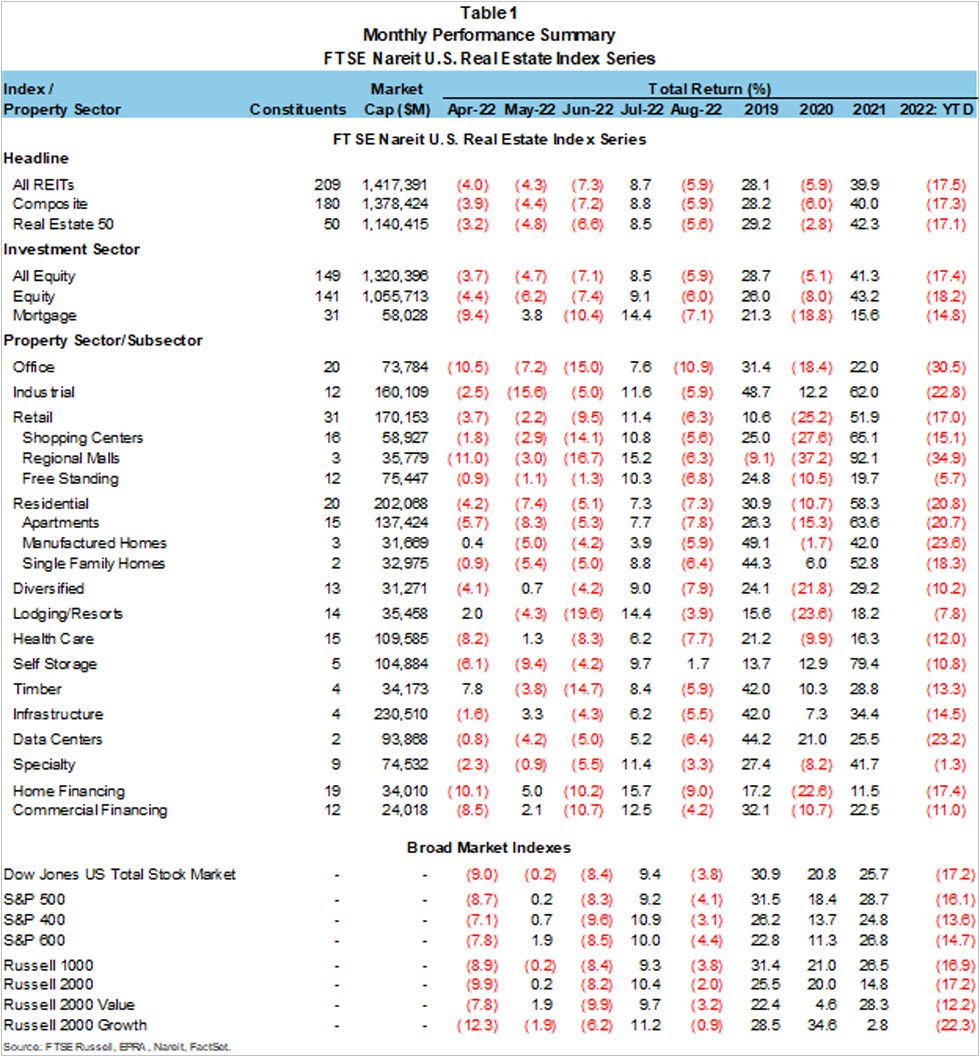

The FTSE Nareit All Equity REITs Index posted a total return of -5.9% and the FTSE Nareit Equity REITs Index fell 6.0% in August. Broader markets also declined, as the Dow Jones U.S. Total Stock Market and the Russell 1000 both fell 3.8%. The yield on the 10-year Treasury rose 60 bps during August to end the month at 3.2%. The decline posted by REITs and equity markets came as investors interpreted the sentiment of the Federal Reserve as being more hawkish than they had in July, with the next FOMC meeting scheduled for Sept. 21.

However, REIT operational performance continues to be robust as U.S. equity REITs posted an aggregate FFO of $19.6 billion in the second quarter of 2022, 22.4% above the 2019 quarterly average of $16.0 billion and 50.1% higher than the 2020 quarterly average of $13.0 billion.

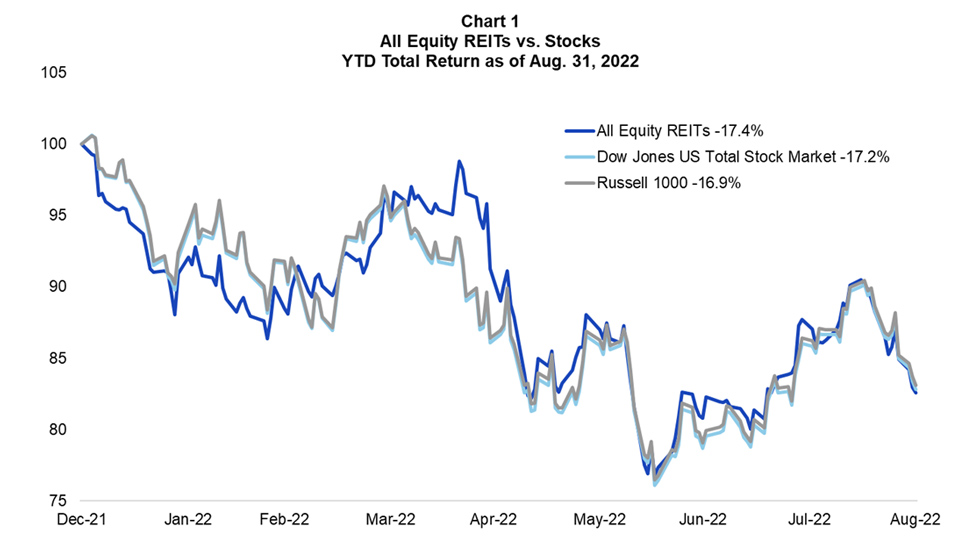

Chart 1 shows REITs are narrowly underperforming broad-market equities on a year-to-date basis through the end of August, with a total return of -17.4% for All Equity REITs, -16.9% for the Russell 1000 and -17.2% for the Dow Jones U.S. Total Stock Market.

Self storage led all sectors and was the only sector posting positive returns in August, with a return of 1.7%. The specialty sector posted a loss of -3.3% followed by lodging/resorts at -3.9%, as reflected in Table 1.

The office sector lagged all others with a total return of -10.9%, followed by the diversified sector at -7.9%, and the residential sector at -7.3%. Mortgage REITs posted a total return of -7.1% in August, with commercial financing mREITs returning -4.2% and home financing mREITs at -9.0%.