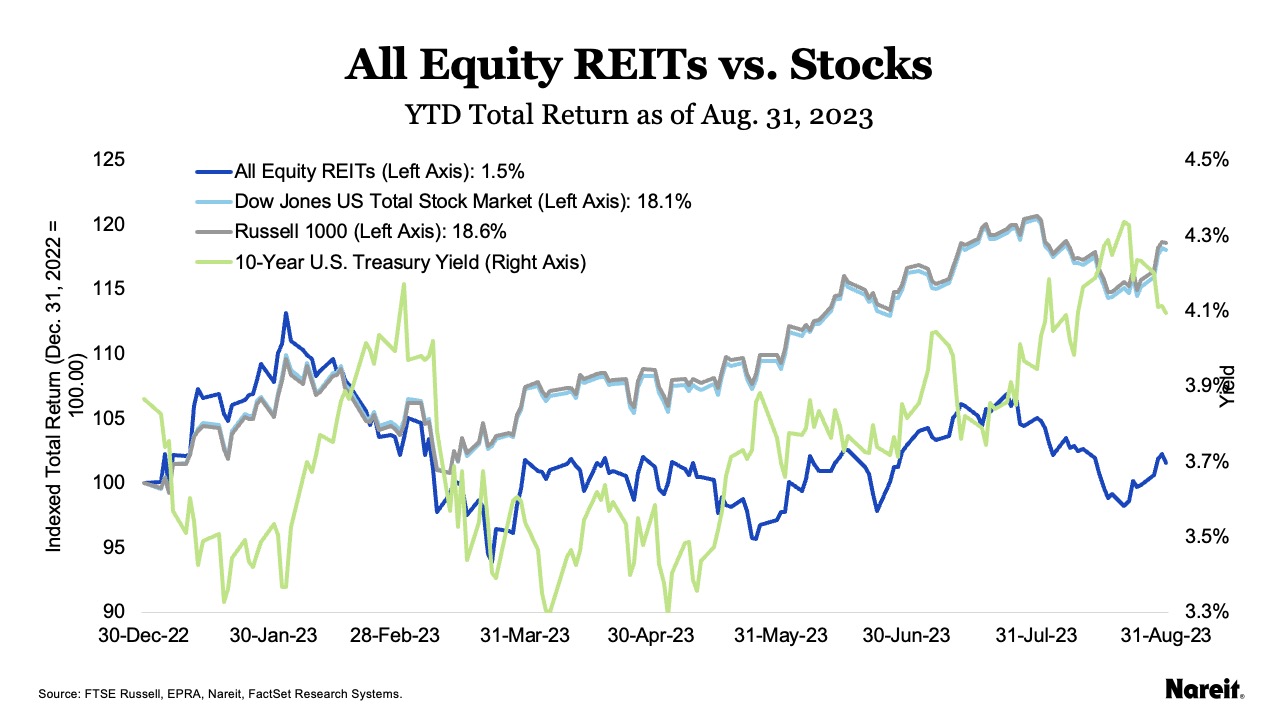

REITs and broad market equities faced challenges in August, as the sharply rising 10-year Treasury yield hit 4.34%, its highest level since 2007, and then declined to 4.09% in the final week of the month. On a total return basis, the FTSE Nareit All Equity REITs Index fell 6.5% through Aug. 21 and then rose 3.4% through the remainder of the month, before ending August down 3.3%. Over these same periods, the Dow Jones U.S. Total Stock Market fell 4.5% before gaining back 2.6% to close the month; its total return for the month was -2.0%. The Russell 1000 declined 4.3% and then rose 2.6%, ending the month down 1.8%.

REITs continued to underperform broader markets on a year-to-date basis. Total returns through the end of August were:

- All Equity REITs: 1.5%

- Russell 1000: 18.6%

- Dow Jones U.S. Total Stock Market: 18.1%

As shown in the above chart, the 10-Year Treasury climbed nearly 40 basis points in the first three weeks of August 2023, before subsiding to end the month at 4.09%. By comparison, the FTSE Nareit All Equity REITs Index yielded 3.98% as of July 31, 2023 and closed August at 4.12%. As yields on the 10-year Treasury and REITs near parity, income-seeking investors are forced to consider the relative safety of investing in government bonds.

