Broad equity and REIT market valuations diverge from time to time. The recent strong performance of the U.S. equity market relative to REITs—driven in large part by the outperformance of AI-linked tech stocks—has resulted in equity valuation multiples soaring above similar REIT metrics. Historically, these types of dislocations have been uncommon, but they have presented buying opportunities for REIT investors. As the valuation measures move back toward equilibrium, i.e., converge, REITs have tended to outperform broad equities.

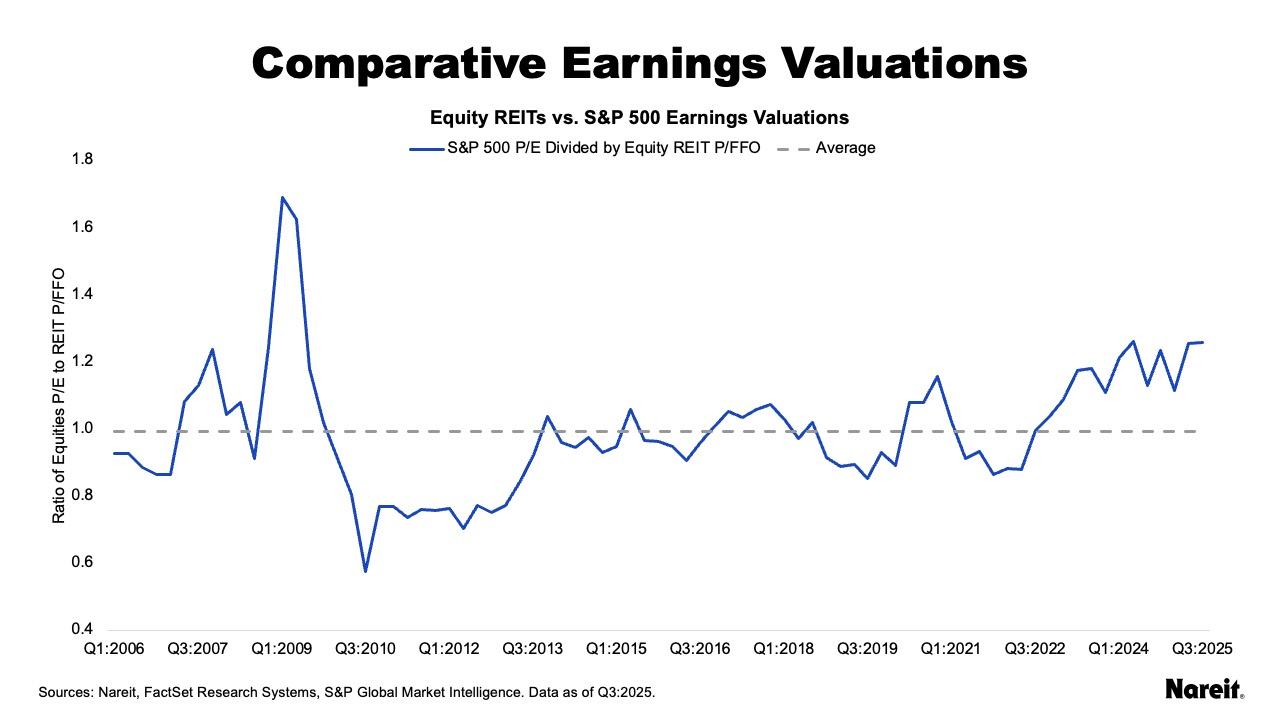

The chart above displays the S&P 500 forward (next 12 months) price to earnings ratio (P/E) divided by the equity REIT forward price to funds from operations ratio (P/FFO), as well as an average of the valuation quotients, since the first quarter of 2006. Valuation quotients greater than 1 indicate that equity multiples were greater than REIT multiples, and vice versa.

Since 2006, the average ratio of the S&P 500 P/E to equity REIT P/FFO has essentially been 1. This ratio was significantly elevated during three periods: the global financial crisis, the COVID-19 pandemic, and the recent AI-driven tech rally. These dislocations have traditionally presented buying opportunities for REIT investors. While past performance is not indicative of future results, REITs have tended to outperform broad equities as the gap between the valuation multiple metrics closes.

- During the global financial crisis, the broad equity-REIT valuation ratio started to rise in 2007; it reached a peak of 1.7 in the first quarter of 2009. Four quarters later, it was 0.9. Over that time, the FTSE Nareit All Equity REIT index posted a total return of 106.7%; the S&P 500 had a gain of 49.8%. REITs outperformed broad equities by 56.9%.

- During the COVID-19 epidemic, the broad equity-REIT valuation ratio reached a peak of 1.2 in the fourth quarter of 2020; it was 0.9 by the fourth quarter of 2021. Over those four quarters, the FTSE Nareit All Equity REIT and S&P 500 indices posted total returns of 41.3% and 28.7%, respectively, resulting in REIT outperformance of 12.6%.

- Along with the current AI-related tech rally, the broad equity-REIT valuation ratio started to rise during 2023. Although the ratio has fluctuated, it has remained elevated; it stood at 1.3 in the third quarter of 2025. Similar to the current public-private real estate divergence, this broad equity-REIT valuation dislocation has lingered.

It is difficult to time the end of a market dislocation, but, historically, every REIT-equity market valuation multiple divergence has had a convergence. While the duration of the current divergence remains unclear, it may set the stage for future REIT relative outperformance in 2026 and beyond.