The FTSE EPRA Nareit Developed Extended Index rose 3.2% in March, narrowly outperforming global equities as the FTSE Global All Cap rose 3.1%. While investors continue to expect central banks to institute more accommodative monetary policy in 2024, the expectations for when we may see rate cuts has been pushed to later in the year than previously expected, as inflation measures remain above target. The yield on the 10-Year U.S. Treasury has risen 32 basis points since the end of 2023.

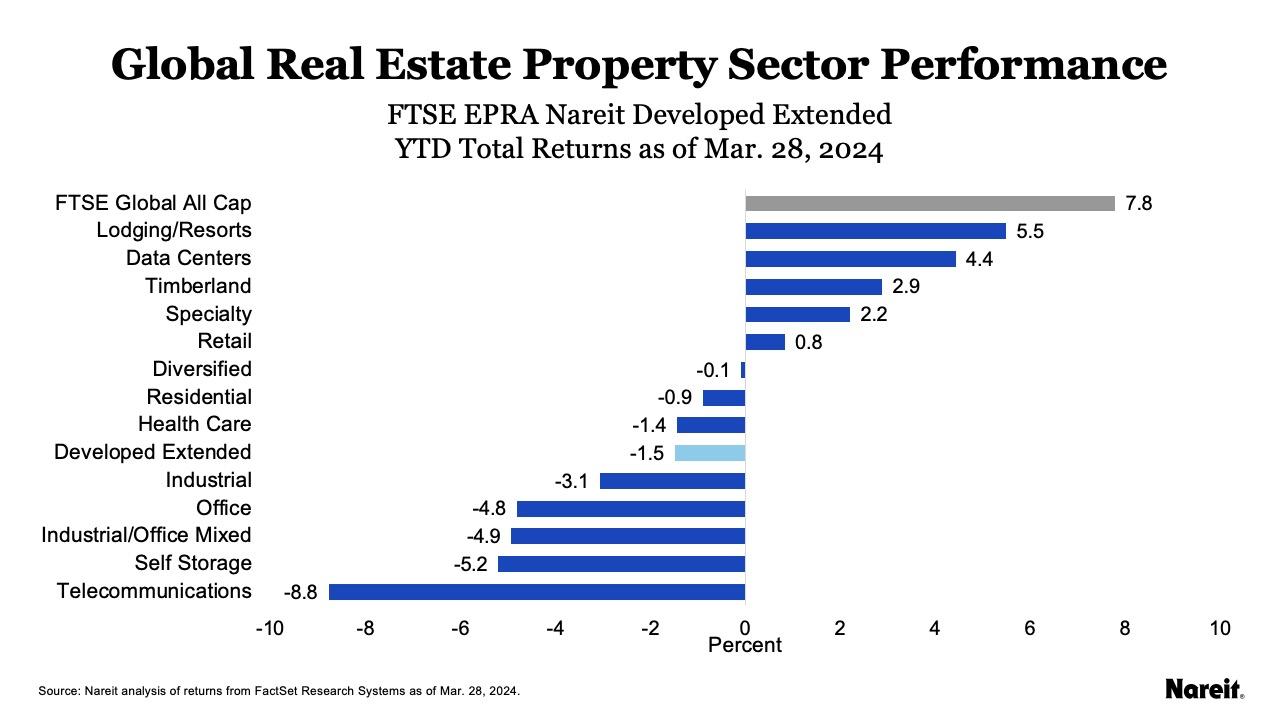

As shown in the above chart, the Developed Extended index has declined 1.5% in the first quarter of the year, as the yield on the 10-Year U.S. Treasury climbed from 3.9% to just under 4.3%. The FTSE Global All Cap has risen 7.8%, year-to-date.

