For all the hand-wringing six months ago, the first half of the year turned out pretty well for commercial real estate markets and REITs. It’s easy to forget how high the anxiety was at the start of the year. Was the global economy heading into a recession? Were prices of commercial real estate out of whack and ready for a fall?

The first half of the year wasn’t great, but was probably better than most had expected. For one thing, the economy kept chugging ahead, even as trade wars flared up in the spring. The recent jobs numbers through July show continued moderate employment growth.

As so often happens, a growing economy gave real estate markets the support they needed:

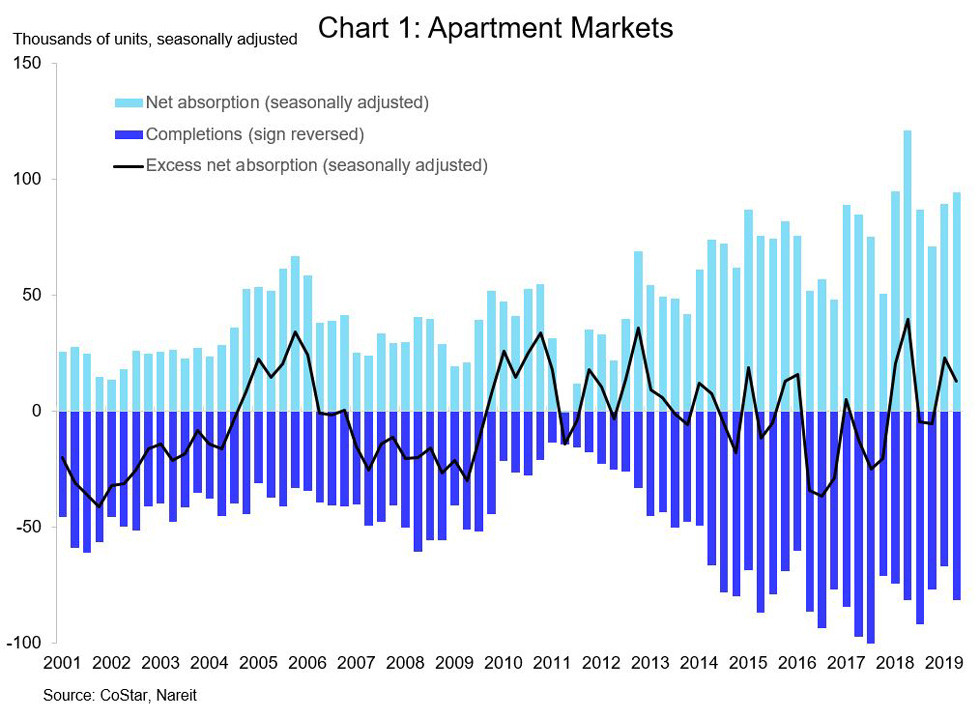

- Apartment demand surged, with the second-highest net absorption on record;

- Office markets saw the largest demand growth in three years.

Other sectors, though, were a bit slower.

- Demand for industrial and logistics facilities in Q1 and Q2 was running at less than half the average pace of the past six years; and

- Retail property markets were quiet, with both supply and demand the lowest in nearly 10 years.

REITs have delivered a total return of more than 20% through July and are on track for the best year since 2014.

It is helpful to keep this backdrop in mind when one considers the cross currents in today’s economy and the concerns about the outlook for the rest of this year and 2020. See the recent Nareit mid-year economic outlook to puts these risks in context to see why the expansion remains on track, and the outlook for commercial real estate and REITs remains positive.