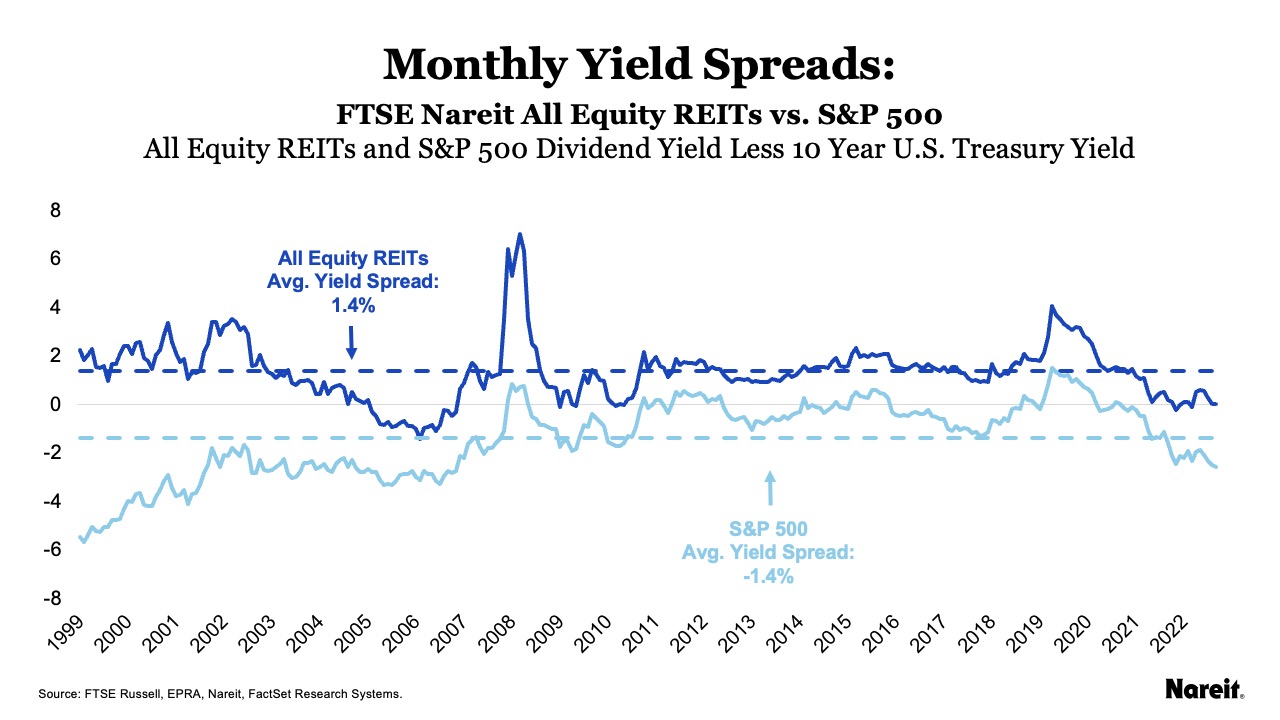

The chart above reflects the strength of REITs as an income-generating mechanism when compared to large-cap equities. Since 2000, the average spread between All Equity REITs and 10-Year Treasury yields was 1.4%; the yield spread between the S&P 500 and 10-year Treasury averaged -1.4%. REITs offer consistent income streams alongside the capital appreciation component of total returns and represent a well-rounded middle ground between the safety of investing in government debt, and the riskier S&P 500, whose total return is more heavily weighted to capital appreciation.

