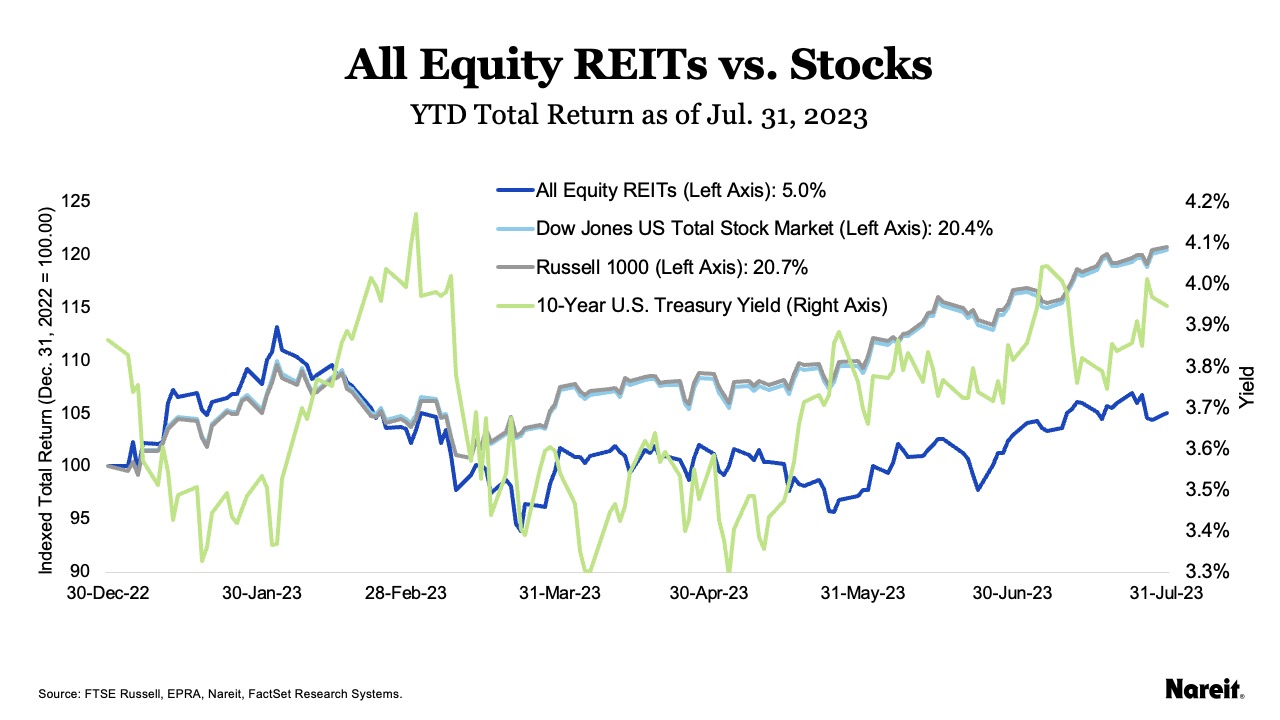

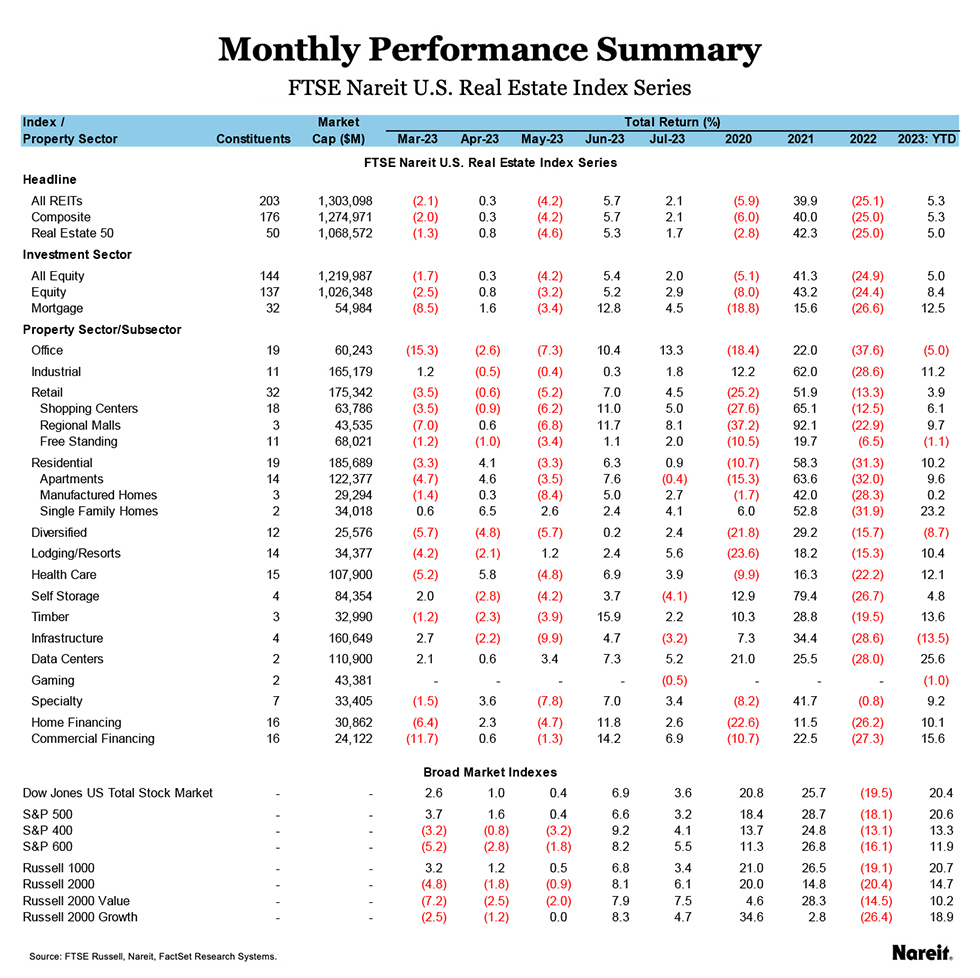

In July, the FTSE Nareit All Equity REITs Index rose 2.0% and the FTSE EPRA Nareit Global Extended Index was up 3.4%. This marked the first back-to-back monthly gains for REITs since October–November 2022. The Federal Reserve resumed tightening monetary policy, hiking the Federal Funds rate by 25 basis points as investor focus shifts to how long rates will remain elevated rather than how many more hikes to expect. Broader markets rose in July as well, as the Dow Jones U.S. Total Stock Market was up 3.6% and the Russell 1000 was up 3.4%. On a year-to-date basis, the All Equity REITs Index has returned 5.0% and the Global Extended Index is up 3.6%. The yield on the 10-Year Treasury ended the month at 3.9%.

Optimism continued for office REITs, as the sector climbed 13.3% in July following a gain of 10.4% in June. Office REITs have recently expressed optimism in leasing trends and are confident that the long-term trend toward premier, amenity-rich properties will be an advantage for REITs.

As shown in the above chart, REITs continue to underperform broader markets on a year-to-date basis, with total returns as follows:

- All Equity REITs: 5.0%

- Russell 1000: 20.7%

- Dow Jones U.S. Total Stock Market: 20.4%

As shown in the table above, property sector performance was generally strong in July. Office led with a total return of 13.3%, followed by lodging/resorts at 5.6%, and data centers at 5.2%. Self-storage trailed with a return of -4.1%, followed by infrastructure at -3.2%, and gaming at -0.5%. Year-to-date, the data centers sector has returned 25.6%, timber is up 13.6%, and health care rose 12.1%. Mortgage REITs rose 4.5% in July and 12.5% year-to-date.