The FTSE EPRA Nareit Developed Extended Index posted a total return of 0.5% in September. North America led with a gain of 1.2% followed by Developed Asia at 1.0% and Developed Europe at 0.4%. Optimism that the Federal Reserve was close to easing interest rates bore out with a 25 basis point cut of the Federal Funds rate.

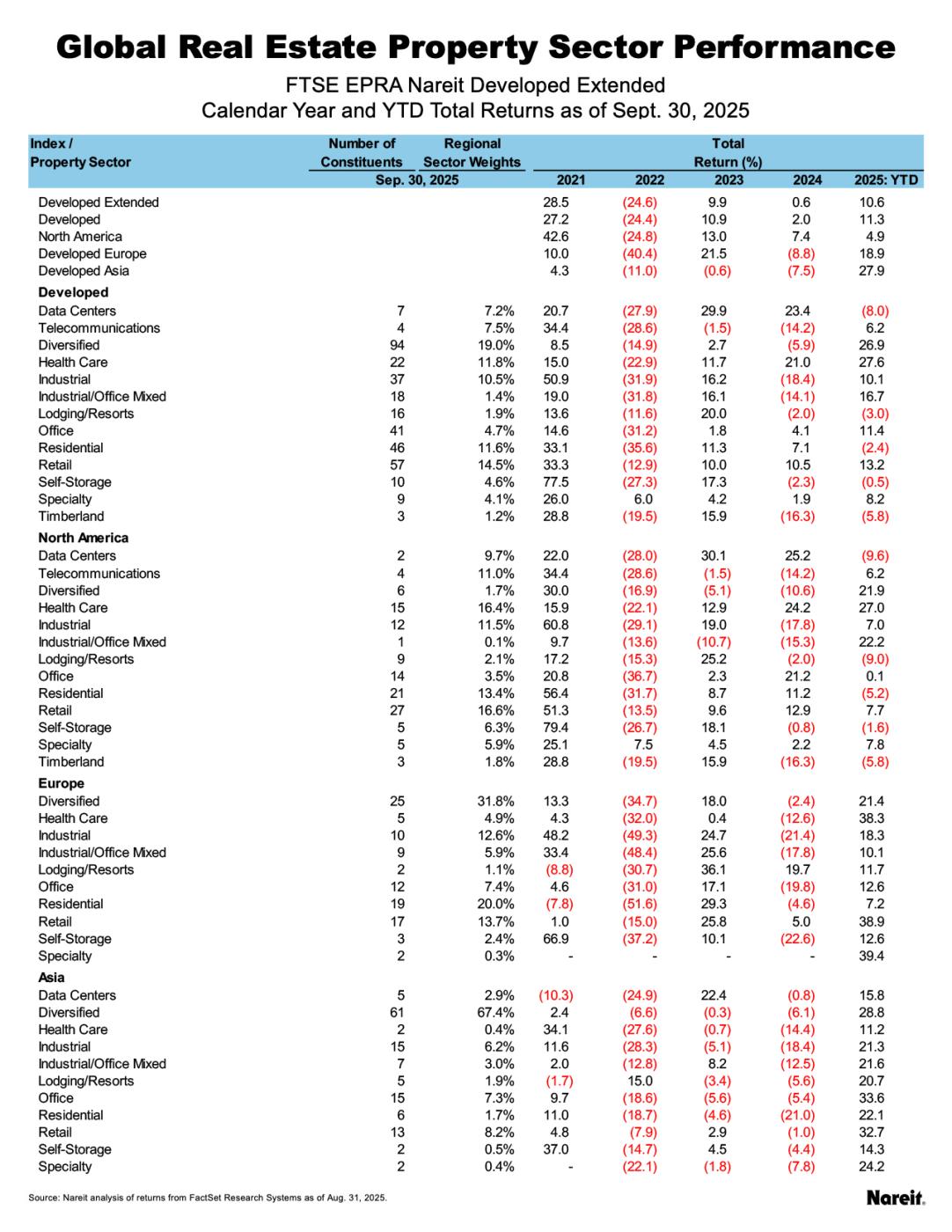

On a year-to-date basis through Sept. 30, the Developed Extended index is up 10.6%, led by Asia with a total return of 27.9%, Europe at 18.9%, and North America at 4.9%. Broad market equities extended their lead on real estate in September as the FTSE Global All Cap rose 3.4%, with a year-to-date total return of 18.7%.

