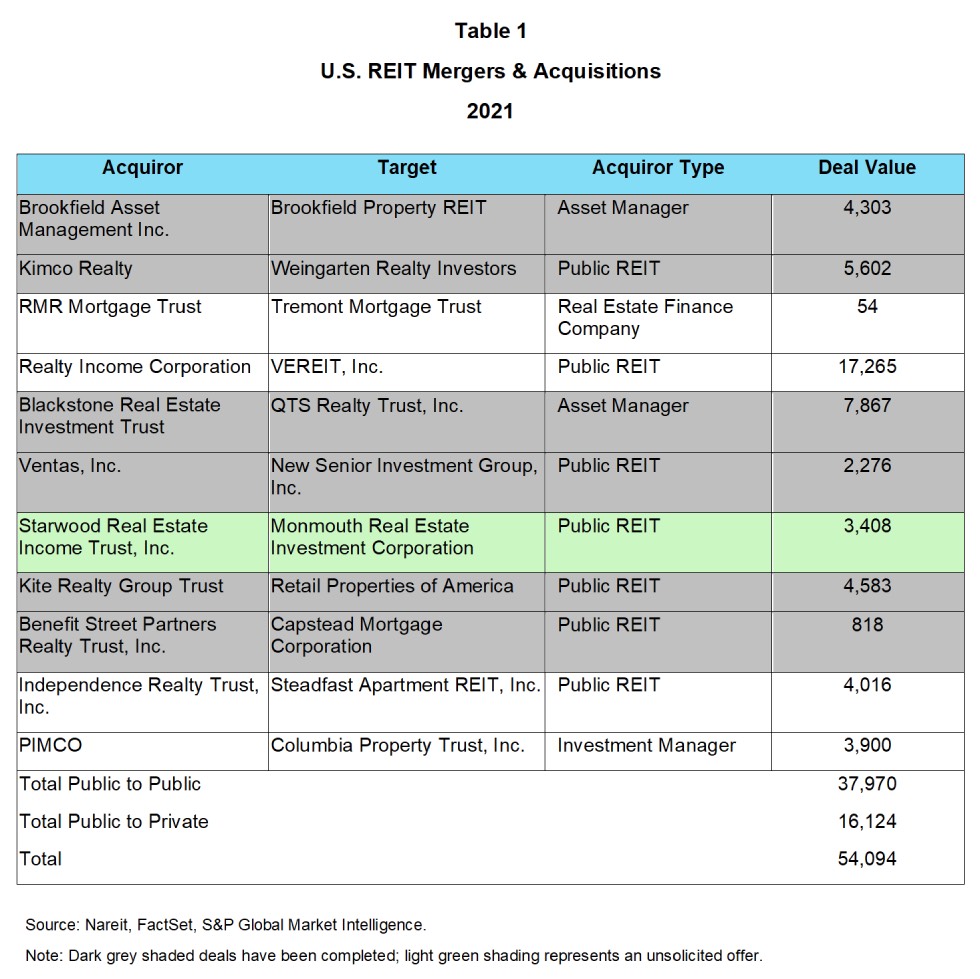

In 2021 REIT capital market activity has been highlighted by the announcement of eleven REIT mergers. These M&A transactions are a product of established REITs looking to combine portfolios strategically to prepare for future growth, as seen in the acquisitions of VEREIT by Realty Income, Weingarten Realty by Kimco Realty, New Senior Investment Group Inc. by Ventas, and Retail Properties of America by Kite Realty Group Trust. Far from the distress transactions that were being discussed in 2020, these deals reflect confidence in the business model and the outlook for the sector.

Capital Raising

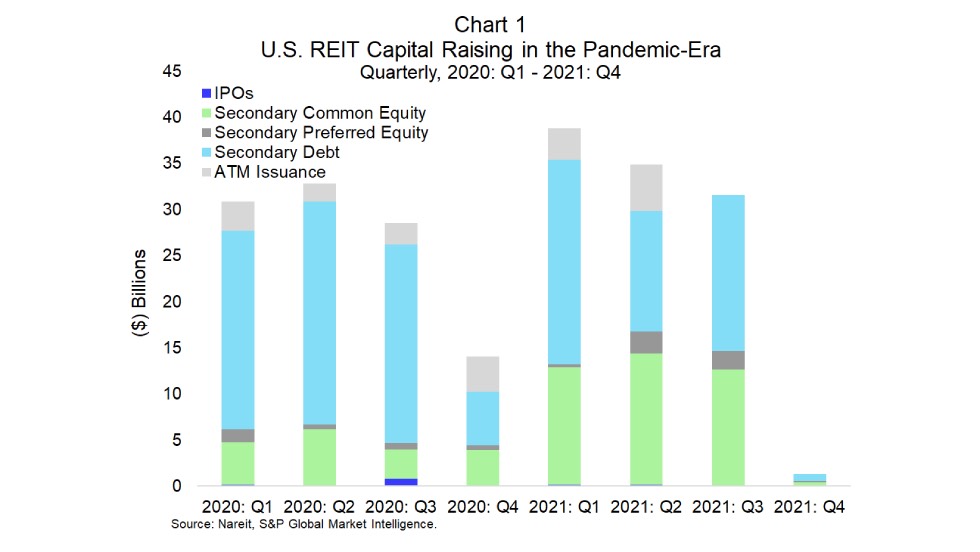

U.S. REITs have raised over $107 billion in IPOs and secondary debt and equity offerings year to date in 2021.

- 2021 equity issuance totals over $54 billion, including $837 million raised in four IPOs, $40 billion raised through common equity offerings, $5 billion raised through preferred equity offerings, and over $8 billion raised in at-the-market offerings. Total equity raised in 2019 was $50 billion, with $33 billion in 2020. ATM issuance data for 2021 are as of June 30th.

- 2021 debt issuance totaled $53 billion raised through secondary debt offerings. In 2021: YTD, REITs have issued over $7 billion in green bonds, while full-year capital raising for 2020 totaled over $8 billion in green bonds were raised. Total debt raised in 2019 was $63 billion, with $73 billion in 2020.

To this point in 2020, REITs had raised over $93 billion. $69 billion, or 74% of the capital raised, came in the form of secondary debt. The equity raises comprised $15 billion from secondary common equity, $3 billion from secondary preferred equity, and $1 billion in IPOs and $5 billion in ATM offerings.

Mergers & Acquisitions

In 2021 eleven deals to acquire public U.S. REITs have been announced; seven of the eleven deals, or 70% of the transaction value of the announced deals, represent acquisitions by other publicly traded U.S. REITs. The proposed acquisition price of each deal represents either a premium or is comparable to the pre-pandemic share price.