What Are the Longer-term Effects of Covid-19 on Commercial Real Estate and REITs?

The COVID-19 pandemic has disrupted most types of economic activity across the globe because of social distancing efforts to slow the spread of the disease. Many of these activities will return to pre-crisis patterns as the virus eventually comes under control.

But there may also be longer-lasting or permanent structural changes in how people interact in public spaces. Since most economic activity takes place within a commercial real estate structure, these changes will impact how people use commercial real estate in the future.

How will these changes affect commercial real estate markets over the medium to long term? In this outlook essay, I discuss how new ways of interacting in public may affect commercial real estate. First, we will look at the current economic fundamentals, including the record decline in GDP in the spring and initial signs of recovery through the summer months. In particular, I highlight the two-track nature of the economy, with some sectors well on their way to recovery while others are still severely impacted by the pandemic.

I then examine each of the major property sectors, including those where REITs operate. Mirroring the overall economy, some property sectors will face headwinds as long as health concerns persist or until a vaccine is approved, especially lodging/resorts and retail. Other sectors, however, like data centers, infrastructure, and industrial, will continue to benefit as concerns about face-to-face contact spur the digital economy.

The economy is still in the early stages of adapting to changes resulting from the coronavirus, and many of the developments discussed here will continue to evolve in the months and years ahead. Some of the recent developments are workarounds that may not be entirely satisfactory but can protect from the virus while risks of infection are high. These changes will eventually fade, as behavior returns to pre-pandemic patterns after a vaccine or other public health measures suppress the virus. Other changes in behavior, however, may prove to be useful innovations that persist and may continue to evolve.

There is considerable uncertainty today, of course, about which developments will be transitory versus permanent. This essay focuses on how behaviors may change, and the impact of these changes on commercial real estate and REITs.

A Record-sized Decline in GDP Is Followed by a Quick (but Uneven) Turn Back Up

The initial economic impact of the COVID-19 virus was severe, with stay-at-home orders and business shutdowns contributing to a record 31.7% annualized decline in GDP in the second quarter. Since restrictions began to ease in some parts of the country in April and May, however, there have already been robust recoveries in some parts, but not all parts, of the U.S. economy. Even as these signs of recovery began to appear in early- to mid-summer, though, there were concerns that the economy could stall or reverse prior gains—the so-called “W-shaped” recovery—especially as some of the federal programs to support the economy, like the $600 per week additional unemployment benefits, expire.

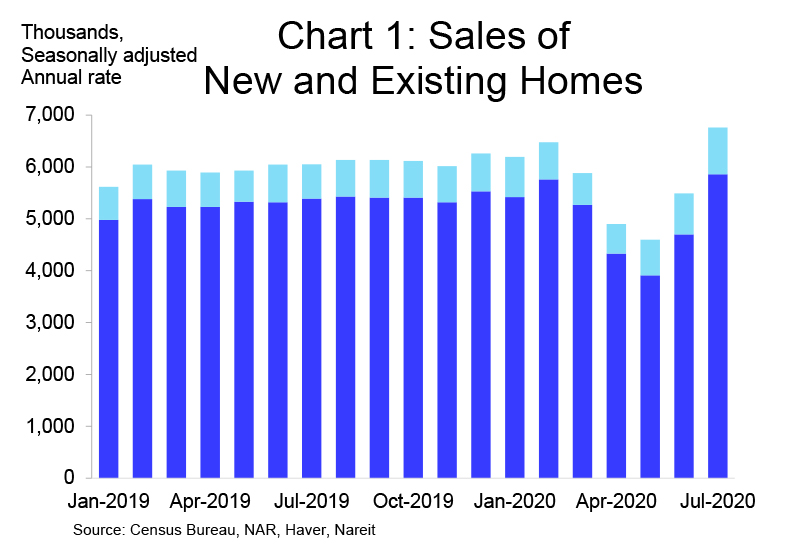

Fortunately, data through July and August reveal few signs of any such reversal. Home sales rose sharply in July, with both new and existing home sales jumping to the highest pace since December 2006.

