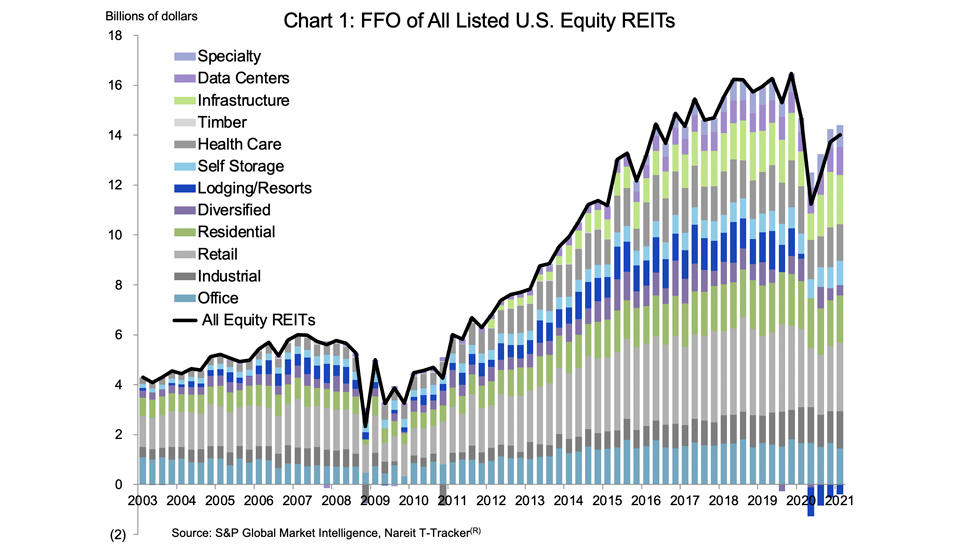

The recovery in REIT earnings from declines early in the pandemic continued in the first quarter of 2021, according to data recently released in the Nareit T-Tracker®. Funds from operations (FFO) rose 2.0% over the fourth quarter of 2020, and was 85% of the level in 2019:Q4, just prior to the onset of the COVID-19 pandemic.

Performance was uneven across property sectors, reflecting the different pace of reopening among parts of the U.S. economy. The sectors that support the digital economy—data centers, infrastructure, and industrial REITs—had FFO at or near record highs.

Self storage REITs also reported robust earnings, with FFO gaining 15.3% from the prior quarter. FFO of self storage REITs was above pre-pandemic levels.

FFO rose 5.5% in the retail sector, including a 14.5% increase by regional malls. Overall FFO of retail REITs stood at 81.2% of its 2019:Q4 level. FFO of residential REITs rose 3.3%.

Recovery appears to be delayed among some other sectors, however. Continued low levels of business and leisure travel resulted in negative FFO for lodging/resort REITs, and work-from-home contributed to a 12.5% decline in FFO of office REITs.

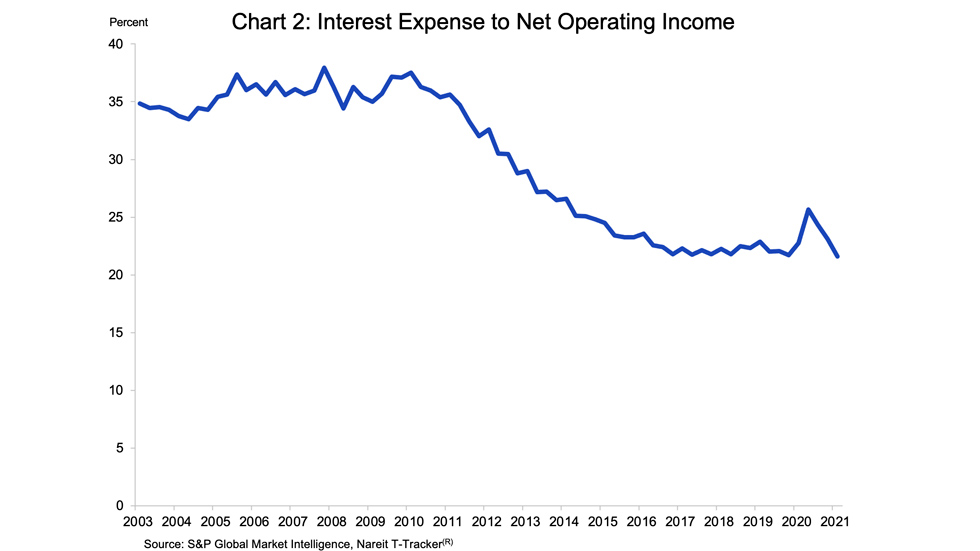

REITs had strong balance sheets and robust operating performance on the eve of the pandemic, which has contributed to their resilience over the past year. Aggregate leverage ratios remain low and interest expense as a share of net operating income moved down to a record low of 21.6%.

Full data and charts from the Nareit T-Tracker are available for free download at REIT.com/T-Tracker.