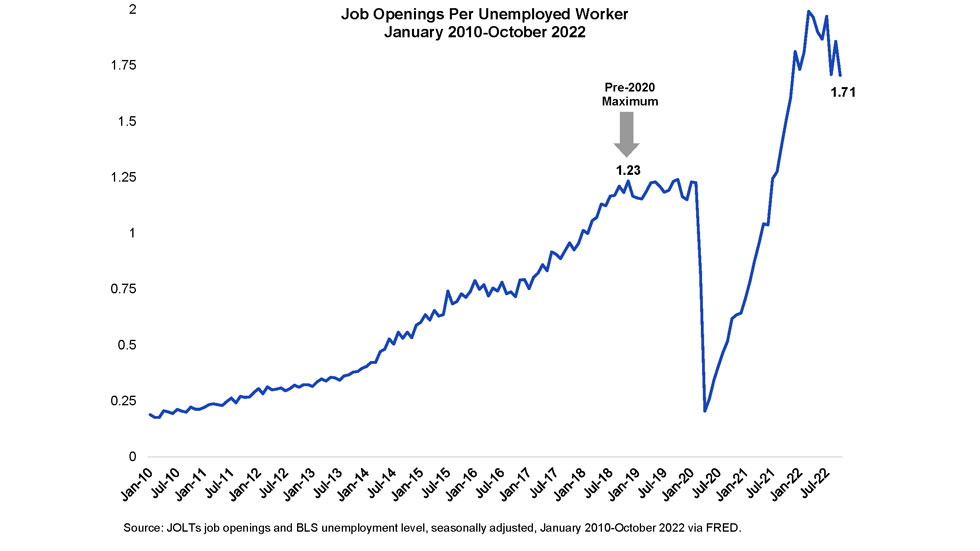

There are approximately 1.7 job openings per unemployed worker in October, according to the Bureau of Labor Statistics’ (BLS) October Job Openings and Labor Turnover (JOLTs) report, which highlights the health of the labor market with data on hiring and job transitions. While below March’s peak of nearly 2 openings per unemployed worker, October’s numbers show the demand for workers slowing from the post-pandemic recovery period, but still robust despite high inflation and slower growth. Separately, the BLS estimates 284,000 jobs were added in October and 263,000 in November on a seasonally adjusted basis with unemployment at 3.7% for both months.

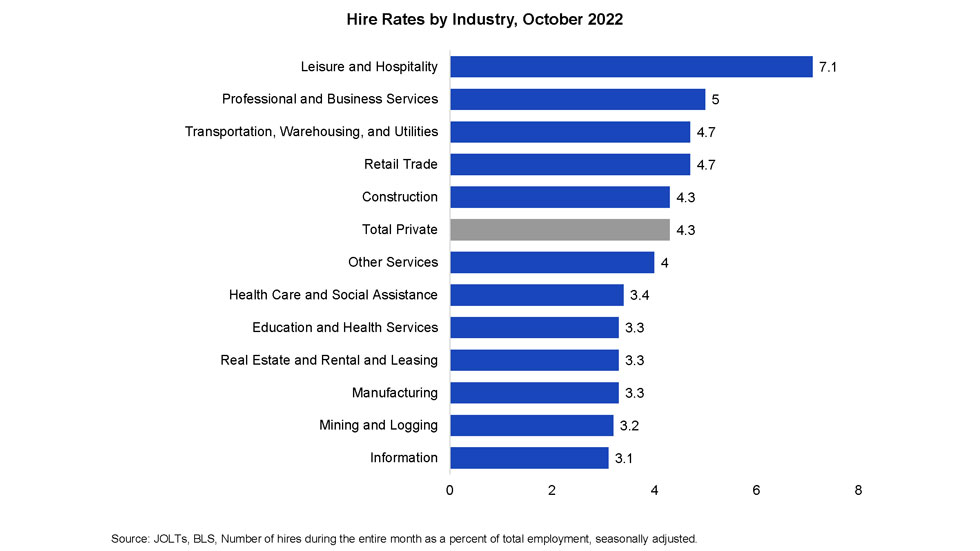

Hiring was strong in the hospitality, warehouse, and retail sectors in October, and the data marked 2.5 years with hires greater than separations. Total openings are at 10.3 million on a seasonally adjusted basis, down from March’s peak earlier in 2022, but still well above pre-pandemic levels.

