs have moved to fixed rate debt, the average interest rate on their debt has fallen. REITs have been able to decrease their weighted average interest rates from 5.9% in 2005 down to 3.6% in the third quarter of 2022.

With less exposure to variable rate debt, and as previously shown, long average terms to maturity, REITs locked in debt at low rates limiting their exposure to higher rates in 2023.

Interest Expense as Share of NOI Is Lower

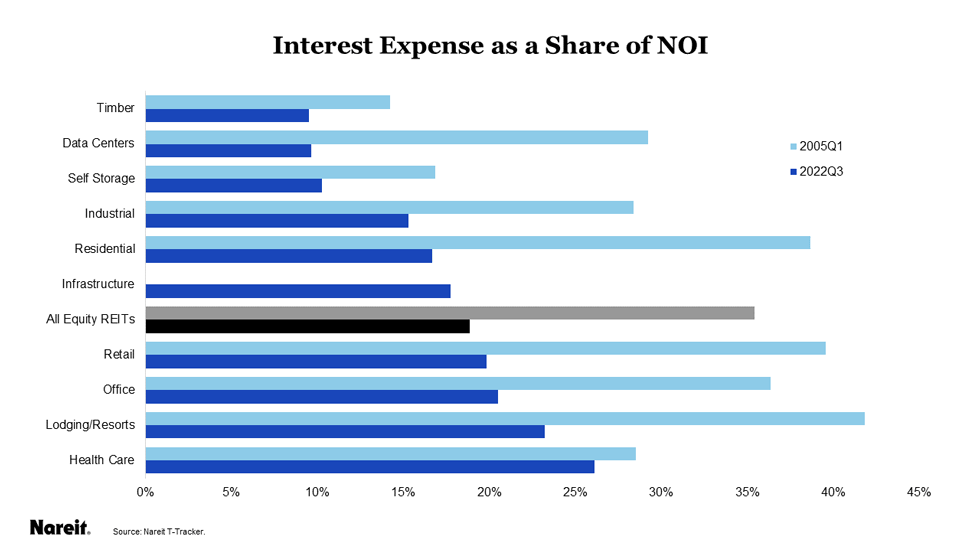

One result of lowering leverage over the past several years for the industry has been lower interest expenses as a share of NOI. Interest expense as a share of NOI had been at 37% in 2009. Since that time, it has experienced a precipitous drop as REITs have reduced leverage and financed their debt with low interest rate debt. As of the third quarter of 2022, it was at 18.9%. As noted above, REITs also have most of their debt at fixed rates, with 87.2% of total debt at fixed rates.

The chart above tracks interest expense as a share of NOI for the 10 pure-play property sectors comparing the beginning of 2005 to the third quarter of 2022 (infrastructure was not separated into its own property sector until 2012). All sectors have reduced interest expense as a share of NOI from 2005 levels. Notably, even the sectors with the highest ratios of interest expense to NOI today have levels below the industry average for 2005 of 35.4%.

Residential has experienced the largest reduction in interest expense to NOI since 2005, down 22 basis points, followed by data centers and retail, both down 20 basis points. Timber and data centers are both far below the industry average for interest expense, below 10%, and have tended to keep interest expense lower than the industry average. Lodging/resorts and health care are above average at 23.2% and 26.1% respectively. Health care has had the smallest reduction in interest expense share, down only 2 basis points.

In 2023, a higher interest rate environment will translate to higher rates on both variable debt and new debt, resulting in higher interest expenses and a larger debt services burden. REITs are in a strong position to weather higher rates and compete against more highly levered market participants for property purchases because they effectively managed their balance sheets.