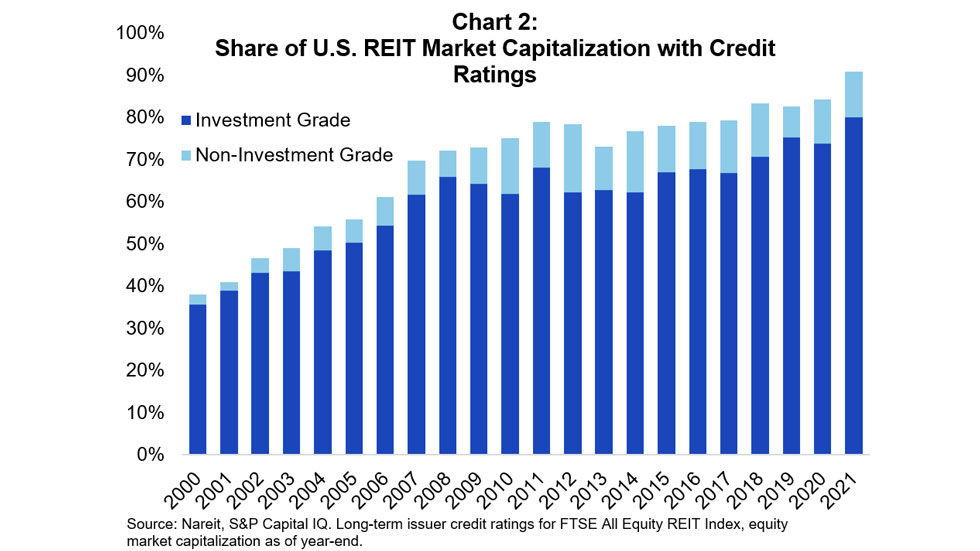

Capital raising for REITs comes in many forms, and unsecured debt has become more common for the industry over the past couple of decades, bringing more flexibility to REITs’ capital structures. At year-end 2021, 89 REITs representing 91% of market cap in the FTSE Nareit All Equity REITs Index were rated debt issuers. Of these, 88% of REITs by market cap were rated investment grade. In comparison, in 2000, only 28 equity REITs were rated debt issuers representing 38% of equity market capitalization in the index.

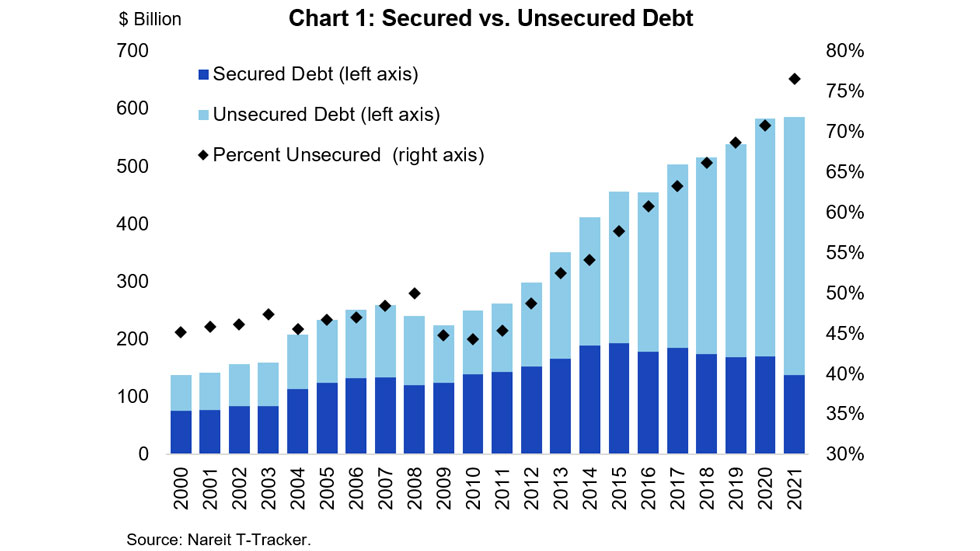

As real asset owners, equity REITs can draw significant capital through secured debt. However, over time, REITs’ capital raising has increasingly turned to unsecured debt with its greater flexibility as shown in Chart 1. Unsecured debt overtook secured debt for equity REITs in 2013 and has greatly outstripped secured debt in the years since. Since 2013, unsecured debt has increased its share every year with a 77% share at the end of 2021. In 2000, unsecured debt had a 45% share of total debt and it hovered around that share until it passed 50% in 2013.

As more REITs have issued unsecured debt, the share of REITs rated investment grade has remained high. Chart 2 shows the total share of market cap for rated issuers by investment and non-investment grade REITs. In 2021, nearly 91% of equity REITs had issued debt and received a credit rating up from nearly 38% in 2000. Of those, 88% were rated investment grade. The majority of REITs have been rated investment grade throughout the period, and fluctuations in the share have generally been due to lower-rated new entrants. Credit rating changes in 2020 and 2021 as published previously have largely kept investment grade status intact.