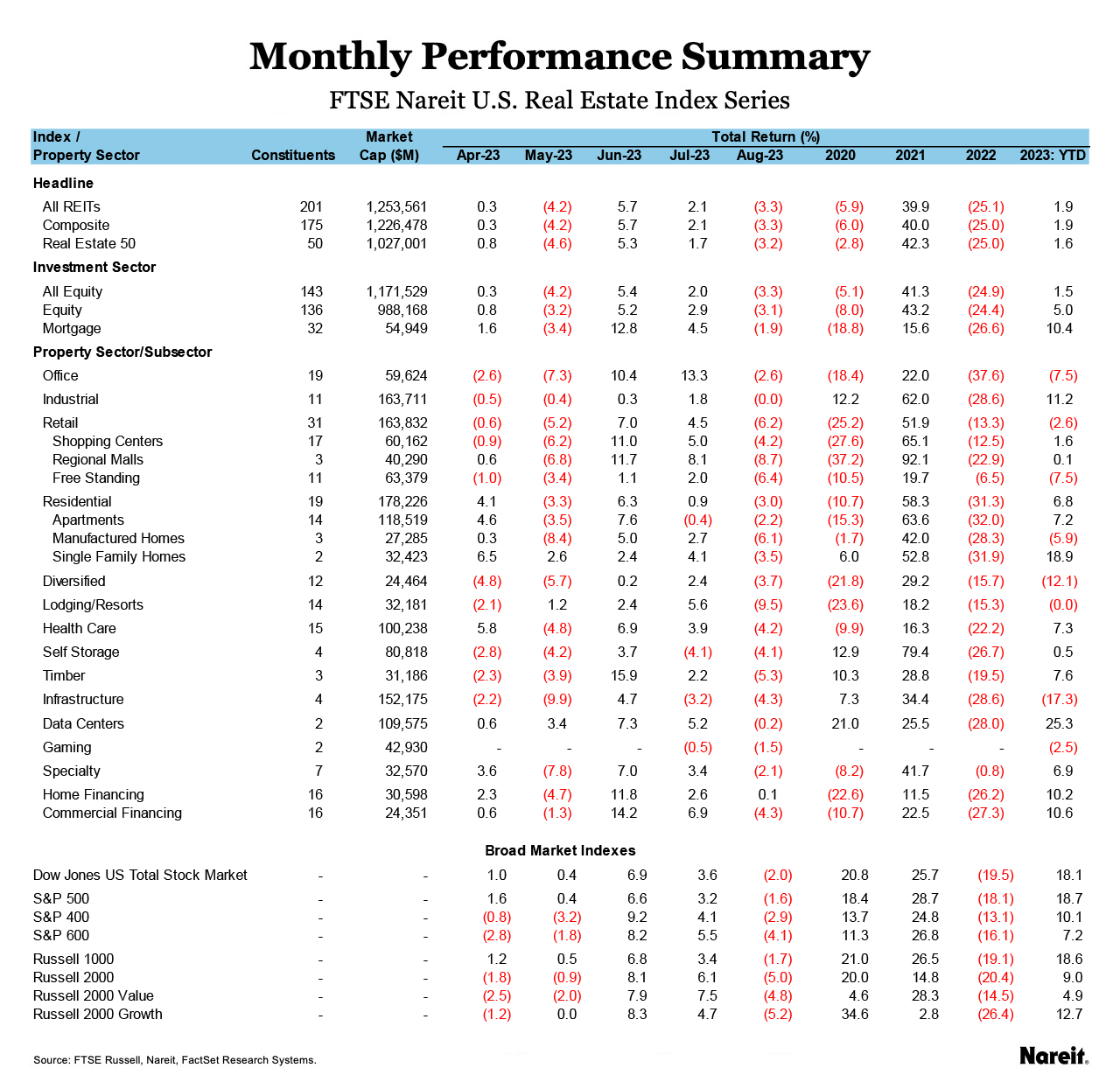

As shown in the above table, industrial led all sectors in August, closing the month flat on a total return basis. The next best performing property sectors were data centers with a -0.2% return, and the recently-launched gaming sector with a return of -1.5%. Timber, retail, and lodging/resorts lagged in August, with total returns of -5.3%, -6.2%, and -9.5%, respectively. On a year-to-date total return basis, the data centers sector continued to lead, followed by industrial and timber, with returns of 25.3%, 11.2%, and 7.6%, respectively. Year-to-date, office is down 7.5%, diversified is down 12.1%, and infrastructure is down 17.3%.

Mortgage REITs fell 1.9% in August, but are up 10.4% on the year. Home financing mREITs rose 0.1% for the month, while commercial financing mREITs fell 4.3%. On a year-to-date basis, home and commercial financing mREITs are up 10.2% and 10.6%, respectively.