Investing in commercial real estate through REITs can help improve portfolio performance in a number of ways. REITs help diversify portfolio exposures, reducing overall risks, while generating a high level of income and a competitive total return.

Investors who are homeowners may ask what the additional benefits are to investing in REITs, as housing gives them some exposure to real estate markets. Homeowners can benefit because income-producing commercial real estate is a very different investment than owner-occupied residential real estate. Analysis shows REIT long-term returns outpaced home ownership returns, even accounting for the imputed value of rent. REITs and homeownership returns are not highly correlated, with a correlation of just 0.46 over four years.

Owning a home is primarily about having a place to live, although it does often produce capital gains over time. Homeownership does not, however, generate current income, but rather requires regular mortgage interest, real estate tax, insurance payments and maintenance costs. Moreover, as shown below, the long-term investment returns to homeownership generally lag REITs, even taking into consideration the value of the home as shelter.

Investment in commercial real estate, which is accessible to everyday investors through REITs, provides valuable diversification benefits for long-term investors while providing competitive returns. An estimated 44% of U.S. households are invested in REITs, mostly through their retirement accounts. REITs generate continuing income flow from rents and are a liquid investment that is diversified across a range of real estate properties in a variety of geographic locations. Investors can choose the amount to invest in REITs without having to buy an entire property. REITs also face different economic drivers than residential housing, and REIT returns have a low correlation with both the broader stock market and home ownership returns. Measuring returns over four years, the correlation is 0.46.

By comparison, a house is a comparatively illiquid asset whose investment risk is not diversified, but rather highly concentrated. Owning a home also does not typically provide income to owners that stay in their homes. Fortunately, it does not have to be an either or scenario - both home ownership and real estate investment through REITs have unique long term benefits and possibilities.

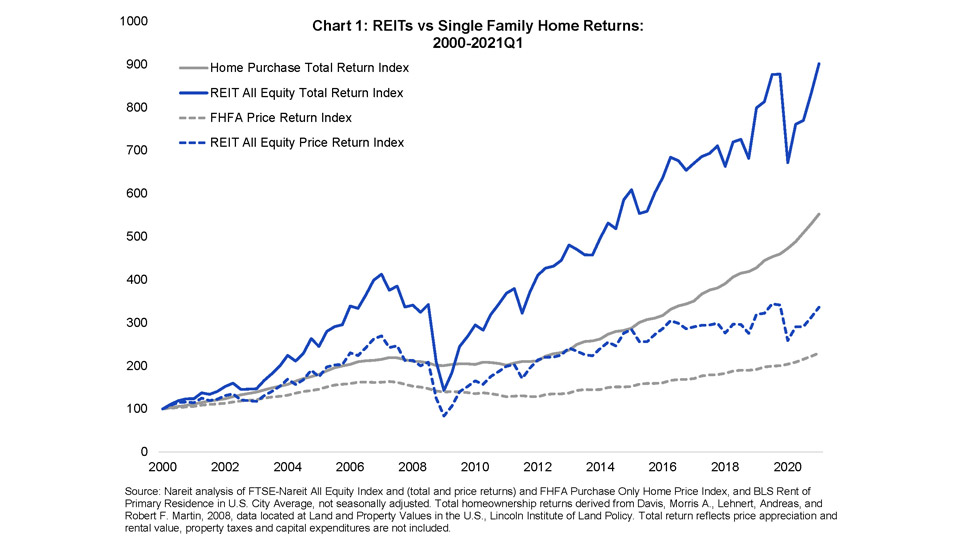

Comparing returns since 2000, REITs have proven to be a valuable investment. Chart 1 shows the quarterly price and total returns over time. REIT returns include dividends and home ownership returns include imputed rent—the rent money the owners are implicitly paying themselves by living in their own house instead of renting it out. Even including imputed rental value, REITs have provided stronger long-term returns.

For $100 invested in REITs starting in 2000, the investor would have $902 at the end of the first quarter in 2021, an 11% compound annual growth rate. A homeowner’s $100 investment would be worth $553, an 8.5% compound annual growth rate.