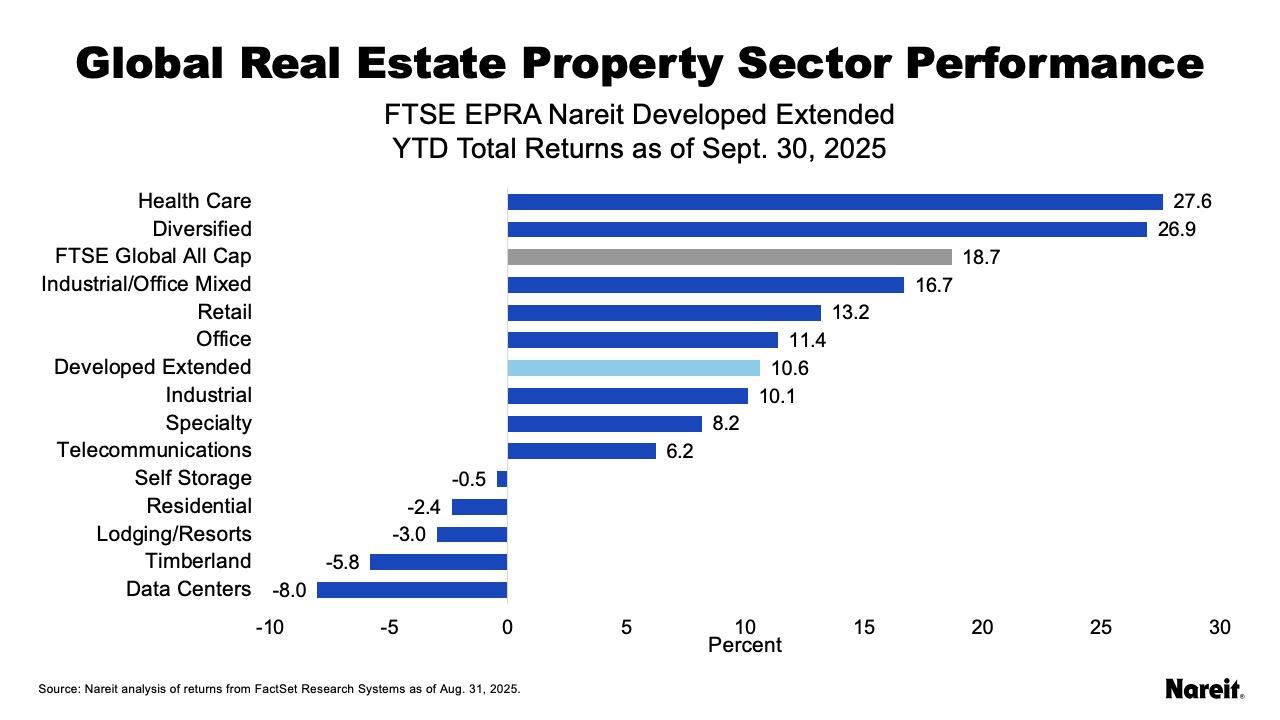

Property Sector Highlights

As shown in the chart above, health care, diversified, and industrial/office continue to lead all sectors on a year-to-date basis, with respective returns of 27.6%, 26.9%, and 18.7%. Data centers gained back some of their losses in September, rising 1.4% and breaking a three-month stretch of declines, but continue to lag other sectors with a decline of 8.0% in 2025.