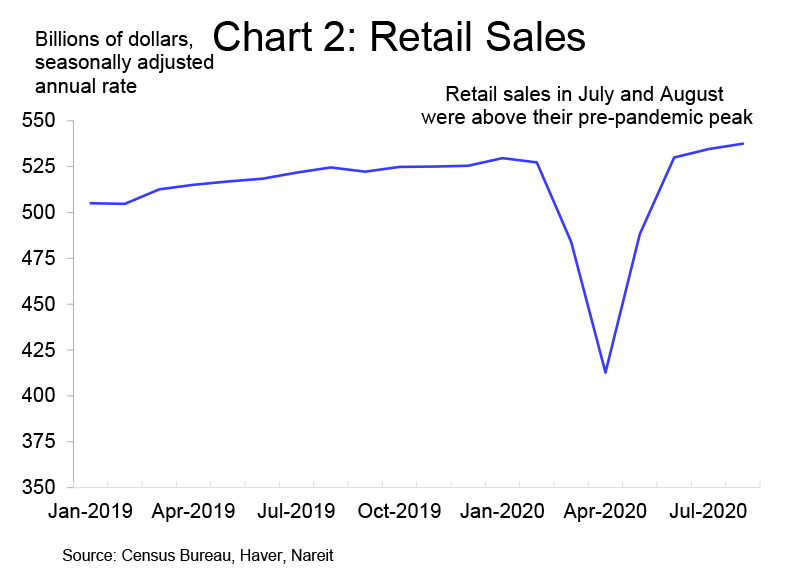

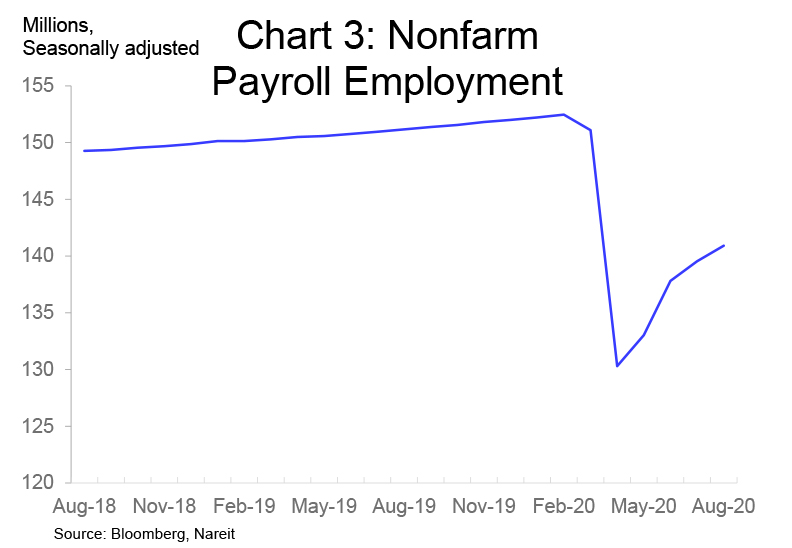

Retail sales have also moved back above pre-pandemic levels. Employment continued to recover through August, with a 1.4 million increase in nonfarm payrolls.

Hiring of temporary workers for the Census boosted total jobs, but private employment also posted a 1.0 million gain. Retail trade, food service and health care re-hired workers as stores, restaurants, bars, and doctor’s offices reopened across the country. Still, the labor market has a long way to go before there is a complete recovery. Private payrolls are still 11.5 million below pre-pandemic levels in February, and the unemployment rate remains elevated at 8.4%

A Two-track Economy in the COVID-19 World

The economy appears headed for a two-track recovery, however, with sectors involving low levels of face-to-face interactions on the path to a full recovery, while others with higher risks of infection lag. These sectors are unlikely to enjoy a broad-based return to pre-crisis conditions until a vaccine or cure is discovered or until other public health measures reduce the prevalence of the coronavirus in the U.S. population.

