Tariff actions have introduced uncertainty into U.S. financial and economic markets. A recent Nareit commentary explored how equity REIT property sector total returns fared under new, and changing, tariff policies. It showed that total returns across all 13 equity REIT sectors declined with the announcement of reciprocal tariffs, but performance rebounded across all these sectors with the limited temporary suspension of higher reciprocal rates. While the net effects of these return movements were generally negative, they varied widely across sectors.

On May 12, the U.S. and China announced an agreement to reduce tariffs on goods from the other country by 115% for 90 days. Tariffs on Chinese goods were reduced to 30%; those on U.S. goods were cut to 10%. Equity markets welcomed this trade thaw. Total returns across equity REIT sectors generally moved higher over the trading week since the joint statement (May 12-16), but performance gains were more muted than the initial rebound after the broader pause on higher reciprocal tariff rates (April 9-May 11).

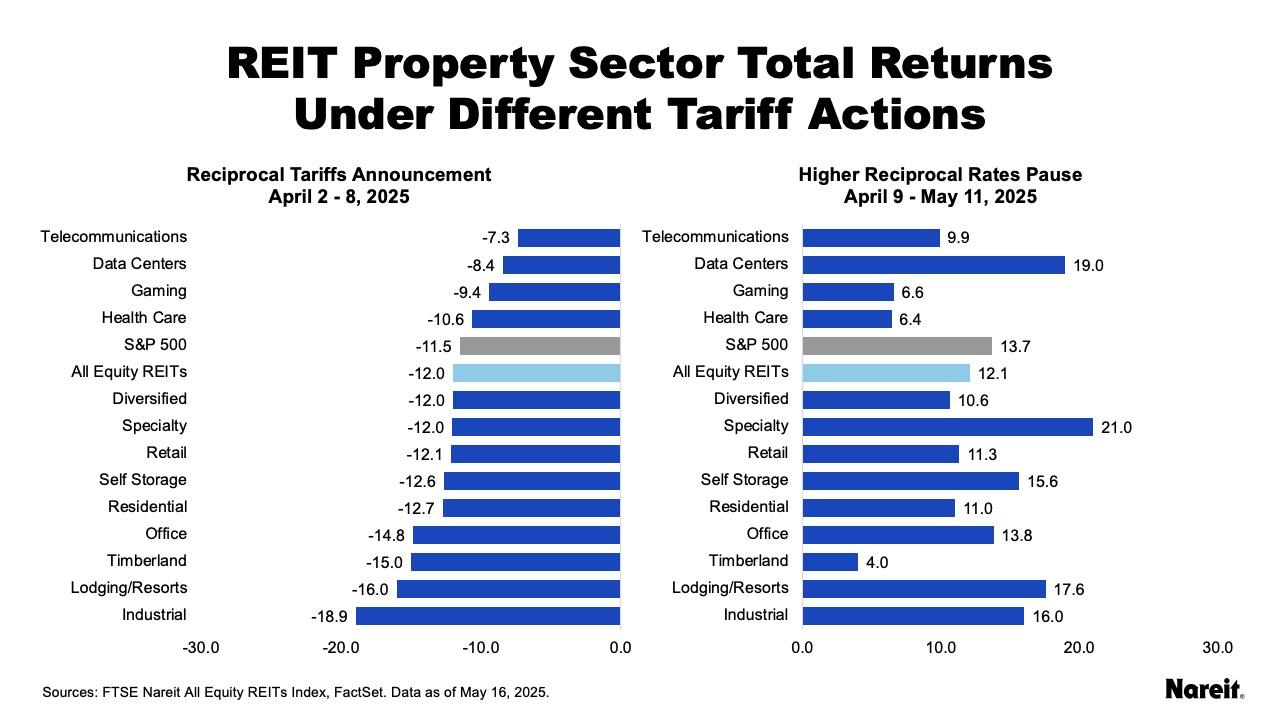

The charts above display total returns for the 13 equity REIT property sectors, as well as the FTSE Nareit All Equity REITs and S&P 500 indices, from April 2-8 and April 9-May 11. The first and second periods highlight market reactions to the reciprocal tariffs announcement and the limited temporary reprieve from higher reciprocal rates, respectively.

Total returns from April 2-8 showed that the reciprocal tariffs announcement had similar adverse impacts on the broad equity (S&P 500, -11.5%) and REIT (FTSE Nareit All Equity REITs, -12.0%) markets. Performance across all 13 REIT property sectors also declined, but the severity of the declines varied widely. Industrial (-18.9%) and lodging/resorts (-16.0%) were the weakest performing sectors. Telecommunications (-7.3%) and data centers (-8.4%) had the strongest performances.

After the temporary pause of higher reciprocal rates, the S&P 500 (13.7%) and FTSE Nareit All Equity REITs (12.1%) indices bounced back. While the S&P 500 gain was able to offset its decline related to the reciprocal tariffs announcement, the FTSE Nareit All Equity REITs gain did not. Each of the 13 equity REIT sectors also posted gains from April 9-May 11. Only gains in four sectors, however, were able to offset their intial declines: data centers (19.0%), specialty (21.0%), telecommunications (9.9%), and self-storage (15.6%).

