Global real estate turned in their strongest monthly performance since December 2021 in July, outperforming broader markets. While rate hikes and inflationary pressures driven by food and energy prices persist as headwinds, continued tightening of monetary policy was taken in stride by investors.

Global Real Estate Performance

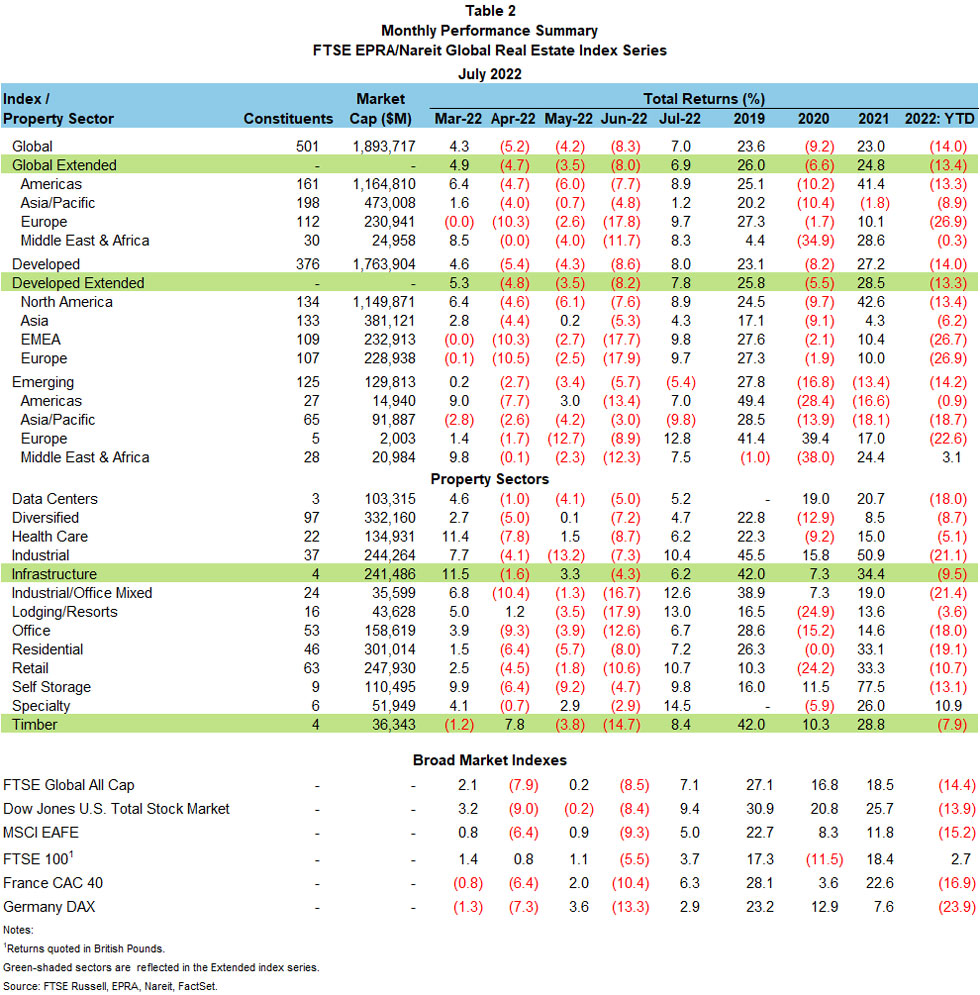

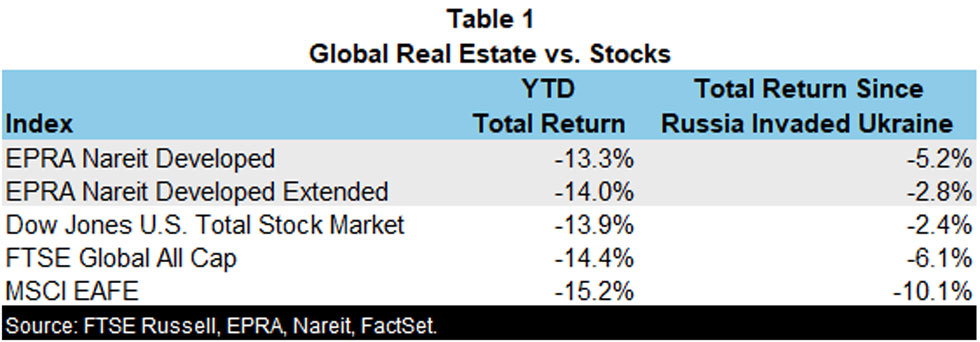

The FTSE EPRA/Nareit Global Real Estate Index Series outperformed broader markets in July. The Developed Extended Index posted a total return of 7.8% for the month and -13.3% year-to-date, while the Global Extended Index, which includes both Developed and Emerging Markets, returned 6.9% and -13.4%, respectively, over these periods. The Developed Index returned 8.0% in July and -14.0% year-to-date.

Broader Market Performance

Broader markets performed strongly in July as well, but underperformed real estate, with total returns on the Dow Jones U.S. Total Stock Market, FTSE Global All Cap, and MSCI EAFE of 9.4%, 7.1%, and 5.0%, respectively. Year-to-date total returns and performance since Russia invaded Ukraine on Feb. 23 are shown in Table 1.