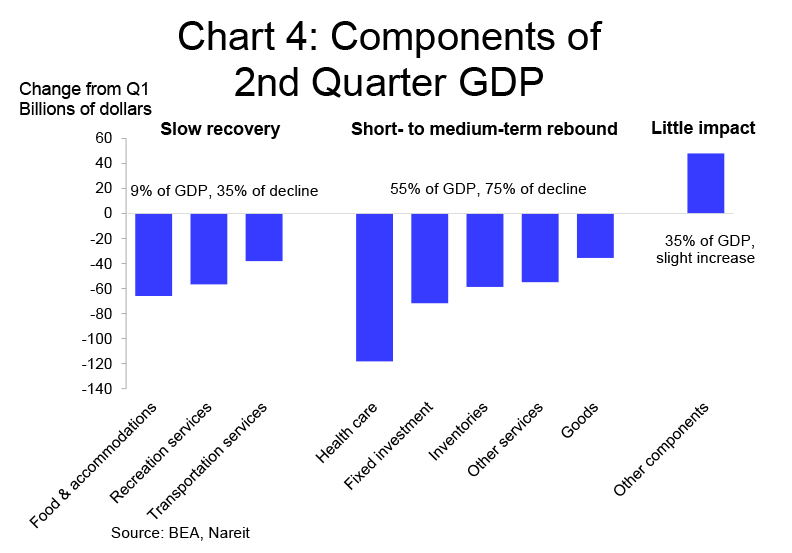

The divergence between different parts of the economy can be seen in the components of GDP growth during the second quarter of 2020, shown in chart 4. Sectors whose activities carry a high risk of infection declined much more sharply than others with lower risks, and the contribution of these at-risk sectors to the decline in second quarter GDP was four times as large as their share in the pre-crisis economy. Specifically, the food and accommodations (restaurants, bars, and hotels), recreation, and transportation services (includes air travel), which represented just 9% of total GDP in 2019, accounted for 35% of the decline in second-quarter GDP. These sectors have a high exposure to face-to-face contact and are likely to remain depressed and recover slowly until the COVID-19 virus is under better control.

There is another slice of the economy that contracted sharply in the second quarter yet is likely to stage a complete or near-complete recovery. This includes health care (especially dentists’ office visits, doctors’ office visits, and elective surgeries), fixed investment (includes construction of homes and commercial buildings, as well as business investment in equipment), inventories, and other goods and services (includes autos, clothing and other consumer purchases at retail stores). These components together represented 55% of pre-COVID-19 GDP but contributed 75% of the second quarter decline. Most of these categories began recovering in the summer months and are forecast to be back to pre-pandemic levels of activity in 2021.

The remaining 35% of GDP (including federal, state and local governments, and net exports) experienced a slight rise in the second quarter and remain above pre-pandemic levels.

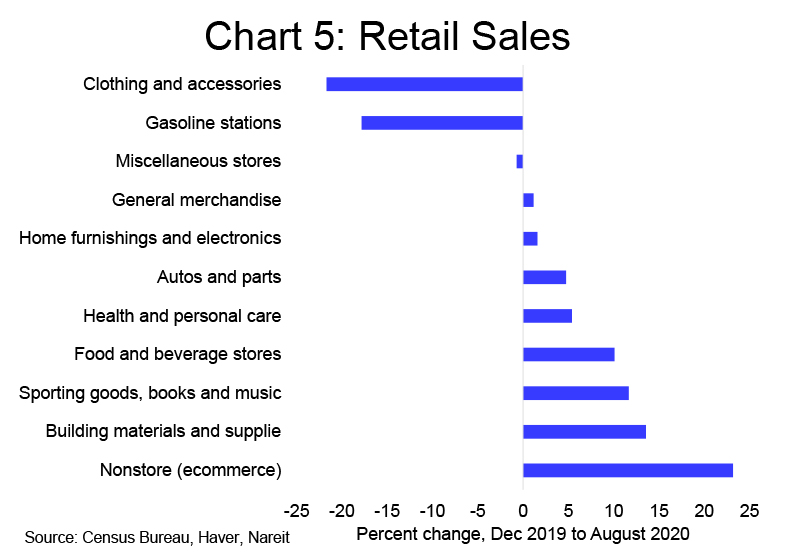

There has been a lopsided recovery in the different components of retail sales. Two categories in July remained below their levels from last December: Clothing and accessories, which was 21.7% lower, and gasoline, which was 17.8% lower. Gasoline sales will recover as people return to normal patterns of driving to work, shopping, entertainment, and vacations.

Social distancing measures have restricted many of the activities that spur clothing purchases, including back-to-school shopping, dinners at a public restaurant, entertainment, holiday parties, family gatherings, and business travel. In addition, shoppers often make clothing purchases in a store rather than online in order to check the size, fit, and appearance. Clothing sales collapsed when malls and stores closed but will likely begin to recover as shopping places reopen. A more complete recovery may occur as other restrictions on social and business activities ease.

The sectors that were more than 10% above their December levels include building materials, reflecting the strong recovery in home sales and home construction; food and beverage stores, as households prepare meals at home instead of restaurant dining; sporting goods, books, and music, as people need gear for new hobbies; and nonstore retailers, as e-commerce captures a larger slice of many types of sales.