Regional Performance

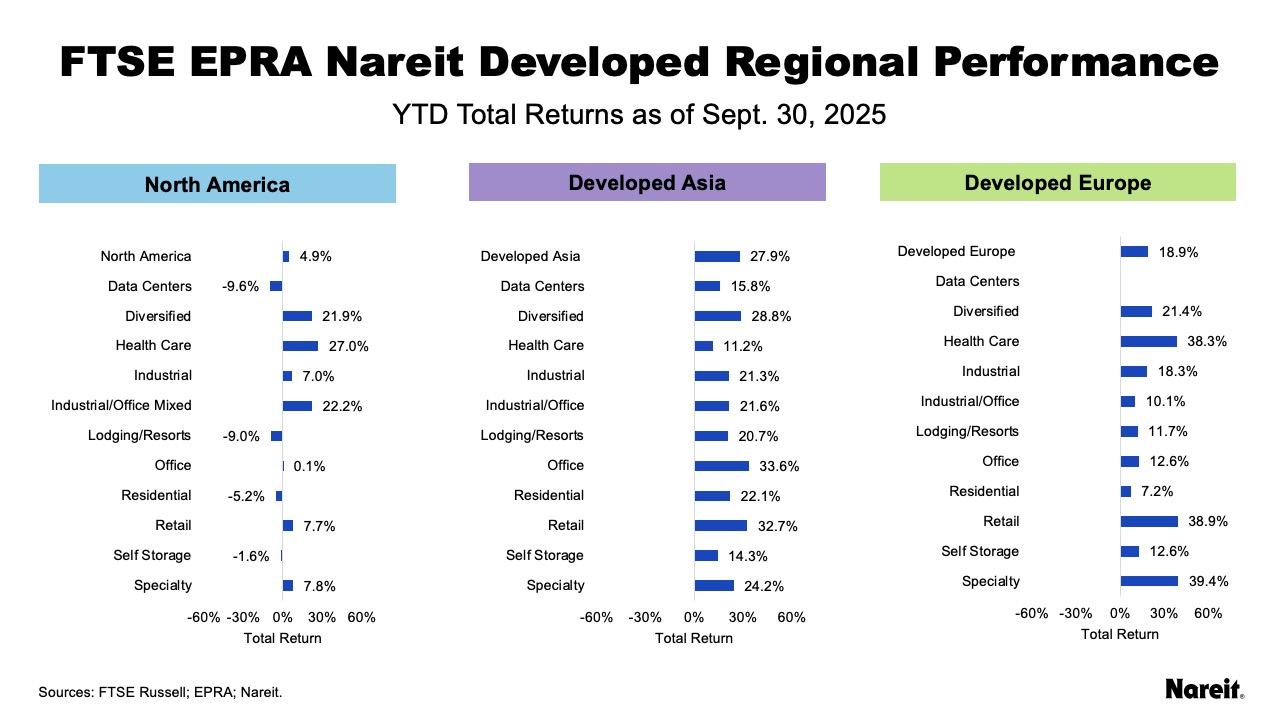

Developed Asia continues to lead in 2025 with a total return of 27.9%, followed by Developed Europe at 18.8%, with North America posting a total return of 4.9%, as shown in the table above. Regional differences in sector specialization continue to shape performance outcomes in meaningful ways. Diversified real estate has delivered strong returns globally, representing a significant share of sector weight in Asia and Europe, in contrast to North America, where the sector has also performed well but accounts for a comparatively small share of the regional market. While this disparity is noteworthy, it is equally important to highlight that all sectors in Asia and Europe have generated positive returns, whereas North American performance in 2025 has been more uneven across sectors.

As reflected in the charts above, sector returns are universally positive in Asia and Europe with a more mixed picture in North America. In Asia, office, retail, and diversified continue to lead, while specialty, retail, and health care have outperformed in Europe. Health care leads in North America followed by industrial/office mixed, and diversified.