The COVID-19 pandemic has disrupted most types of economic activity across the globe because of social distancing efforts to slow the spread of the disease. Many of these activities will return to pre-crisis patterns as the virus eventually comes under control.

But there may also be longer-lasting or permanent structural changes in how people interact in public spaces. Since most economic activity takes place within a commercial real estate structure, these changes will impact how people use commercial real estate in the future.

How will these changes affect commercial real estate markets over the medium to long term? The Nareit Fall 2020 Economic Outlook examines how new ways of interacting in public may affect commercial real estate. The Outlook first addresses current economic fundamentals, including the record decline in GDP in the spring and initial signs of recovery through the summer months, and highlights the two-track nature of the economy, with some sectors well on their way to recovery while others are still severely impacted by the pandemic.

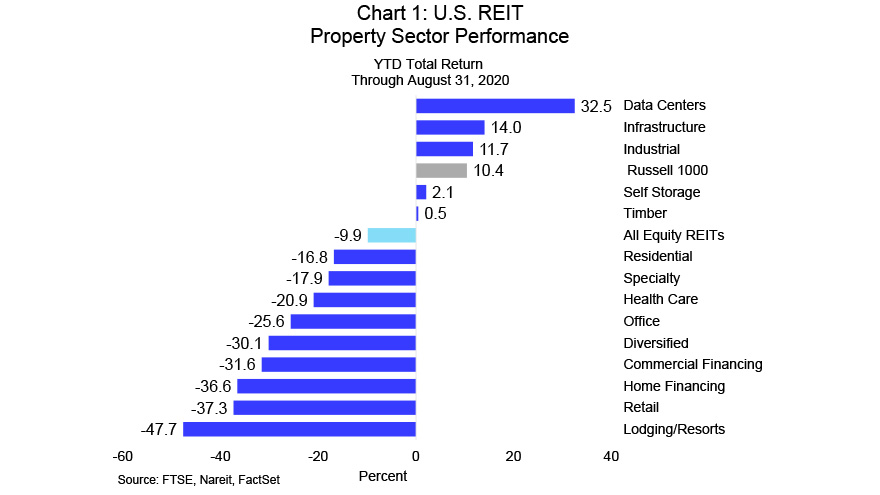

The Outlook then examines each of the major property sectors, including those where REITs operate. Mirroring the overall economy, some property sectors will face headwinds as long as health concerns persist or until a vaccine is approved, especially lodging/resorts and retail. Other sectors, however, like data centers, infrastructure, and industrial, will continue to benefit as concerns about face-to-face contact spur the digital economy.

The economy is still in the early stages of adapting to changes resulting from the coronavirus, and many of the developments discussed in the Outlook will continue to evolve in the months and years ahead. Some of the recent developments are workarounds that may not be entirely satisfactory but can protect from the virus while risks of infection are high. These changes will eventually fade, as behavior returns to pre-pandemic patterns after a vaccine or other public health measures suppress the virus. Other changes in behavior, however, may prove to be useful innovations that persist and may continue to evolve.

There is considerable uncertainty today, of course, about which developments will be transitory versus permanent. The Outlook includes a discussion of several major property sectors and focuses on how behaviors may change, and the impact of these changes on commercial real estate and REITs.

Key takeaways include:

- A record-sized decline in GDP is being followed by a quick (but uneven) turn back up;

- The economy is on a two-track path in the COVID-19 world—those at high risk of infection versus all the rest;

- The divergence of economic outcomes is mirrored in the REIT universe, with some sectors experiencing significant declines year-to-date, others more modest declines, while some have had large gains.

See the Nareit Fall 2020 Economic Outlook for more details, as well as a discussion of how changes in behavior may lead to longer-lasting structural changes in major real estate and REIT sectors.