The pandemic has had a severe impact on the travel industry, including the lodging/resorts and hospitality sectors, due to government-mandated stay-at-home orders, businesses curtailing travel, and lingering concerns about face-to-face interaction with service providers and other customers. Measures to address public health—extra cleaning, reconfiguring common areas—add expenses and possible capital outlays for remodeling. Even as more lodging and resorts open up there may be lower revenues from on-site restaurants and bars, which may be closed or operating below capacity due to social distancing.

There has been progress, however, in developing new procedures to minimize risks of infection and allow some resumption of activity. This includes cleaning, social distancing and direction of foot traffic patterns, contactless check-in and check-out, and more. REITs have been reopening more hotels and report rising occupancy and revenues in recent months.

In addition, a new study by researchers at the T.H. Chan School of Public Health at Harvard University finds that, with proper precautions, the risk of transmission during air travel could be less than while shopping in a grocery store or eating at a restaurant. Safe travel may facilitate the recovery in the lodging/resorts sector.

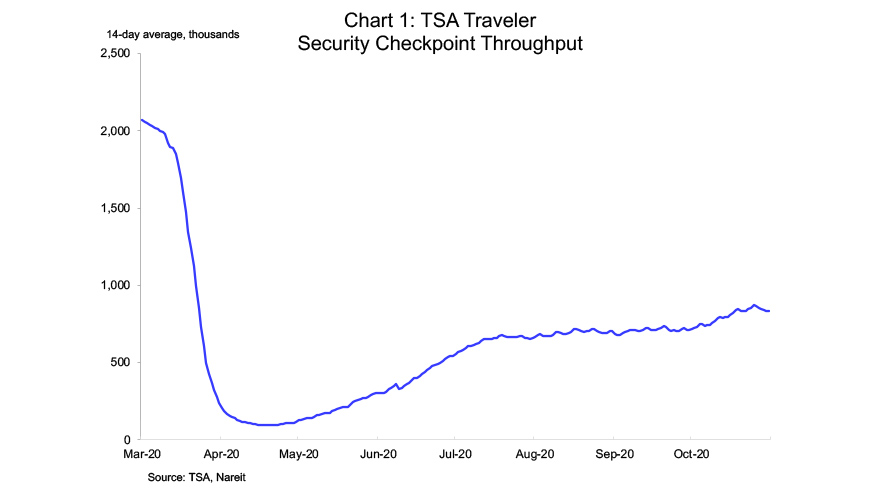

Travel and entertainment are vital parts of the lives of many people, and important for business operations. Visits with family and friends and meetings for important business purposes have an essential element that cannot be fully replicated online. Indeed, travel has begun to pick up, and the TSA reported a daily average 825,000 travelers at airport security checkpoints in October, compared to 110,000 daily average in April. Even with this recovery, however, travel remains severely depressed, at 44% of the 1.87 million daily average in the first half of March.

Once the threats of infection have been adequately addressed, the travel, hospitality, and entertainment sectors are likely to enjoy a full recovery. Share prices of lodging/resort REITs fell sharply in February and March, though, and have recovered just a fraction of their initial decline, suggesting that the market has perhaps overreacted to the near-term challenges this sector faces. Many REITs in the lodging/resort sector have maintained solid balance sheets and sources of liquidity during this difficult period. For the long-term investor with high tolerance for risk, today’s share prices may represent a good investment opportunity.

This is a selection from the Nareit Fall 2020 Economic Outlook, which analyzes the current state of commercial real estate markets, as well as potential longer-term structural changes that are evolving during the pandemic. See the full outlook for a discussion of other major commercial property sectors.