Recent disputes over tariffs and trade policy introduced volatility to global real estate markets alongside broader stock markets. From April 2–8, the FTSE EPRA Nareit Developed Extended Index fell 10.0% before rising 12.7% from April 8–May 9. The Dow Jones U.S. Total Stock Market declined 12.4% before rising 14.2% and the FTSE Global All Cap fell 11.0%, then rose 14.4% over these respective time periods.

From April 2–May 16, the FTSE EPRA Nareit Developed Extended Index rose 4.6%, trailing global equities as the FTSE Global All Cap rose 5.4%, but leading the U.S. stock market as the Dow Jones U.S. Total Stock Market posted a total return of 0.7%.

On May 12, the United States and China announced a 90-day agreement to reduce tariffs. Under this new deal, U.S. tariffs on Chinese goods were lowered to 30%, while China cut its tariffs on American products to 10% and equity markets rallied in response to the reduction in tension. During this period of volatility, the U.S. dollar has weakened against other major currencies. From Dec. 31, 202 –May 16, 2025, the dollar declined 7.2% against the euro, 7.1% against the Japanese yen, and 5.6% against the British pound.

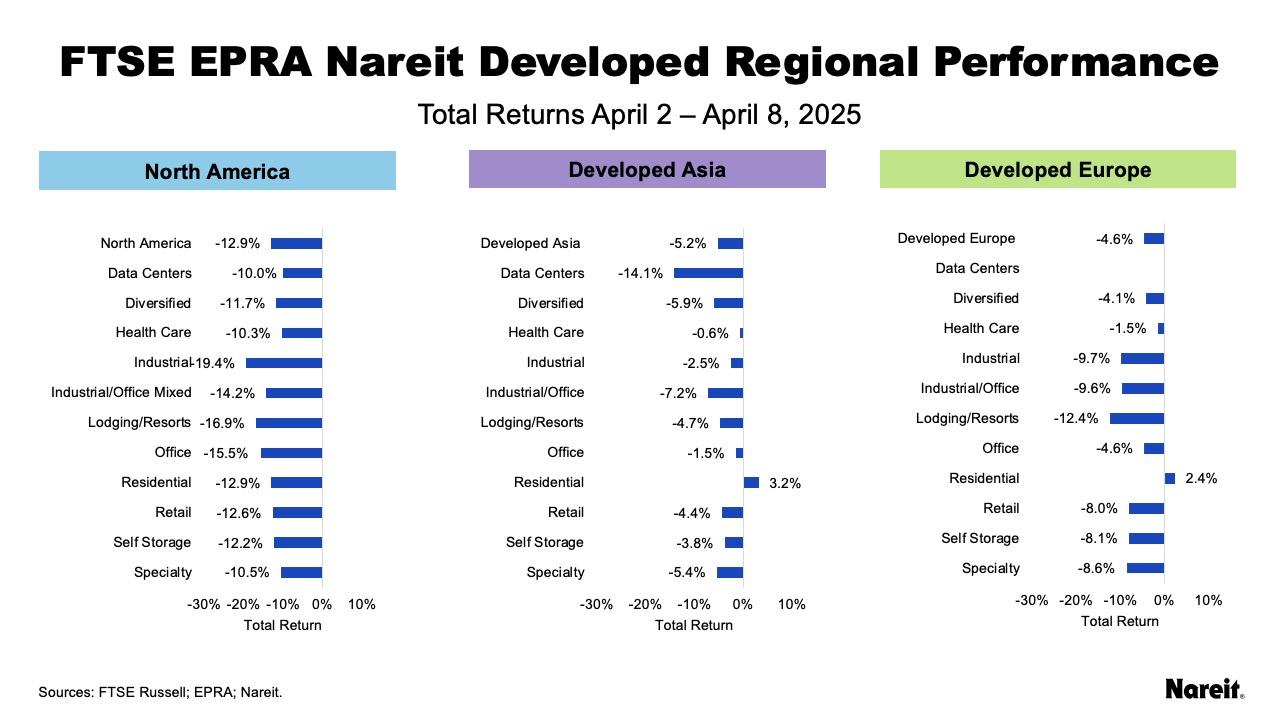

After the announcement of a broad array of tariffs affecting most countries that trade with the U.S. on April 2, broader markets, including real estate, reacted negatively as trading partners announced tariffs of their own. The regional impact on real estate was not evenly distributed during the initial phase of the dispute, as reflected in the chart above.

North America fell 12.9%, with all property sectors suffering double digit losses led by industrial, lodging/resorts, and office. Asia and Europe declined as well, though less severely, with respective returns of -5.2% and -4.6%. In Asia, data centers were hit hardest, falling 14.1%, while lodging/resorts fell 12.4% in Europe.

