REITs are making great strides in ESG by working to enhance ESG data and disclosure, strengthen board oversight of ESG, implement programs that prioritize the health and wellness of stakeholders, and put in place climate mitigation and adaptation strategies to reduce carbon emissions while increasing resiliency.

Publicly-traded REITs have a comparative advantage over private real estate as transparency, disclosure, and accountability are embedded in their business model. Nareit’s 2021 REIT ESG Dashboard and its REIT Industry ESG Report 2022 provide valuable data on ESG performance over time.

In 2021, all of the top 100 REITs by equity market capitalization reported publicly on their ESG efforts with 80 producing stand-alone reports (up from 66 the previous year).

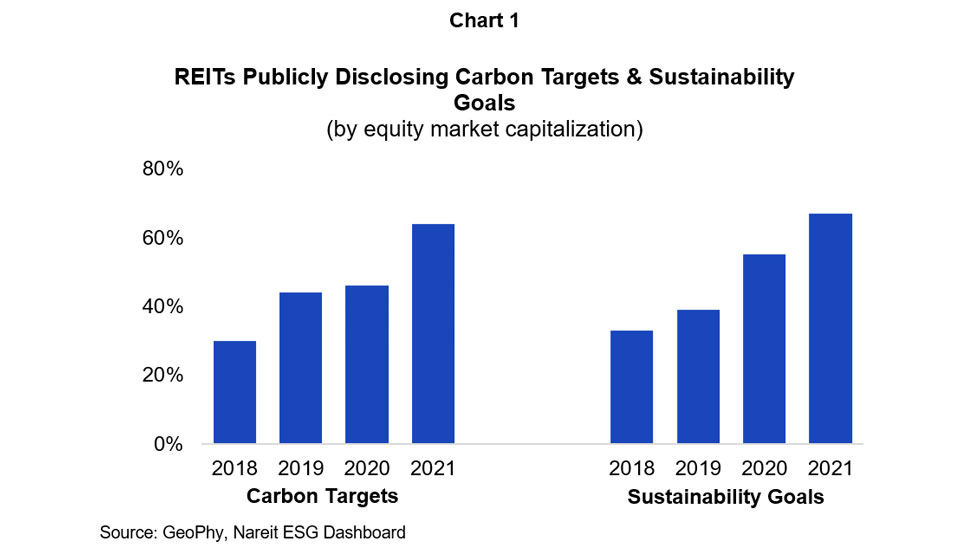

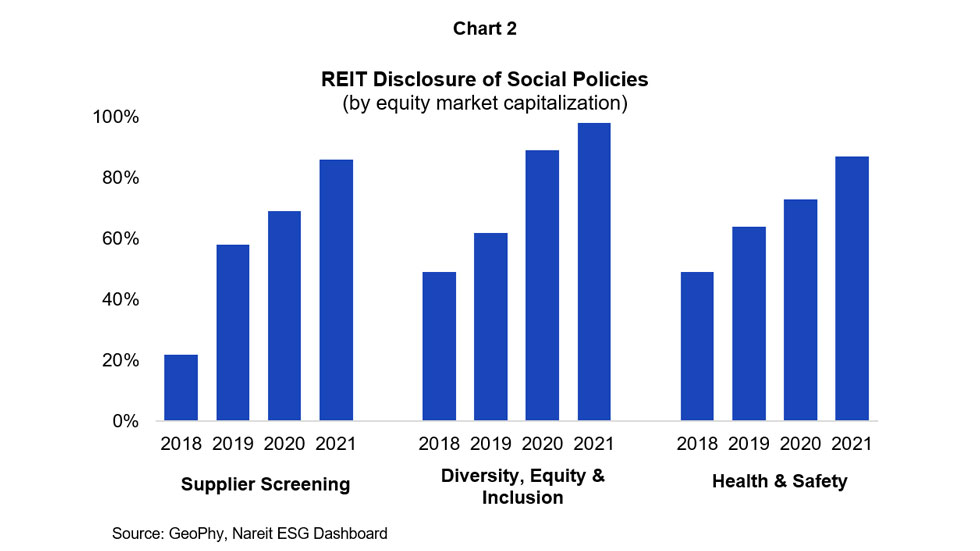

Along with increased reporting, more REITs are disclosing carbon targets, sustainability goals, and social policies, including those around supplier screening, diversity, equity, and inclusion, and health and safety.

As shown in Chart 1, the share of REITs (by market cap) reporting on carbon targets and sustainability goals more than doubled from 2018 to 2021. Chart 2 shows how REITs have steadily increased their disclosures of social policies from 2018 to 2021with nearly all REITs in the top 100 disclosing diversity, equity, and inclusion policies.

