In making the case for an allocation to real estate in an investment portfolio, one of the oft-cited arguments is real estate’s ability to generate income. Historically, U.S. public equity REITs have provided attractive and reliable income streams to investors, on average, outshining their equity and private real estate counterparts. By design, REITs must distribute at least 90% of their taxable income to shareholders as dividends. As a result, dividends are an important component of REIT total returns. For investors seeking income, REITs can deliver.

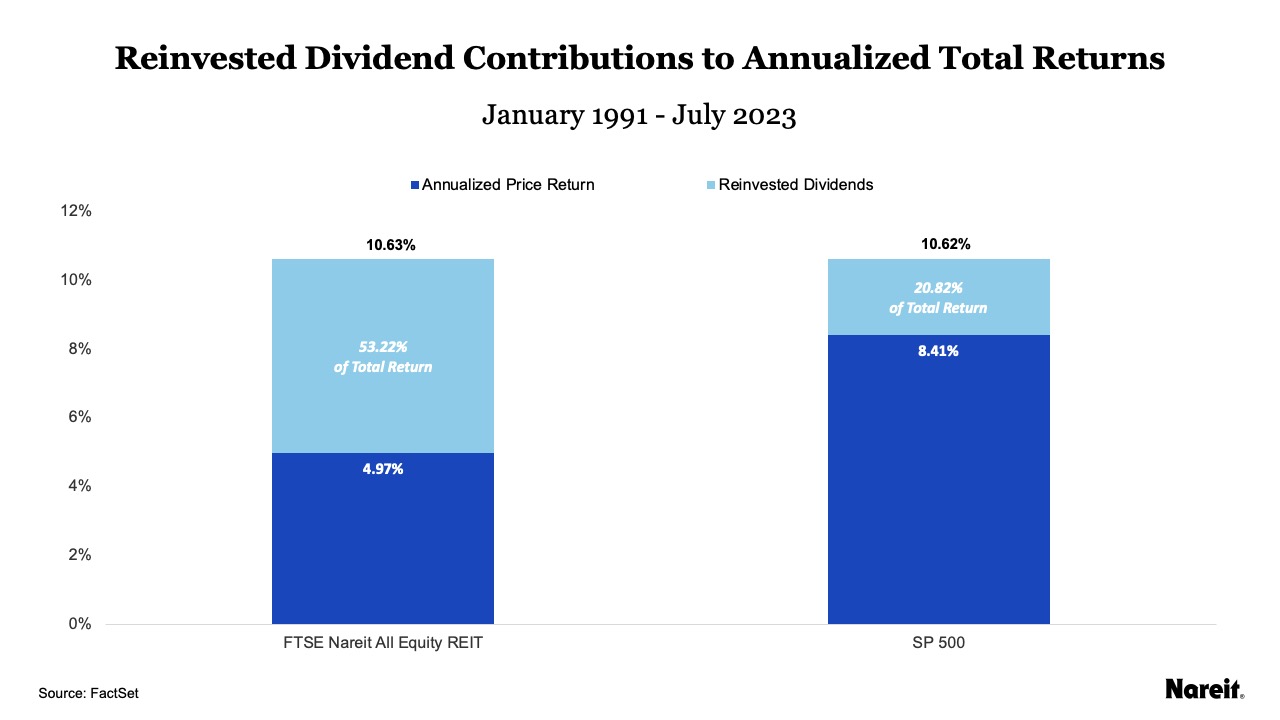

The chart above displays the annualized price and total returns for REITs (FTSE Nareit All Equity REIT Index) and the broader equity market (SP 500 Index) from January 1991 to July 2023, typically referred to as the modern REIT era. It also shows the contribution of reinvested dividends to annualized total returns (as a percentage of total returns) for each index.

Over the modern REIT era, public equity real estate total returns have been, on average, comparable to those of the broader equity market. From January 1991 to July 2023, annualized total returns for the FTSE Nareit All Equity REIT Index and SP 500 Index were 10.63% and 10.62%, respectively. While overall investment performance has been similar for both indices, the contributions of reinvested dividends and price returns to overall performance have been starkly different. Reinvested dividends accounted for more than half (53.22%) of REIT total returns; they comprised approximately one-fifth (20.82%) of equity total returns. Dividends play an important role in REIT total returns.