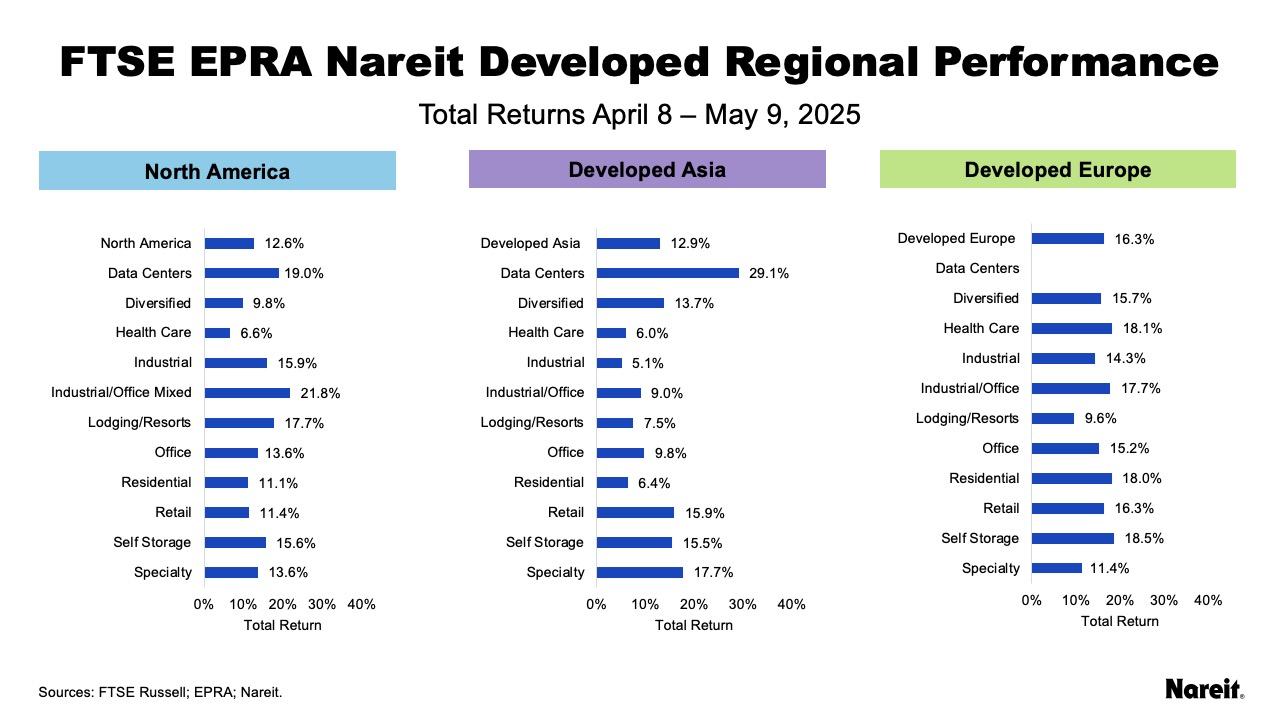

Shortly after announcing the new tariffs, the U.S. suspended implementation in order to allow time to negotiate with most trading partners, with the exception of China. From April 8–May 9, all regions and property sectors recovered as the most severe tariff policies were reduced. During this period, Europe led with a total return of 16.3%, followed by Asia at 12.9%, and North America at 12.6%. Sector performance showed some dispersion, as Europe was led by self-storage and health care, data centers and specialty led in Asia, and North America was led by data centers and industrial/office mixed.