Commercial real estate, including REITs, is boosted by strong economic growth, and typically REITs have performed well in inflationary environments, but not as well in recessionary environments. The strong job market may potentially counter some of the recessionary tailwinds, even as labor demand begins to slow.

According to research by Nareit, across the last six recessions, REITs posted an average cumulative total return of 6.0% for the FTSE Nareit All Equity Index and the average cumulative total return for private real estate was -1.6% for the NFI–ODCE.

The chart above shows the historical trend of job openings per unemployed worker. The rate had been rising before the onset of the pandemic and began to rise again by June 2020 peaking in March 2022 at nearly 2 openings per unemployed worker. Despite the recent decline, October’s 1.7 openings are still well above the pre-pandemic peak in November 2018 of 1.2 openings.

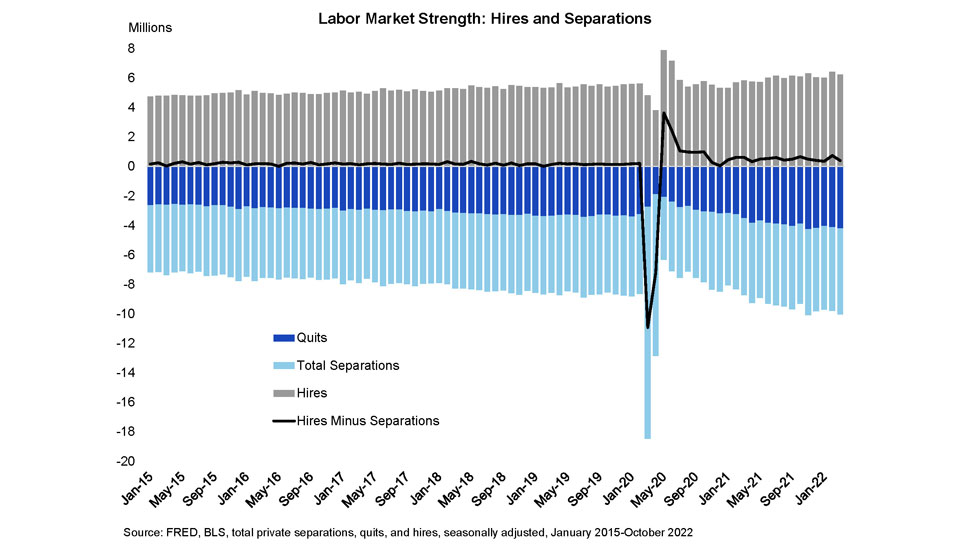

Quits are a measure of worker confidence in the job market and the quits rate is at 2.9%— under the all-time high of 3.4% from November 2021. Private quits in October were flat from September at 3.8 million on a seasonally adjusted basis.

The historical trend in hires and separations, including quits, from 2015 through March 2022 is shown in the chart above, and notably the level of hires minus separations had been steady since 2010. As the economy has recovered from the pandemic shutdowns, quits have been a higher proportion of total separations, rising from 60% of separations in March 2020 to 71% of separations in October 2022, as shown in the chart above. Overall hires have outpaced separations during the recovery with cumulative net hires since April 2020 at nearly 21 million.

Looking by industry, the chart above shows hiring has been strong in the hospitality sector; professional and business services; transportation, warehousing, and utilities; and retail. Strong hiring in these areas points to continued operating strength for the REITs in the lodging/resorts, industrial, and retail property sectors.

The next JOLTs report will take into account high profile layoffs in the tech sector that began in November. The tech sector is below the average for hiring in October and likely to fall further behind. Even in the face of potentially elevated tech layoffs, demand for data center real estate should remain robust especially given a low level of new supply. The retrenchment’s impact should be minimal for the property sector. Health care hiring lags the total private hiring rate as the sector continues to struggle with staffing issues.