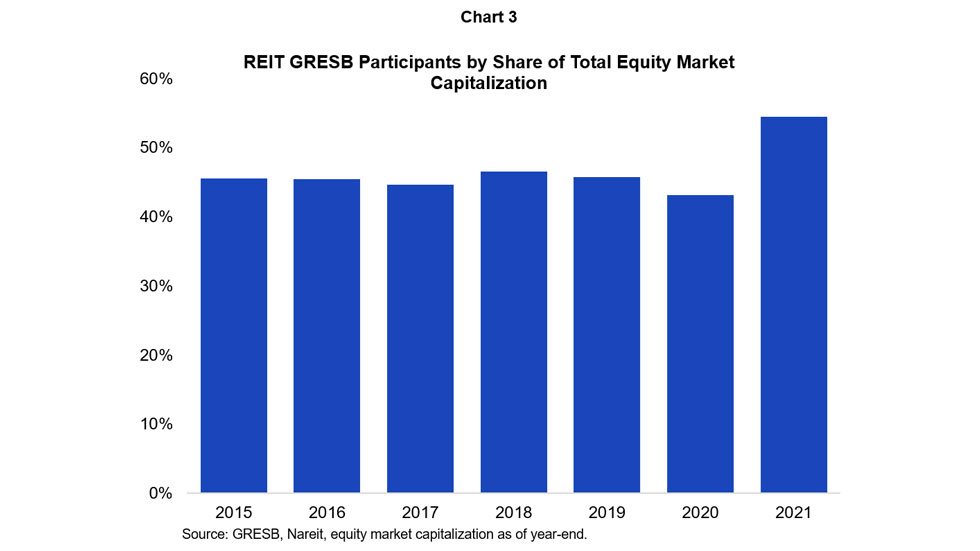

More REITs are also participating in Global Real Estate Sustainability Benchmark (GRESB), a global ESG benchmark for commercial real estate world-wide. GRESB collects, validates, scores, and benchmarks ESG data from commercial real estate owners to provide business intelligence, engagement tools, and regulatory reporting solutions for investors, asset managers, and the wider industry.

Since 2015, the number of U.S. REITs participating has nearly doubled and has increased 125% by market cap as shown in Chart 3. Fifty-nine U.S. REITs participated in 2021 versus 46 U.S. REITs in 2020. Across property sectors, self-storage (95%), office (90%), and industrial (83%) REITs had the highest proportion of REITs reporting to GRESB by market cap.