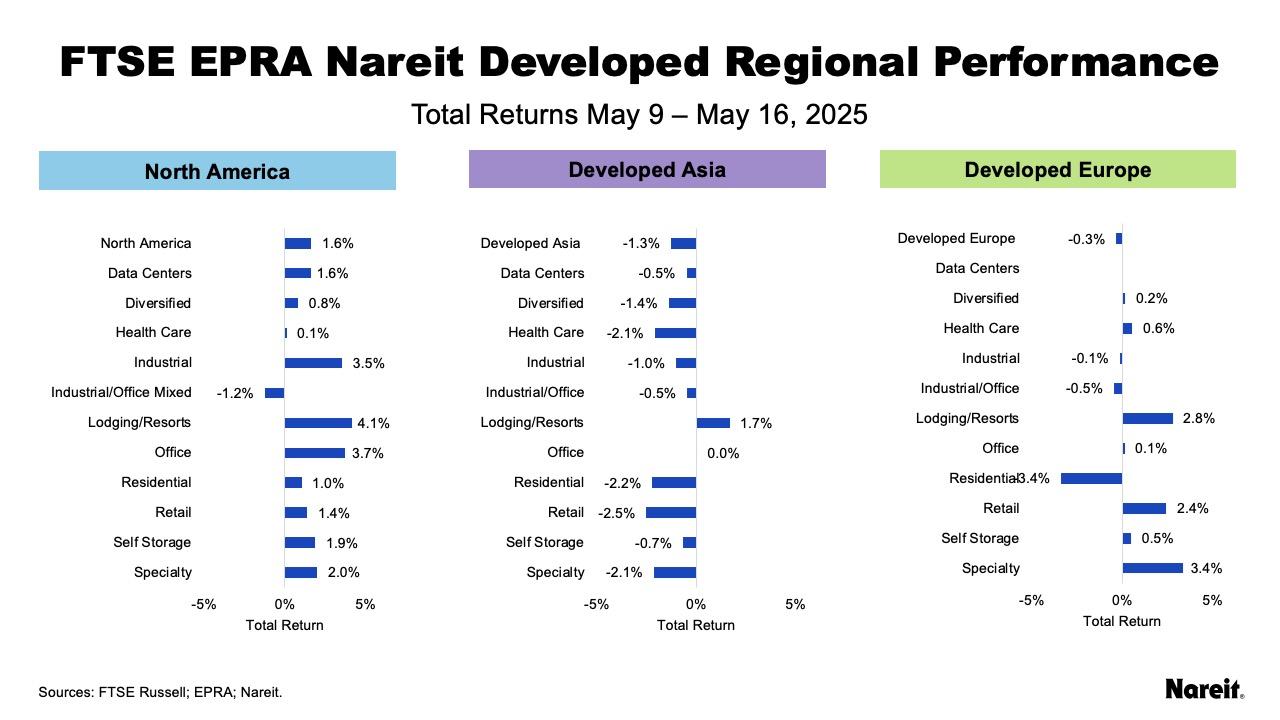

After China and the U.S. agreed to a temporary reduction in the most severe tariffs on May 12, North America responded positively with a total return of 1.6%, while Europe and Asia declined with respective losses of 0.3% and 1.3%. North America was led by office and industrial, while specialty and lodging/resorts outperformed in Europe. In Asia, lodging/resorts was the lone positive sector.

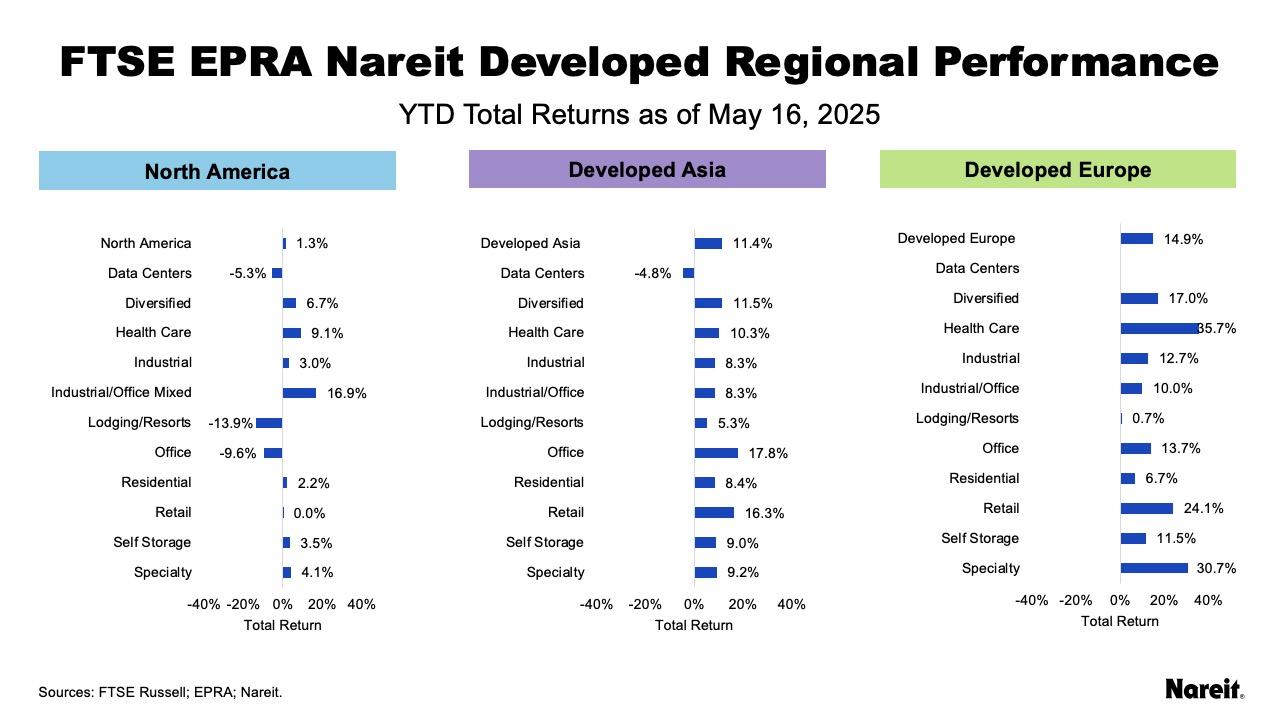

The global real estate market offers opportunities on both a regional and property sector basis. On a year-to-date basis as of May 16, Europe and Asia have broadly outperformed North America. Developed Europe rose 14.9% during this period, led by health care and specialty, while Developed Asia has returned 11.4%, led by office and retail. North America has lagged, with a total return of 1.3%, with lodging/resorts and office suffering the most, while industrial/office mixed and health care have outperformed, as reflected in the exhibit above. Over this period, the FTSE Global All Cap rose 5.4% while the Dow Jones U.S. Total Stock Market rose 1.4%.