Last week we began a series of market commentaries tracking the performance of the REIT property sectors through the early stages of the coronavirus crisis. Given the rapidly changing landscape, we will continue to provide brief updates on returns each week.

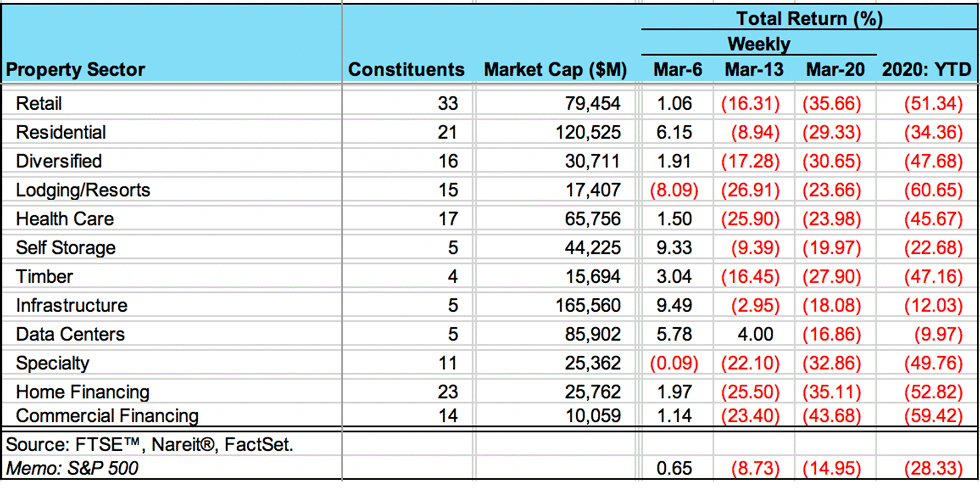

Conditions worsened significantly over the past week, both in terms of the expected economic impact of the disruptions to activity in response to the virus, and also in stock market returns. The S&P 500 had a total return of -14.95% last week, nearly twice as large a decline as in the preceding week (memo item in table below).

Nearly every REIT sector saw an acceleration of price declines as well. Sectors with the largest declines last week (more than 30% declines) include both commercial financing and home financing mREITs, retail, specialty and diversified REITs.

There were several sectors that had only modest declines in the week of March 13, including self storage, infrastructure and data centers—which had actually posted a 4% gain. Last week, however, these sectors posted double-digit negative returns, albeit still less than other REIT sectors.

Two sectors that had registered some of the largest declines one week ago saw some moderation of declines last week. Lodging and resorts and health care REITs still posted significant declines of roughly 23%, however.