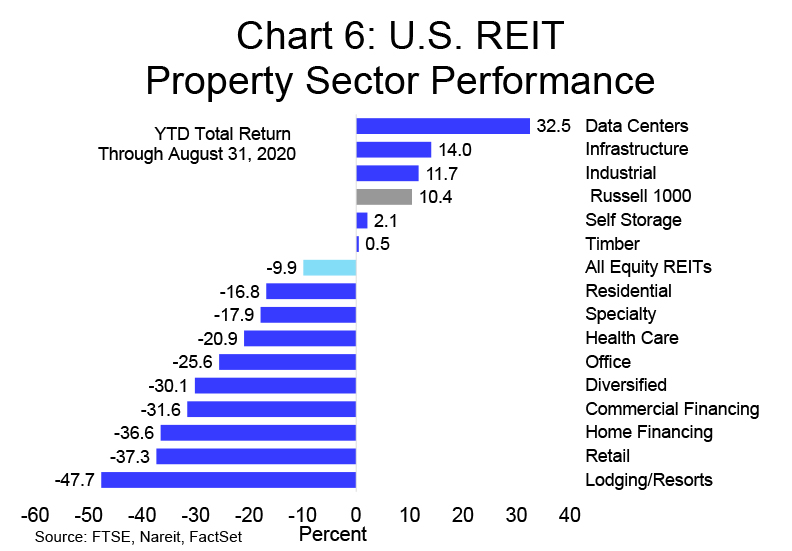

This two-track path forward is also visible in commercial real estate. Lodging/resorts and retail REITs support travel, restaurants, clothing, and other consumer shopping that experienced some of the biggest declines in demand discussed above. These sectors also posted the largest declines in total return year-to-date. (For REIT returns and other data, see REITWatch ).

The diversified, office, health care, specialty, and residential REITs also experienced double-digit negative returns through Aug. 31 of this year. These declines reflect both a loss of current revenues as well as higher expenses. For example, senior housing occupancy has fallen in the health care sector while costs for cleaning, PPE, and additional labor have risen. In addition, investors may be pricing in some concerns about the longer-term structural changes to these sectors that will be discussed in the next section.

There are several sectors of the REIT industry that support the digital economy and have benefitted from a tailwind as the pandemic spurs online interactions and purchases. Industrial REITs delivered a positive total return of 11.5% through the first eight months of this year due to sharply rising demand for their logistics facilities used in the shipment of goods bought online. Infrastructure REITs, which own many of the cell towers used to transmit voice and data communications, and data centers, which house the servers that host cloud computing, had total returns of 13.6% and 31.8%, respectively. (For data on REIT operating performance, see the Nareit T-Tracker® ).

The two-track nature of the recovery is a strong example of how exposures to the virus shape behavior across different sectors of the economy. This differential impact will help determine which changes in commercial real estate are transitory and which may be more permanent. We explore the possible long-term structural changes across property sectors below.

Longer-term Structural Changes to How Commercial Real Estate Is Used

Many of the changes in real estate markets that have happened this year will persist long after the virus comes under control, as they reflect not simply a lower level of demand, but rather structural changes in how people use real estate. One of the most prominent examples is work-from-home (WFH), which has proven to be less disruptive than expected, and many employees and employers expect WFH to play some role in many offices in the future. Also, online shopping and curbside pickups have grown in popularity for many types of products that had previously been slow to migrate to e-commerce. Many consumers may continue to buy these goods online while saving their trips to the mall for unique experiences and clothing, footwear, and other items where the look and fit is hard to judge on a computer.

The next section examines several of the property sectors facing significant longer-term changes because of the pandemic. I take a look at both risks and opportunities as well as a discussion of how the pandemic has impacted demand, how behaviors may change as the economy opens up, and what are the implications for demand, rents, and property prices.

Lodging and Resorts

In-person visits and meetings, whether with family and friends or for important business purposes, have an essential element that cannot be fully replicated online

The travel, lodging/resorts, hospitality sectors, along with restaurants and entertainment, have some of the highest potential exposures to COVID-19 due to the degree of face-to-face interaction with service providers and other customers. This will prevent these sectors from having a complete recovery until the pandemic is well under control.