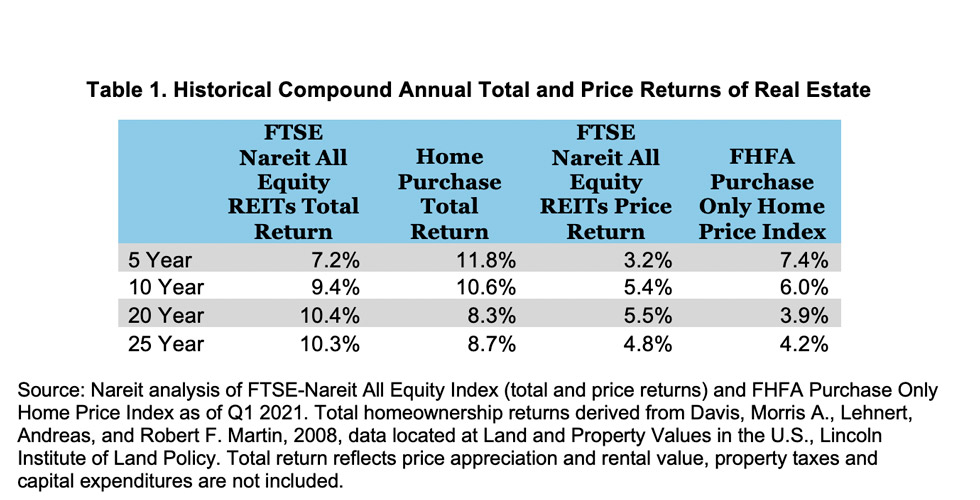

Table 1 compares the compound annual price and total returns for REITs and single family home ownership over various holding periods. Across time periods, we can see that over the 5 and 10 year windows, home ownership has outperformed REITs, driven by price returns. However, most homeowners keep their homes longer than 10 years. According to the American Community Survey, 50% of homeowners stay in their homes 13 or more years and over an investor’s lifetime, they are likely to have multiple decades of ownership by owning a number of individual homes. For durations over ten years, REITs outperform by a healthy margin.

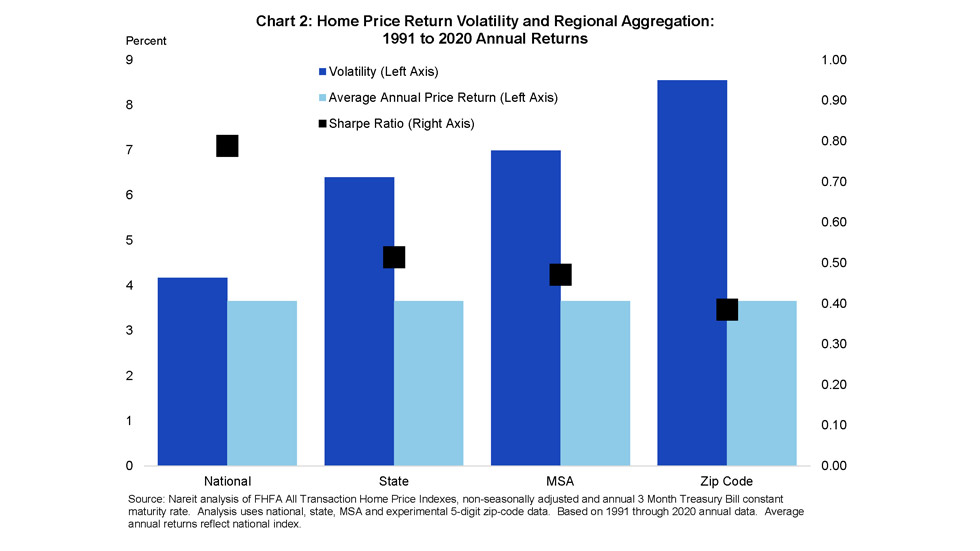

The homeownership returns shown above are based on national averages. But for single family homeowners, their houses are in one market in one geographical location resulting in less diversification and more volatility in returns than implied by the national index.

REIT investors can invest in funds that mirror the broad index—representing over 500 thousand structures—or buy individual REIT stocks. Even individual REIT stocks provide returns for a portfolio of structures. Chart 2 shows how the volatility increases when home prices are indexed in more narrowly defined geographical areas. As the volatility in price returns increases from left to right, this reduces the risk-adjusted return as shown by the Sharpe Ratio.

There continue to be benefits to individuals who pursue home ownership, and REIT investment is a way to complement this activity.