Property Sector Highlights

Industrial/office mixed led in March with a total return of 7.2%, followed by diversified at 7.0% and retail at 4.8%. After two months of outperformance, data centers lagged with a return of -4.9%, followed by telecommunications at -0.5%. On a year-to-date basis, the lodging/resorts sector leads with a total return of 5.5%, followed by data centers at 4.4%, and timberland at 2.9%. Telecommunications is down 8.8%, self-storage has fallen 5.2%, and industrial/office mixed is down 4.9%.

Broader Market Performance

Broader equity markets rose in March. The MSCI EAFE led with a total return of 3.4%, followed by the Russell 1000 and Dow Jones U.S. Total Stock Market at 3.2%, followed by the FTSE Global All Cap at 3.1%.

Regional Performance

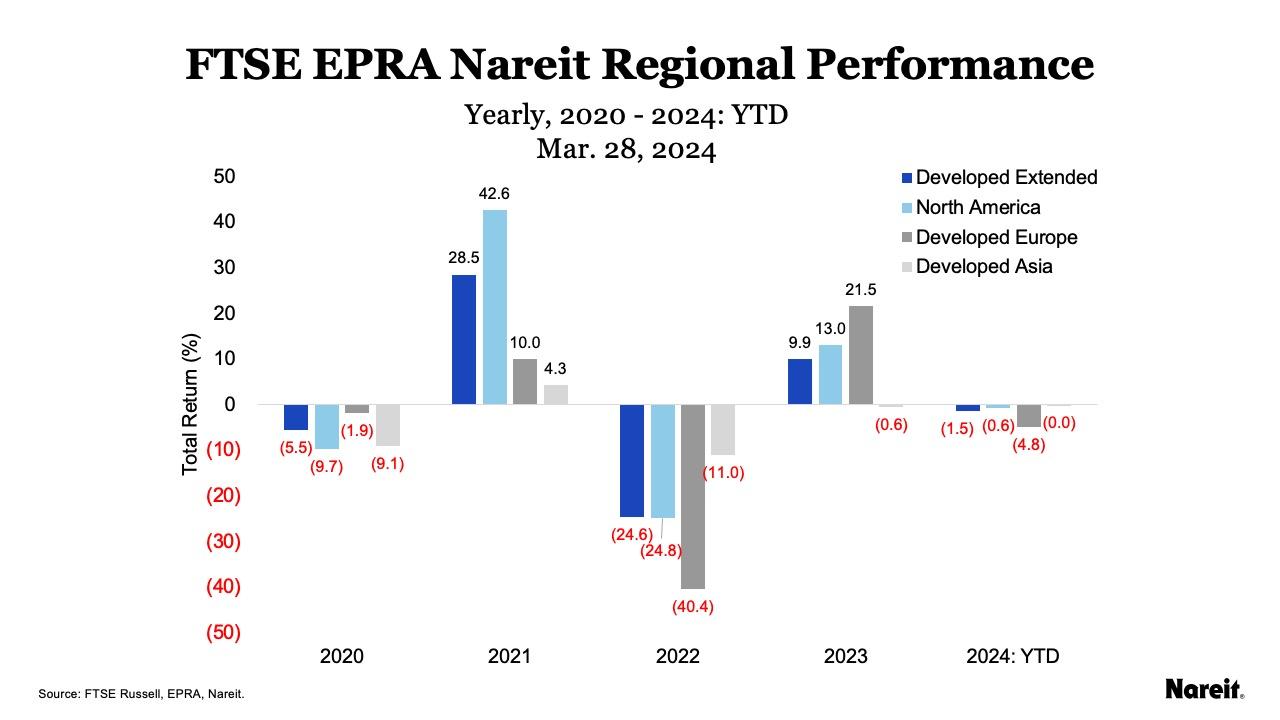

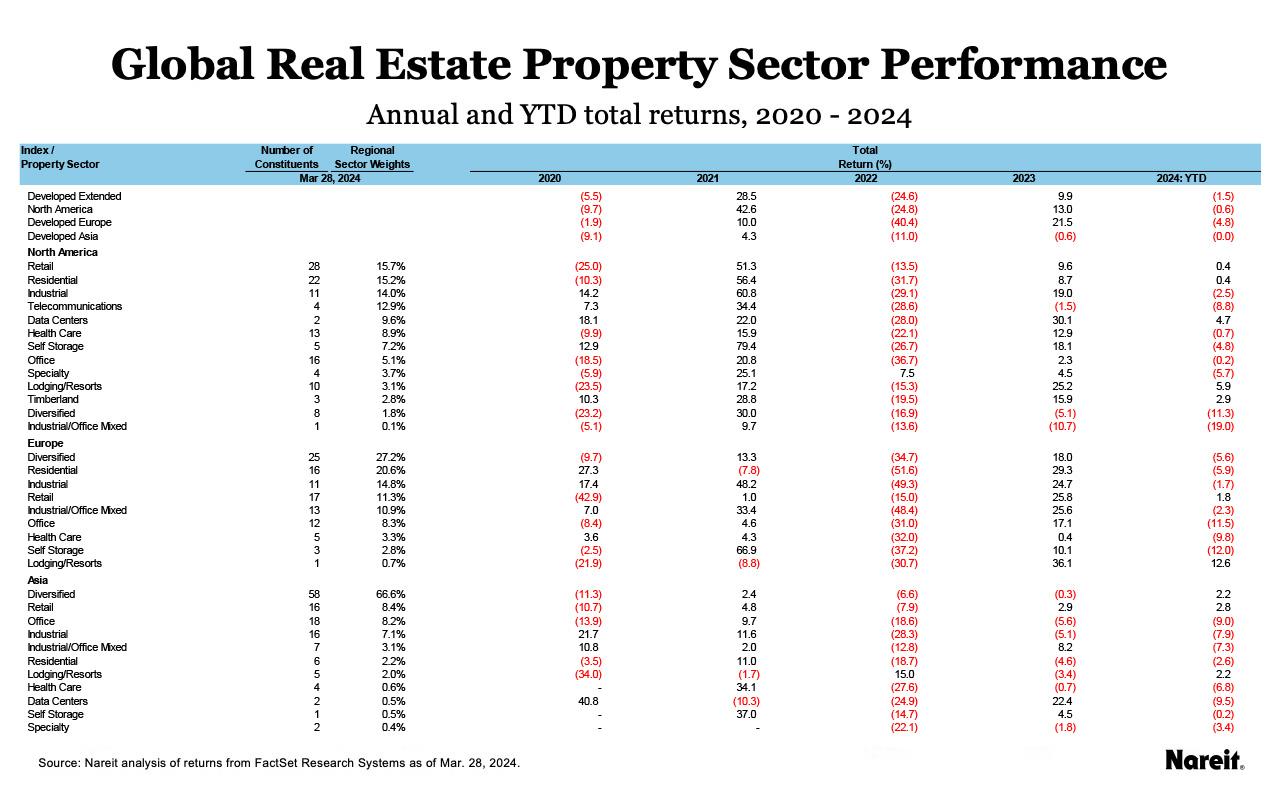

As shown in the chart and table above, in 2024 within the EPRA Nareit Developed Series, Developed Asia is flat year-to-date, North America is down 0.6%, and Developed Europe has posted a total return of -4.8%.

In Asia, retail has returned 2.8%, followed by diversified and lodging/resorts with a return of 2.2%. Data centers, office, and industrial lagged with returns of -9.5%, -9.0%, and -7.9%, respectively.

In North America, lodging/resorts is up 5.9%, followed by data centers with a return of 4.7% and timberland at 2.9%. Industrial/office mixed trails with a return of -19.0%, followed by diversified at -11.3%, and telecommunications at -8.8%.

In Europe, lodging/resorts leads with a total return of 12.6%, followed by retail at 1.8% and industrial at -1.7%. Self-storage, office, and health care lagged with returns of -12.0%, -11.5%, and -9.8%, respectively.