These sectors are developing new procedures to minimize risks of infection and allow some resumption of activity. This includes cleaning, social distancing and direction of foot traffic patterns, contactless check-in and check-out, and more.

Travel and entertainment are vital parts of the lives of many people, however, and important for business operations as well. It is likely that, once the threats of infection have been adequately addressed, the travel/hospitality/entertainment sectors will rebound. For the long-term investor with high tolerance for risk, today’s prices may represent a good opportunity.

Risk factors:

- The travel industry has been among the hardest hit by the shutdowns and has been slower to start to recover than most other parts of the economy.

- Measures to address public health—extra cleaning, reconfiguring common areas—add expenses and possible capital outlays for remodeling.

- Overall demand may not recover fully until there is a vaccine, as online meetings replace business travel, and as households vacation closer to home.

- Restaurants and bars, a key source of revenue, are closed or operating below capacity due to social distancing.

Opportunities:

- Most of the opportunities for a recovery in lodging/resorts will be realized only after the pandemic is well under control.

- Personal and vacation travel will likely recover once the risks surrounding the COVID-19 outbreak fade. Business travel may be slower to regain pre-pandemic levels, however, as online video meetings and teleconferences replace some in-person events.

- In-person meetings, however, whether with family and friends or for important business purposes, have an essential element that cannot be fully replicated online.

Retail

Many shoppers enjoy the retail experience and still prefer to check the size, fit, and appearance of certain products at a physical location

As much as any property sector, retail embodies the three most important factors in real estate: location, location, location. Retail properties in markets with little job growth and lower incomes have been most affected by the e-commerce trends over the past half-decade and remain most exposed in the period ahead. Properties located in markets with growing populations and higher incomes, in contrast, have fared better than the rest, with rising rents and high occupancy rates in the months prior to the pandemic.

This divergence will likely continue in the months and years ahead, and the fortunes of retail properties will vary according to the quality of the property and the geographic considerations discussed above. Lower-quality malls have been more likely to lose anchor stores and suffer from declining occupancy. Some of these may be closed or redeveloped to other uses, including logistics, offices, and multifamily. Higher-quality properties, in contrast, have continued to attract shoppers and provide an engaging shopping experience. Most retail properties owned by REITs are newer, higher-quality properties in the more rapidly growing markets.

The spread of e-commerce has proceeded more rapidly in some types of products, but more slowly in others, as many shoppers prefer to check the size, fit, and appearance of certain products at a physical location. Retail sales of clothing and footwear fell more sharply in March and April than any other components of total retail sales, perhaps as many of these in-store purchases were delayed rather than shifting transactions to online channels.

Many retailers have found that the choice of bricks-and-mortar store outlets and e-commerce sales is not an either/or proposition. While e-commerce is a vital channel for meeting the needs of many shoppers, retailers have found that online sales fall in areas where they close a physical store location. Curbside pickup is another variant of the hybrid online/physical store model that has surged in popularity during the pandemic.

Risk factors:

- The impact of the COVID-19 pandemic comes on top of structural changes that were already underway due to the growth of e-commerce. Some of the impact of the pandemic has been to accelerate these pre-existing trends. There will, however, also be longer-term changes that had not been anticipated prior to the pandemic.

- The subsectors of retail have had different experiences:

- Many regional malls shut down completely in March and April, but have since reopened

- Shopping centers have had a mixed experience, with many stores closed but grocery anchors and other essential stores doing brisk business

- Free-standing retail has pockets of weakness (restaurants) but also strength (pharmacies).

Opportunities:

- Retail was one of the first parts of the economy to implement new measures to reduce risks of transmission in public spaces, including directing traffic flow; touchless payment with barriers for cashiers; greater distances in toilets; food courts closed for now; more frequent cleaning.

- Rent collections among free standing retail and shopping centers rose in June, July, and August as malls and shopping centers reopened (see REIT Industry August 2020 Rent Survey Results.

- Curbside pickup introduces a hybrid form of shopping with online selection and purchasing, but pickup from a physical location. Curbside pickup still requires bricks-and-mortar retail space for inventory and customer pickup.

- The spread of e-commerce has proceeded more rapidly in some types of products, but more slowly in others, as many shoppers prefer to check the size, fit, and appearance of certain products at a physical location.

- E-commerce sales continued rising in June, July, and August, however, even as bricks-and-mortar sales rebounded. This suggests that some of the changes in shopping patterns during the pandemic are an acceleration of trends that were already underway and are likely to continue in the future.

