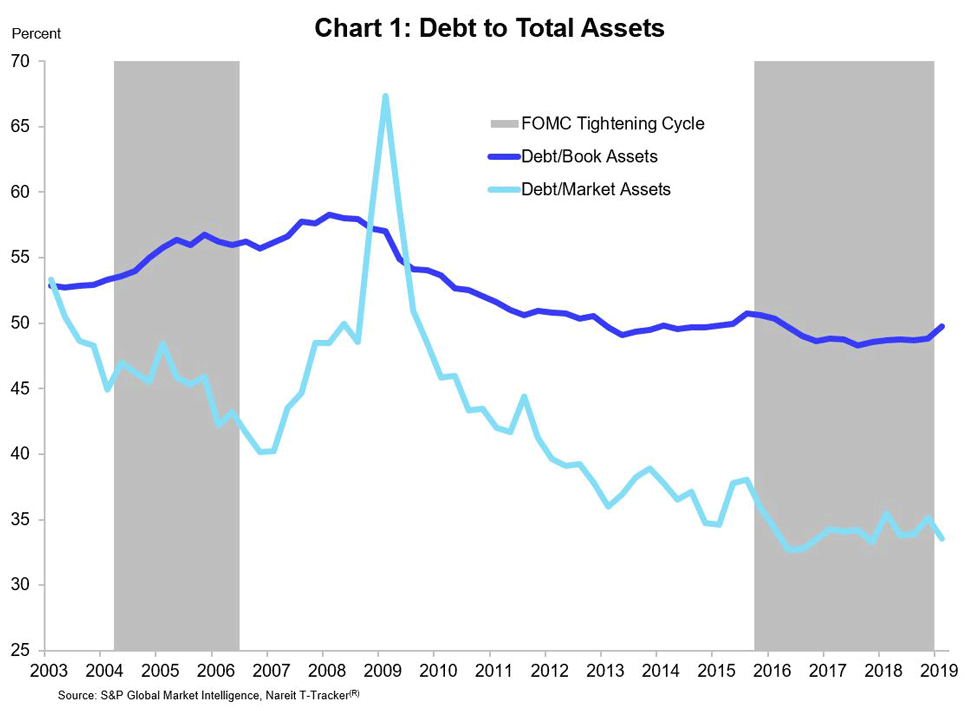

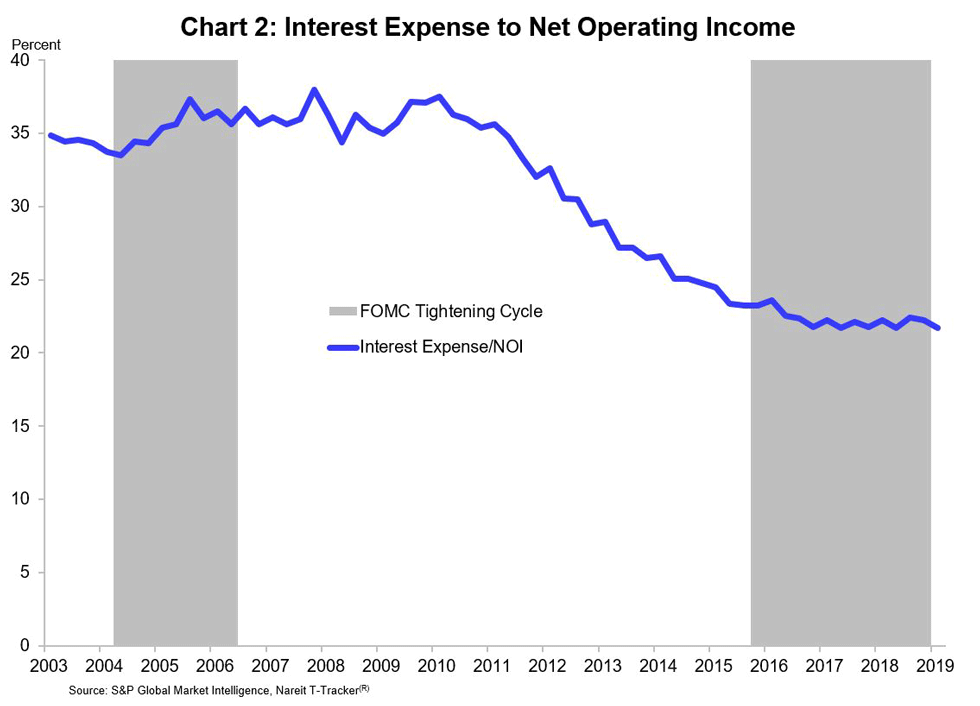

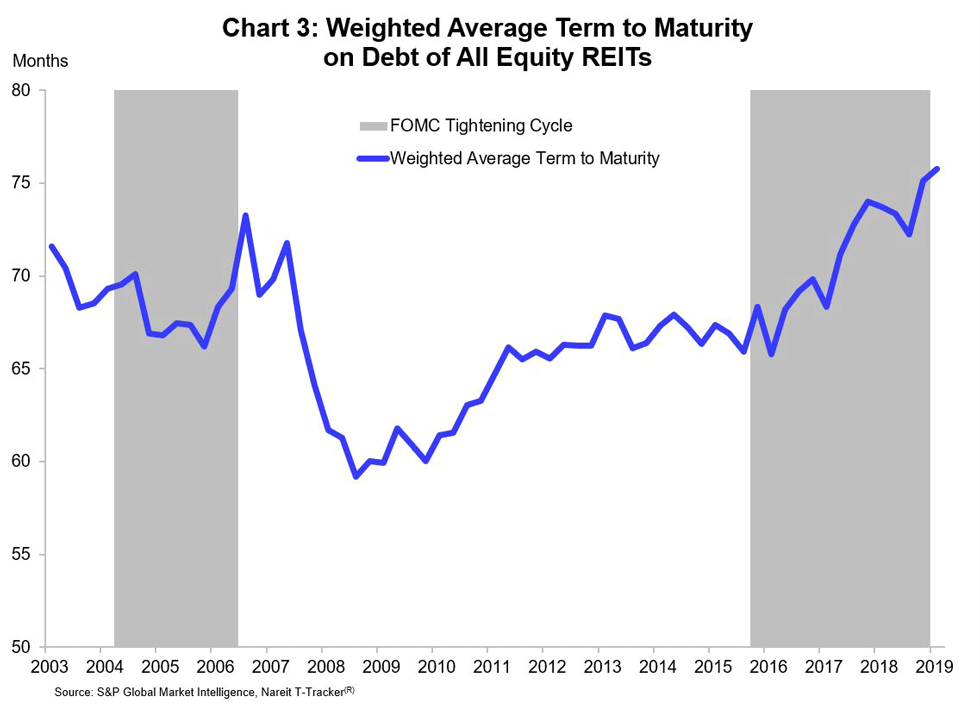

The exposure of REIT balance sheets and earnings to rising interest rates has attracted a lot of attention in recent years. Many investors would be surprised to learn that exposures are low, as REITs have raised equity capital to reduce leverage, and have lengthened the maturity of their debts to lock in low interest rates for many years into the future (charts 1, 2 and 3; see also a recent Market Commentary on REIT balance sheets).

Recently a number of commentators have drawn attention to REIT issuance of commercial paper and suggested that the use of short-term debt raises risks for the sector (see, for example, Real-Estate Companies Amass Cheaper—but Riskier—Short-Term Debt). Commercial paper is a short-term financing instrument with maturities generally shorter than 270 days. Issuers must roll over the borrowings on a regular basis, leading some observers to ask about the risk that issuers may be unable to refinance this debt during a period of market stress.

REIT issuance of commercial paper is small relative to their long-term debt, however, and does little to change the low-risk stance of their balance sheets. For example, a half-dozen or so REITs have commercial paper programs, with total borrowing standing at $2.3 billion in the first quarter of this year. This compares to over $60 billion of long-term debt, or about 4% of total borrowings of the REITs with commercial paper programs. Long-term debt of the total REIT industry dwarfs the commercial paper borrowings with a total long-term bond and mortgage outstanding of $525 billion as of 2019:Q1.

Many firms use commercial paper as a low-cost source of liquidity for short-term funding needs and working capital. Commercial paper issuers, including REITs, can benefit not only from lower interest rates but also the flexibility to adjust their borrowings to meet their near-term liquidity needs, while relying on long-term corporate bonds and mortgages (and equity capital) to fund their property holdings. Moreover, access to the commercial paper market is generally limited to firms with investment grade ratings that have among the highest ability to repay these debts.

The REIT industry has de-risked balance sheets by reducing leverage and extending maturities of their debt, and the REITs that have accessed the commercial paper market have done so from a position of balance sheet strength.