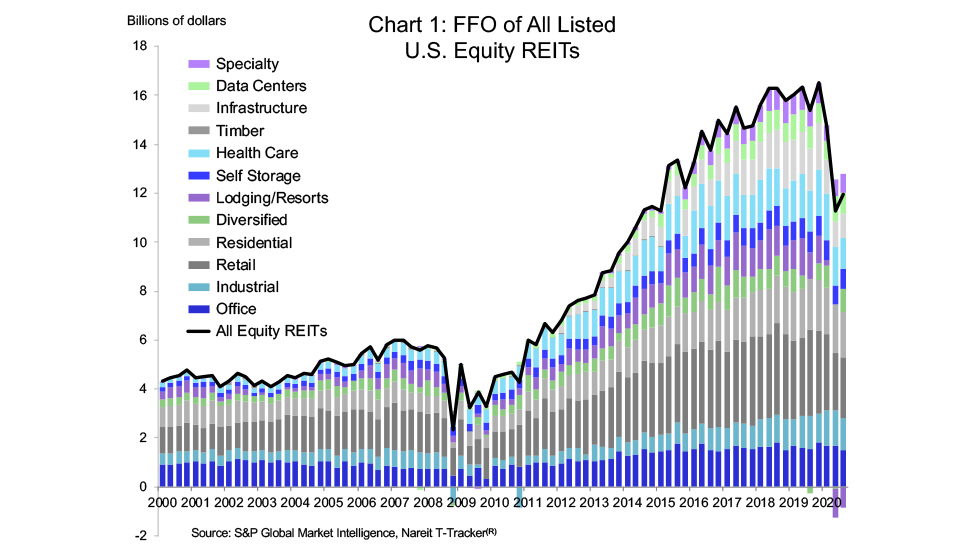

REIT earnings, measured by funds from operations (FFO), stabilized in the third quarter, according to the Nareit T-Tracker®.

FFO of all equity REITs rose 5.6%, following the 23.5% decline in the second quarter. Even with this modest quarter-over-quarter improvement, however, FFO was 22.3% lower than the third quarter of 2019.

Three sectors that had been most directly impacted by the economic shutdown in the spring accounted for much of the improvement in the third quarter. Diversified REITs saw FFO swing from negative $102 million in the second quarter to positive $962 million; Lodging/resorts had a modest improvement due to rising travel volumes and the reopening of hotels, as FFO went from negative $1.17 billion in the second quarter to negative $848 million in the third quarter; and retail REITs saw FFO rebound from $2.36 billion in the second quarter to $2.49 billion in the third quarter.

REITs have been able to weather many of the challenges during the pandemic due to their strong balance sheets and financial strength:

- Leverage remains near the lowest levels on record, with the book debt-to-total assets ratio at 50.8% in the third quarter of 2020, significantly lower than 58.3% during the 2008 financial crisis;

![]()

- REITs had lengthened the maturity of their debts during the years since the 2008 financial crisis, reducing the need to refinance during the pandemic. The weighted average maturity of REIT debt in the third quarter was 84.9 months, or just over seven years, compared to 59.2 months in 2008; and

- The weighted average interest coverage ratio–an indication of ability to service debt out of current income–was 3.8x in the third quarter, considerably higher than the 2.7x in 2007.

The T-Tracker does show, however, other signs of a difficult operating environment amidst the pandemic. Same-store net operating income (SS NOI), which measures NOI generated by properties held for one year or more, fell 7.5% from a year ago, in line with the 7.3% decline through the second quarter.

The weighted average occupancy rates for all properties owned by REITs rose 110 bps, from 89.8% to 90.9%. Much of the increase was due to the reopening of the lodging/resort sector after the economic shutdown in the first half of 2020. Industrial sector occupancy rates rose 60 bps, from 95.3% to 95.9% (30 bps higher than one year earlier). Occupancy rates declined, however, in the apartment (down 40 bps from last quarter, to 93.9%, which is 160 bps lower than one year earlier) and office (down 70 bps, to 92.3%, which is 120 bps lower than one year earlier) sectors.

![]()

These charts and other earnings and operating data on REITs, including details by property sector and full history from 2000 to 2020:Q3, are available for download from the Nareit T-Tracker.