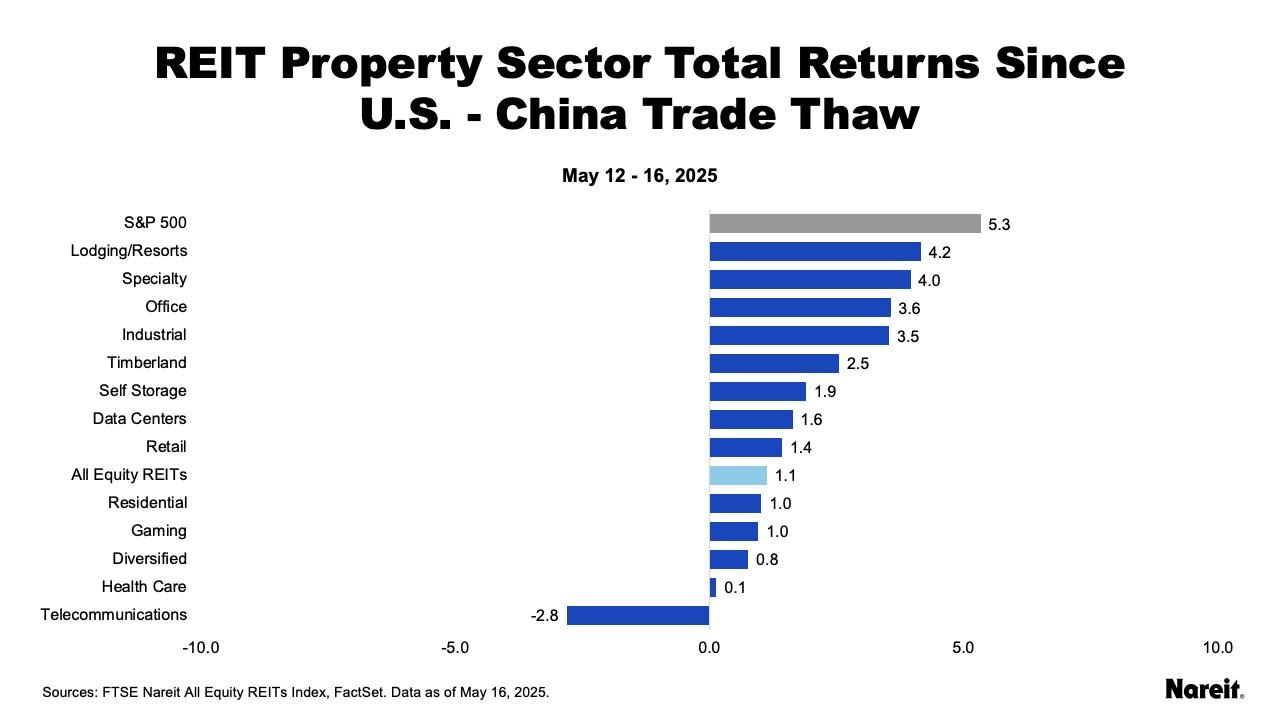

The chart above presents total returns for the 13 equity REIT property sectors, as well as the FTSE Nareit All Equity REITs and S&P 500 indices, from May 12-16. The time period indicates the broad equity and REIT market reactions to the U.S-China announcement to reduce tariffs on goods from the other country by 115% for 90 days.

With the temporary trade thaw, the S&P 500 experienced a sizable rise (5.3%) over the five examined trading days.The REIT market reaction was positive, but less pronounced (1.1%). All the REIT property sectors posted positive, but varied, total returns, with the exception of telecommunications (-2.8%). Interestingly, the strongest performing sectors were among those that had the weakest performance over the reciprocal tarifffs announcement period (April 2-8), i.e., lodging/resorts, office, industrial, and timberland. Compared to the pause on higher reciprocal rates, market reactions to the U.S.-China joint statement were more muted, likely due to the agreement’s narrower focus; the duration of the reaction period may have also been a factor.

The chart above shows total returns for the 13 equity REIT property sectors, as well as the FTSE Nareit All Equity REITs and S&P 500 indices, from April 2-May 16.

The net effects of recent tariff actions have been positive for the S&P 500 (6.0%) and near neutral for REITs (-0.2%). From April 2-May 16, five REIT sectors posted positive total returns: data centers (10.7%), specialty (10.7%), self-storage (2.9%), lodging/resorts (2.8%), and office (0.4%). Six sectors, i.e., retail, telecommunications, diversified, residential, gaming, and industrial, posted total returns between 0% and -3%. The two weakest performing sectors were health care (-4.7%) and timberland (-9.3%).

New tariff policies may have elevated economic uncertainty and financial market volatility, but the net broad equity and REIT investment performance effects related to recent tariff actions have been considerably more tempered than many investors feared.

Despite abundant investor concerns, year-to-date through May 16, the S&P 500 and FTSE Nareit All Equity REITs indices posted positive total returns of 1.8% and 2.6%, respectively. Although further tariff actions are likely to influence future financial market performance, REITs are generally well-positioned to weather any potential fluctuations due to their solid property operations and strong balance sheets.