Office

Employees and employers expect that many or most days each week will be in the office, but with greater flexibility to WFH on certain tasks

The office environment faces significant challenges and may undergo extensive changes in the months and years ahead. For most of the past decade the emphasis has been on less space per worker and greater use of shared workspaces and common areas. This trend almost certainly will reverse in the period ahead, and it is unclear how much overall demand for office space will decline due to WFH if there is an offsetting increase in the space per worker.

WFH has been a useful workaround for the early stages of the pandemic, but many employers are finding significant drawbacks. There are still important benefits of face-to-face meetings that online video conferences cannot capture. Some activities are more successful in-person, like planning new projects, building new work teams, certain collaborative and creative efforts, or monitoring and disciplining underperforming employees. The informal meetings that happen by chance in the hallway often spark productive collaborations across work groups.

The status of the enclosed individual office space will be an important variable if flexible WFH becomes widespread. Will professionals who have long had their own office, bookshelves, filing, and personal space continue to expect this in the future? If so, WFH could mean that every third or fourth office sits empty on any given day but does not reduce the total office space required. Alternatively, will these professionals agree to rotating to whatever space is available on any given day? Such an approach would economize on total space needs but would require changes to working-day patterns. There are many unanswered questions about how the office workspace will change.

A move toward flexible WFH has significant implications for the geographic choice of an office location. When in-person meetings dominate the workday, a central downtown location that is closer to other offices can attract a significant premium. In the future, however, some businesses may be more likely to choose locations in suburbs, office parks, or in smaller cities for a greater portion of their total staffing needs. In addition to lower rents, these locations often have an easier commute and may be closer to residential areas where many employees live, and these locations may have more parking available. Such a shift may reduce the premium for rents and property prices in the downtown areas of major cities, but boost rents and prices in the suburbs and smaller metro areas.

Risk factors:

- WFH is here to stay—to some extent, at least. Several surveys of both employees and employers anticipate that most workers will spend many or most days each week in the office, but with greater flexibility to WFH on certain tasks.

- A more flexible work schedule may reduce the need for overall office space. WFH may, furthermore, allow some offices to shift from the premium downtown locations to less expensive suburban spots or office parks, or smaller cities. This may reduce the premium pricing that downtown office buildings have been able to command in the major cities.

- There may be capital costs to implement measures to reduce risks of infection, including installing barriers, and changing air flow patterns.

- Elevators, subways, downtown parking, pantries, food courts, and common areas in an office environment all pose challenges.

Opportunities:

Offices are here to stay as well.

- There are still important benefits of face-to-face meetings that online video conferences cannot capture.

- Some activities are more successful in-person, like planning new projects, building new work teams, certain collaborative and creative efforts, or monitoring and disciplining underperforming employees.

- The informal meetings that happen by chance in the hallway often spark productive collaborations across work groups.

- The trend toward densification of office space over the past decade will be reversed—but how much? The combination of flexible WFH but greater spacing within an office may result in more moderate changes in overall demand for space.

Residential: Multifamily, Manufactured Homes, Single-Family Home Rentals

Housing is different from retail or office, as one cannot live and sleep online

The future of residential markets, including apartments, single-family homes (owner-occupied and for rent), and manufactured housing, is closely linked to the changes in office and working arrangements discussed above. Changes to the residential market can be grouped into three categories:

- Geographic changes, if demand shifts from the urban core and close-in suburbs to locations farther out within the same city, or in a different city;

- Shifts in demand from one type of unit to another—apartment living to single family home, or to manufactured homes, or from renter to owner; and

- Changes within a living unit to accommodate the needs during the day from a person or people who are working or studying from home.

An apartment building may need to provide more services or different amenities to a greater population of residents who are working or studying at home all day long.

The existing apartment stock in most cities is dominated by one- or two-bedroom units that may be less able to accommodate a larger number of inhabitants who are at home several days a week. This could spur demand for the single-family rental market. In addition, households whose financial position was weakened by job loss or the failure of a personal business during the crisis may opt for rental housing, including single family rentals. Stock returns to the single-family home REIT subsector reflect a possible increase in demand, as this is one of the few areas in positive territory over the first eight months of 2020.

Risk factors:

- Downtown and close-in suburban locations may lose their relative attractiveness as WFH becomes a more prevalent long-term option.

