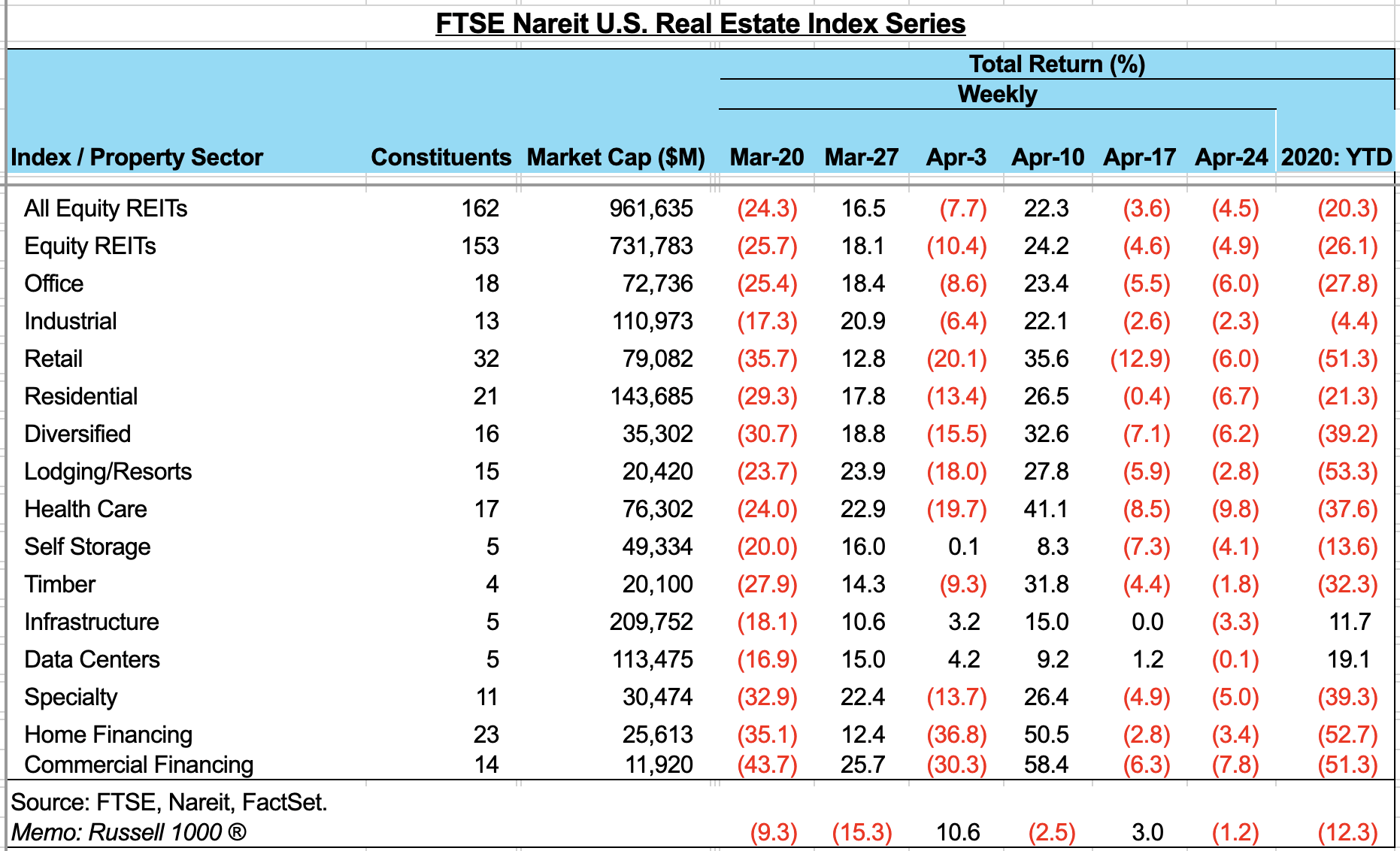

Stock market conditions have calmed down a bit, with more moderate moves lately in the FTSE Nareit All Equity REITs index. Last week the index posted a total return of negative 4.5%, the second week of single-digit moves after much sharper gyrations both up and down in the early stages of the crisis.

By property sector, last week’s returns were all in negative territory, although for some sectors, just barely. Data centers had a total return of -0.1%, and are up 19.1% year-to-date. Timber, industrial, lodging/resorts and infrastructure all had declines of less than 4%. Infrastructure is also in positive territory for the year so far, with a total return of 11.7%.

Reporting for first quarter earnings is just getting underway. Many investors may be in a wait-and-see mode for information not only on first quarter performance, but also what management sees for the period ahead.