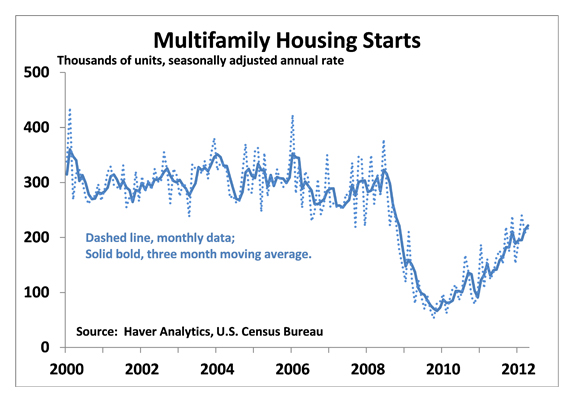

Construction of new multifamily housing units continues to recover as apartment rental market conditions tighten. Multifamily housing starts rose 4.3 percent in April to a 217,000 annual rate.

Despite having tripled from the lows reached during the financial crisis, multifamily starts remain well below the pre-recession trend rate of 300,000. Moreover, rental occupancy has been rising more rapidly than construction, pushing vacancy rates lower. (The Census Bureau recently reported that rental vacancy rates fell 0.6 ppt. in the first quarter to 8.8 percent, the lowest since early 2002.)

Learn more about the current outlook for multifamily REITs.