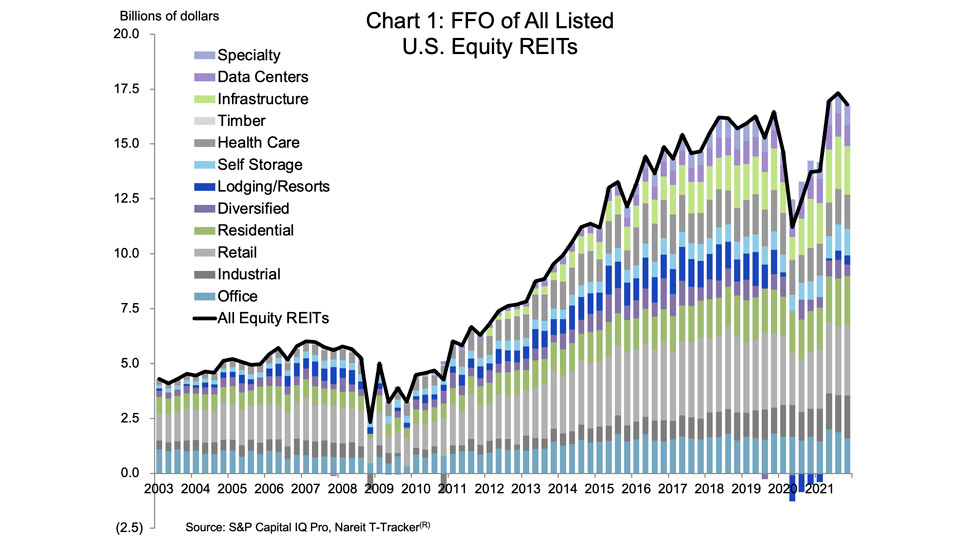

REIT earnings, as measured by funds from operations (FFO), rose 24.6% in the full year 2021 as the recovery from the early stages of the pandemic gained momentum, according to the Nareit T-Tracker®. On a quarterly basis, FFO overall was down slightly in the fourth quarter, declining 3.0% from the prior quarter.

Performance varied widely across property sectors in the fourth quarter. Industrial REITs continued to post incredible earnings growth, with FFO rising 13.8% from the third quarter, to $1.9 billion. This is 51.2% higher than one year ago, and 64.5% higher than in 2019:Q4, the last full quarter before the pandemic.

Several other sectors had more moderate gains, including retail and lodging/resorts, which are recovering after having been among the sectors most impacted by the shutdowns early in the pandemic.

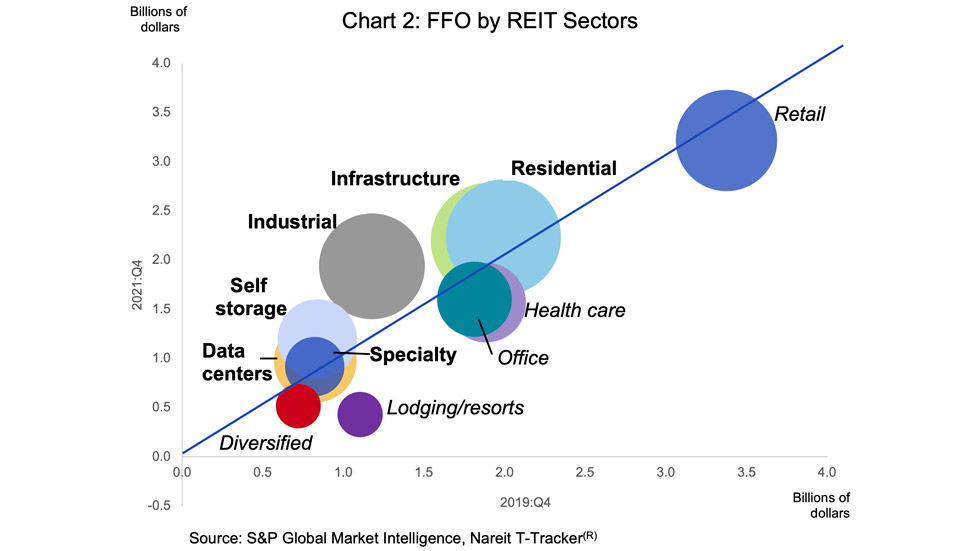

In the fourth quarter of 2021, FFO of all equity REITs was 2.1% higher than in 2019:Q4:

Property sectors with FFO exceeding pre-pandemic levels include industrial (+64.5% above 2019:Q4), self storage (+43.2%), data centers (+17.6%), infrastructure (+15.7%), residential (+12.1%), and specialty (+11.6%).

Property sectors with FFO below pre-pandemic levels include retail (-4.7%), office (-11.7%), health care (-16.7%), diversified (-28.4%), and lodging/resorts (-61.0%).

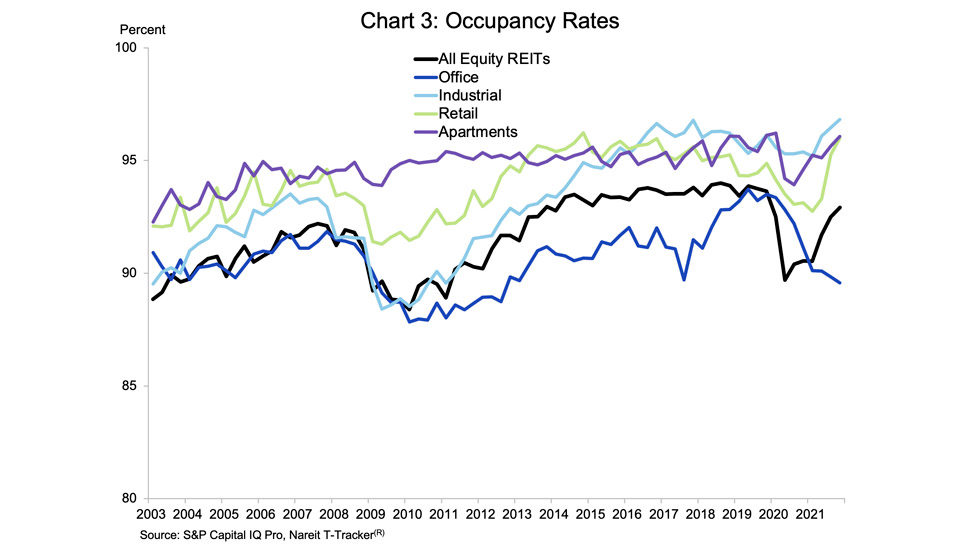

Operating performance of REITs has improved in most property sectors. In particular, occupancy rates of all properties owned by REITs have risen 320 bps from the low point of reached in the second quarter of 2020 (black line in Chart 3). Retail, apartment, industrial, and lodging/resort (not shown on chart) have all enjoyed significant increases in occupancy rates, while occupancy has continued to decline in the office sector.

For complete data available to download in spreadsheets and charts, visit the Nareit T-Tracker .