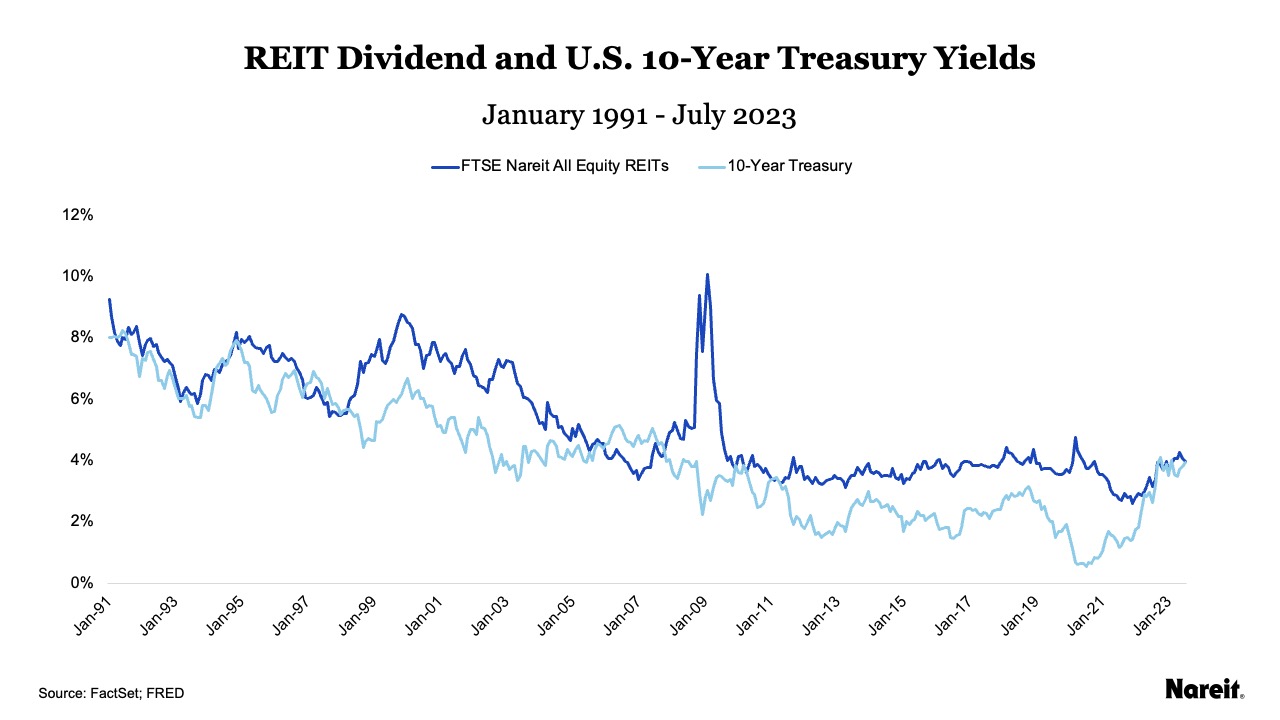

The chart above presents the annualized REIT dividend yield (FTSE Nareit All Equity REIT Index) and U.S. 10-year Treasury yield on a monthly basis from January 1991 to July 2023.

A review of the chart shows that the REIT dividend yield has tended to be greater than the U.S. Treasury yield and that the two measures have been positively correlated (with a correlation coefficient of 0.80). As the 10-year Treasury yield has trended downward, so has the REIT dividend yield—although it has remained at a consistent level since September 2009; it averaged 3.66%, while the 10-year Treasury averaged 2.31%. As of July 2023, the REIT dividend yield was 3.97%, offering just a two basis point premium over the 10-year Treasury. Although the spread is near zero today, REITs continue to offer investors an attractive income return, along with the potential for price appreciation.

Dividends play an important role in U.S. public equity REIT total returns. Historically, REITs have provided attractive, meaningful, and reliable income streams to investors, on average, outshining their equity and private real estate counterparts, as well as U.S. 10-year Treasuries. For investors seeking income, REITs deserve a serious look; they can deliver.