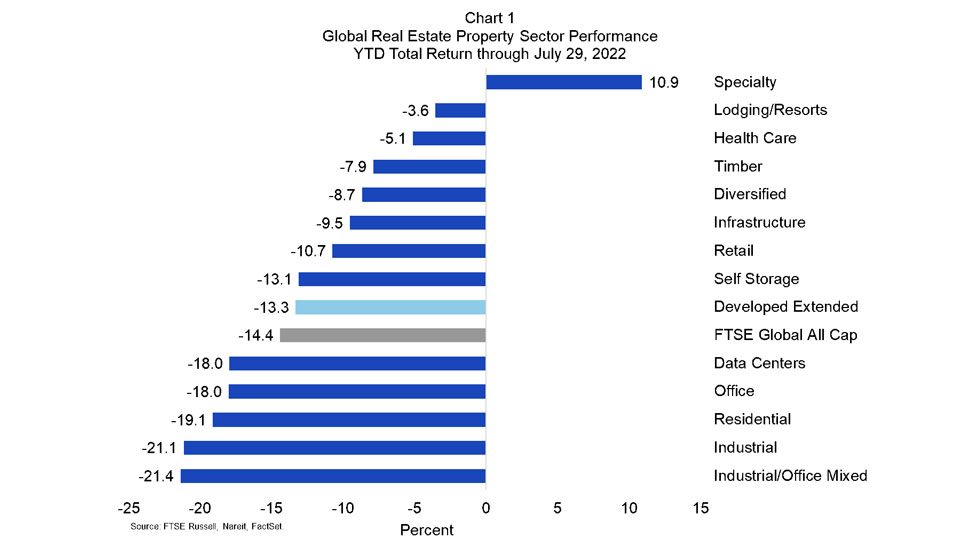

Property Sector Highlights

In July, the specialty sector led with a total return of 14.5%, followed by the lodging/resorts sector at 13.0%, and the retail sector at 10.7%. On a year-to-date basis, these sectors have posted total returns of 10.9%, -3.6%, and -10.7%, respectively. Diversified lagged in July, with a total return of 4.7%, followed by data centers at 5.2%. Year-to-date, these sectors are down 8.7% and 18.0%, respectively.

Regional Performance

Regionally within the Developed series, EMEA outperformed in July, with a total return of 9.8%, followed by North America at 8.9%, and Asia at 4.3%. Year-to-date, these regions posted returns of -26.7%, -13.4%, and -6.2%, respectively.

Emerging markets performance was mixed in the EPRA/Nareit series. For the month, Emerging was down 5.4%; regionally, Europe led, with a total return of 12.8%, followed by Middle East & Africa at 7.5%, Americas at 7.0%, and Asia/Pacific at -9.8%. Year-to-date, the Emerging Index is down 14.2%, with returns of 3.1% for Middle East & Africa, -0.9% for Americas, -18.7% for Asia/Pacific, and -22.6% for Europe.