- There may be extra maintenance costs and capital expenditures for cleaning of common areas, including lobbies and exercise facilities, providing different amenities to attract residents or accommodate those working from home, and redesigning spaces for social distancing.

Opportunities:

- Housing is different from retail or office—one cannot live and sleep online, and WFH means you are at home.

- More extensive WFH may shift demand from the urban center and close suburbs to less expensive locations farther out or in different cities.

- Many city dwellers chose downtown living for the amenities, including restaurants, theater, museums, and walkable neighborhoods. These activities may gain in popularity after the pandemic ends.

- WFH requires more space to work, separate from sleeping and eating areas, especially if the worker is in shared rental housing or has children at home. This may increase the demand for larger rental units.

- Demand for single-family home rentals has surged as households that are able to WFH move out of the city and its dense environment to be closer to parks and other outdoor recreational activities (for an analysis of the rise of institutional single family rentals, see Single Family Rentals: Demographic, Structural and Financial Forces Driving the New Business Model).

- The overall supply of housing imposes constraints on how much living patterns can shift. Housing markets across the country had little slack prior to the pandemic, as construction of both houses and apartment units have lagged population growth since the housing crisis in 2008-2009. A national shortage of housing stock, both owner-occupied and rental, single family and multifamily, limits the downside risks to prices and rents.

Health Care

The baby boom generation is moving into retirement and presents a demographic shift that will generate future demand

The health care sector is comprised of several different property types. Senior housing makes up a majority of REIT portfolios, but there are also significant positions in skilled nursing, lab space, and medical office buildings.

Senior housing and skilled nursing are residential communities and some have faced challenges maintaining a safe environment for residents. Most operators implemented changes as recommended by the CDC, including social distancing, closing or limiting common eating areas, testing for the coronavirus, PPE for staff, and materials for cleaning. Occupancy rates have declined, however, as some prospective tenants are cautious above visiting a facility and moving in with the current environment.

Over the coming years a growing number of baby boomers are likely to consider senior living as a housing choice. This sector has witnessed a construction boom in recent years, in anticipation of this future demand. Current market conditions may be soft, but the demographic trends will not be slowed by the pandemic, suggesting that market conditions should continue to recover.

Medical office buildings may face higher operating costs for providing a safe environment. Lab space may experience higher demand due to greater needs for testing and medical research.

Risk factors:

- Expenses have increased due to the need for cleaning, PPE, and personnel to limit transmission of the virus.

- Concerns about risks of infection in enclosed spaces, including common areas, dining rooms.

- Prospective tenants in senior housing may have been deterred from visiting facilities and moving in during the pandemic.

- The pandemic has led to a surge in telemedicine, which may reduce demand for medical office space. Increased access to screenings, however, could lead to an increase in in-person visits for follow up care. The net impact of telemedicine on medical office buildings remains unclear.

Opportunities:

- The baby boom generation is moving into retirement and presents a demographic shift that will generate demand for senior housing and skilled nursing over the coming decades.

- Medical office buildings and lab space remain important in delivering and developing medical care.

Industrial, Infrastructure, Data Centers

These three sectors—industrial, infrastructure, and data centers—help support many aspects of the digital economy and have benefitted from the shift away from in-person commerce and communications to the electronic realm. Industrial REITs own logistic centers that ship the goods bought on the internet. Infrastructure REITs own cell towers that transmit rising volumes of both voice and data communications. Data center REITs own facilities that hold the servers that host cloud computing and web platforms.

These sectors had enjoyed robust growth prior to the pandemic. Social distancing requirements have accelerated the growth in all these areas. Many households and businesses enjoy the convenience provided by greater use of e-commerce and digital communications, suggesting that this new demand will remain even after the pandemic is over.

The main question facing these tech-linked sectors is how rapidly demand will continue to grow from this new higher level. Stock market valuations suggest that investors are relatively optimistic that demand will continue to grow at an elevated pace.

Risk factors:

- The main risk to these sectors is that demand based on digital communications and e-commerce will grow but grow more slowly than current market pricing anticipates.

Opportunities:

- Accelerated trend toward e-commerce spurs demand for logistics space.

- Continued reliance on online video meetings and other areas of the physical realm that shift to the digital economy drive further growth in demand for cell tower transmissions and for servers for web hosting and digital commerce.

- These trends are all positive for occupancy, rents, prices.