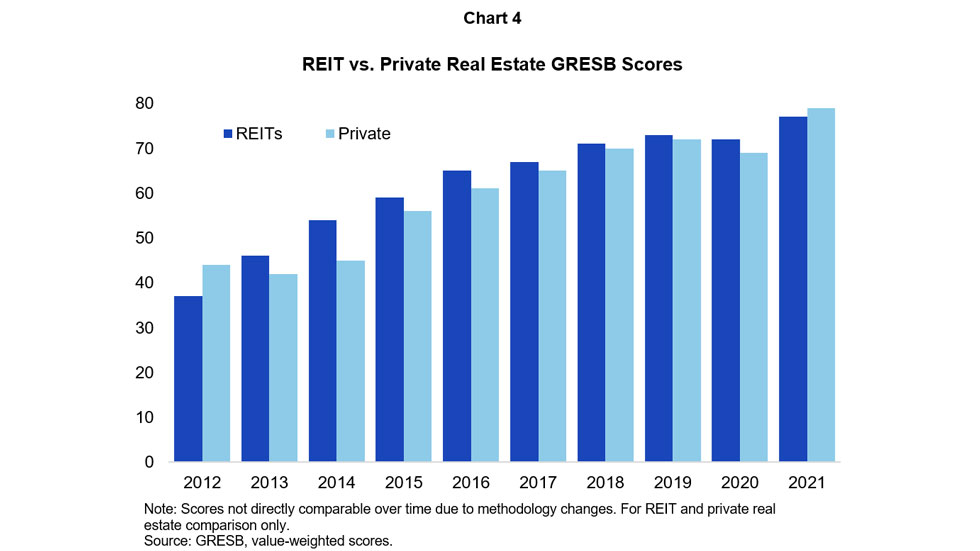

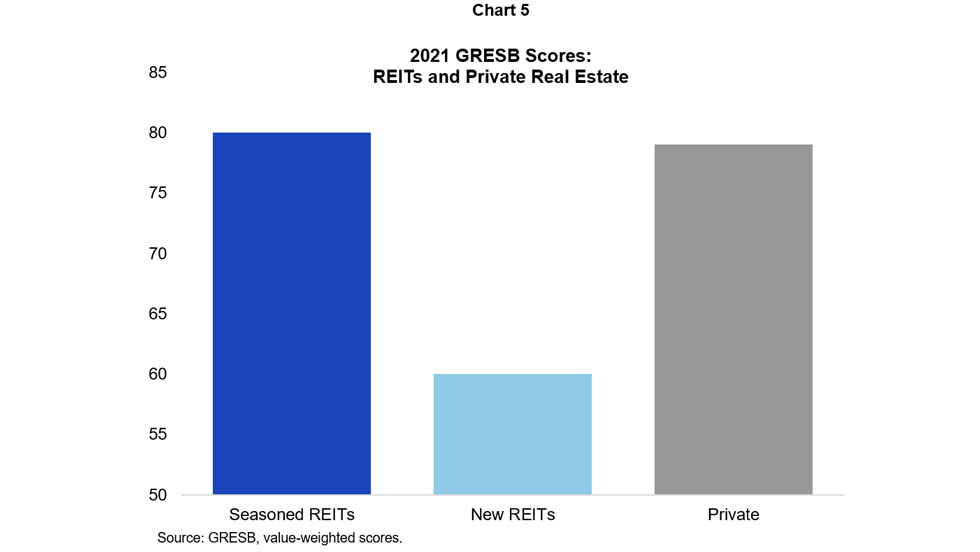

By participating in GRESB, REITs provide the ability for institutional investors to compare performance across public REITs and private funds. REITs typically outperform private fund ESG scores, although they fell slightly behind in 2021.

Chart 4 shows the relative performance in GRESB scores for REITs and private real estate from 2012 to 2021. The REIT and private fund scores are comparable with each other by year, but because of methodological changes, the scores are not directly comparable from year-to-year except for 2020 and 2021. Increased REIT participation in GRESB led to a drop in the overall score for 2021.

As Chart 5 shows, in 2021, seasoned REITs (those with one or more year of participation) outperformed the total for private real estate by one point. In fact, of the 42 companies that reported to GRESB in both 2020 and 2021, 37 (88%) improved their numeric scores.

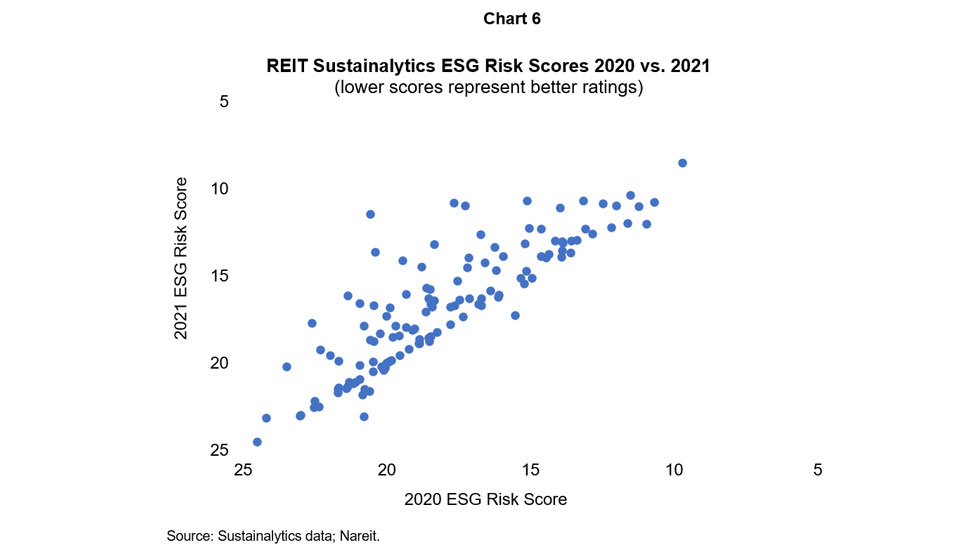

In addition to GRESB, which focuses solely on real estate, each year REITs receive ratings from multiple public markets-focused rating systems that score them based on their publicly available data on ESG. In theory, these scores give investors an idea of how proactive companies are at managing ESG issues, which could be an important indicator of the company’s value and performance. In practice, the different scoring systems often provide contradictory or inconsistent rankings of companies. Nevertheless, these scoring systems are increasingly widely used, and REITs have improved their overall performance in a number of the ranking systems. The real estate sector was rated higher or the same in 2021 versus 2020 by a number of well-regarded ESG rating systems including Sustainalytics, MSCI, FTSE, ISS, and Bloomberg.

Sustainalytics ESG risk scores measure a company’s exposure to key industry ESG risks and how well that company is addressing those risks. Scores for REITs improved by an average of 7% from 2020 to 2021 with 85% of REITs improving or maintaining their scores year-over-year, as illustrated in Chart 6. REITs earned improved ratings in 2021 for each category of environmental, social, and governance risk, with social risk being the most improved.

REITs are enhancing their commitment to ESG as each year more companies are disclosing their policies, participating in benchmarks, and being rated higher for their ESG practices. Investors value companies that focus on ESG, and in recent years, REITs have been steadily improving their ESG commitments and disclosures. Learn more about REITS and ESG.