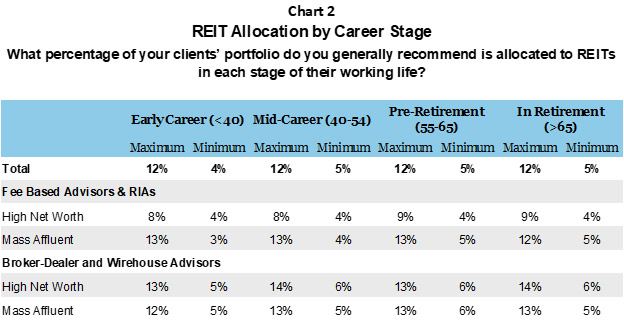

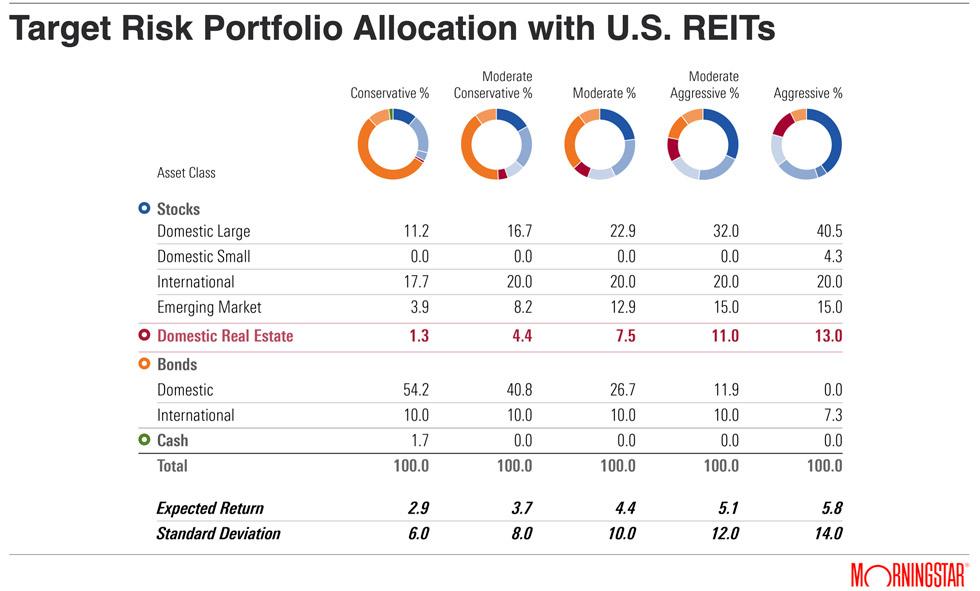

A new Morningstar Associates analysis, sponsored by Nareit, found that the optimal portfolio allocation to REITs ranges between 4% and 13%. The Morningstar analysis came on the heels of another Nareit-sponsored analysis by market research firm Chatham Partners demonstrating that financial advisors understand the importance of meaningful REIT allocations – irrespective of the client’s age – from early career through retirement.

Morningstar Analysis: The Role of REITs in Asset Allocations

As illustrated in Chart 1, the Morningstar analysis shows that the inclusion of REITs in a portfolio may increase the return for a given level of risk. The following table depicts five portfolios targeting different levels of risk. For example, a moderate portfolio targeting a 10% standard deviation and 4.4% return allocates 7.5% to REITs, and an aggressive portfolio targeting a 14% standard deviation and 5.8% return is estimated to have a 13% REIT allocation.

In this analysis, Morningstar used Black-Litterman methodology, a mean-optimization methodology well respected by the institutional investment community. Portfolio managers use this methodology as a tool to understand how to optimally allocate investments across different asset classes. The Black-Litterman model is an extension of mean-variance optimization, which asserts that an investment’s risk and return characteristics should not be viewed alone, but be considered based on how the investment impacts the overall portfolio’s risk and return. Black-Litterman seeks to avoid the often extreme unconstrained portfolio allocations that result from mean-variance optimization. The Black-Litterman approach produces stable, optimal portfolios based on an investor’s insights. Using the Black-Litterman mean-variance optimization, the table identifies efficient asset mixes that provide the greatest expected return for a given amount of expected risk. The inputs used are based on Morningstar Investment Management’s assumptions.

Chatham Partners Research: Use of REITs Among Financial Advisors

It is already a widely accepted view in the investment community that commercial real estate is a core asset class with unique investment attributes and return drivers, and that an investment in REITs is an investment in real estate.

This fundamental asset class proposition is based on specific, well-documented attributes of real estate investment, including:

- A distinct economic cycle relative to the cycle for most other equities and bonds due to supply inelasticity, which reduces the correlation of investment returns from real estate with the returns from other assets,

- Competitive, long-term investment returns that potentially provide high and growing income from rents plus moderate capital appreciation over time,

- Potential inflation hedging attributes due in part to the fact many leases are tied to inflation and that real asset values tend to increase in response to rising replacement costs.

In the U.S., institutional and retail investors have embraced REITs and real estate as a core asset class. For example, in the defined contribution market, the growing use of target-date funds remains the dominant investment-related trend and it is estimated that nearly 100% of these products now feature REIT allocations.

With respect to financial advisors, the just completed Chatham Partners survey found that 83% of financial advisors invest their clients in REITs and the most frequently referenced attribute they cite is “portfolio diversification.” As exhibited below, advisors recommend allocations to REITs in the range of 4% to 12% -- irrespective of the client’s age – from early career through retirement.

Commercial Real Estate is a Large Asset Class

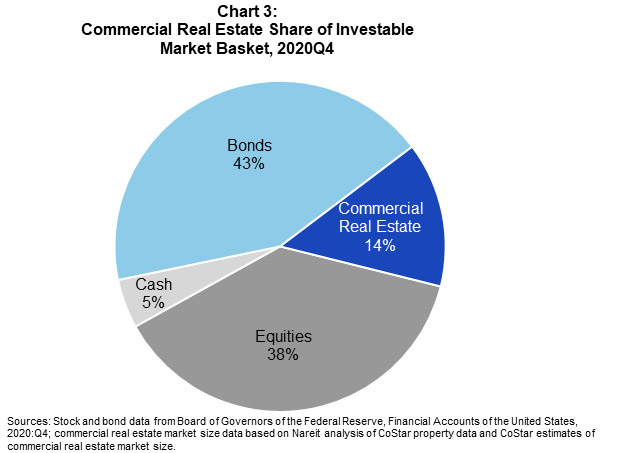

The fact that the optimized model portfolios produced by Morningstar and Wilshire feature meaningful REIT allocations is not a surprise given the size of the commercial real estate market. Modern portfolio theory emphasizes the importance of diversification within a portfolio (in addition of returns and volatility) and well-diversified investment portfolios should include meaningful allocations to all assets in the entire market basket, including real estate.

Commercial real estate is the third largest asset (14%) in the U.S. investment market, after U.S. equities (38%) and U.S. bonds (43%). It is important to note that, while REITs only represent an estimated 10%-20% of the real estate asset figure, research by organizations such as CEM Benchmarking have found that Equity REIT returns are highly correlated with other forms of commercial real estate For this reason, REITs can be used to gain commercial real estate exposure in a portfolio. REITs and listed real estate securities may also be used to invest in the global commercial real estate market.

The latest Morningstar analysis and Chatham Partners survey demonstrating the importance of meaningful portfolio allocations to REITs represents more than a key milestone in the maturation of the real estate industry. It is a sign of the growing consensus about the wisdom and durability of the REIT approach to real estate investment.