REITs are long-term investors and are incentivized to rent to high quality skilled nursing facility (SNF) operators who will be stable and successful tenants. New research shows that REITs target high performing operators for investment and that skilled nursing operators increase staffing after becoming REIT tenants.

Key Findings

New research in the journal Health Affairs finds:

- REITs on average invest in SNFs that have higher registered nurse (RN) staffing hours per resident day (staffing time).

- REIT investment is associated with higher licensed practical nurse (LPN) and certified nursing assistants (CNA) staffing.

- There is no statistically significant change in RN staffing time following REIT investment.

- If there is any meaningful causal relationship between a REIT purchasing the property that houses a SNF and quality of care, it is that REIT ownership improves overall staffing time with residents.

Nareit research finds:

- REITs own the structures that house about 11% of U.S. SNFs.

- Nearly 95% of the REIT-owned properties were in net lease arrangements where the REIT is the landlord to a skilled nursing operator tenant.

- SNFs that are housed in public REIT-owned properties have higher quality of care outcomes than those skilled nursing facilities that are not housed in REIT-owned properties.

- Public REIT-owned properties have high quality tenants with higher average long-term resident quality ratings.

- REIT skilled nursing tenants have a higher share of four- and five-star operators than the general population and a lower share of one- and two-star operators.

Analysis

The paper in the journal of Health Affairs, The Role Of Real Estate Investment Trusts In Staffing US Nursing Homes, focuses on staffing at SNFs in the Centers for Medicare and Medicaid Services (CMS) provider database. Specifically, the report compares SNFs housed in properties leased from REITs compared with facilities that rent non-REIT properties or own their buildings and the correlation between staffing levels in SNFs in properties leased from REITs. The paper finds that 11% of SNFs, or 1,806 facilities, were housed in REIT-owned properties in 2021. Highlights from the paper show there is increased staffing time in properties leased from REITs. Our analysis shows there is high quality of care for long-term residents of SNF facilities housed in REIT-owned properties.

REITs Invest in Skilled Nursing Facilities with Higher Staffing Time

The table below, reproduced from the paper, compares staffing hours for operators in properties subsequently chosen for REIT investment with properties that did not receive a REIT investment. There was no statistically significant difference in staffing for LPNs and CNAs between the two operator or property types. Operators in properties chosen for REIT investment did have a statistically significant 0.12 higher RN staffing hours per resident day compared with properties that did not receive a REIT investment.

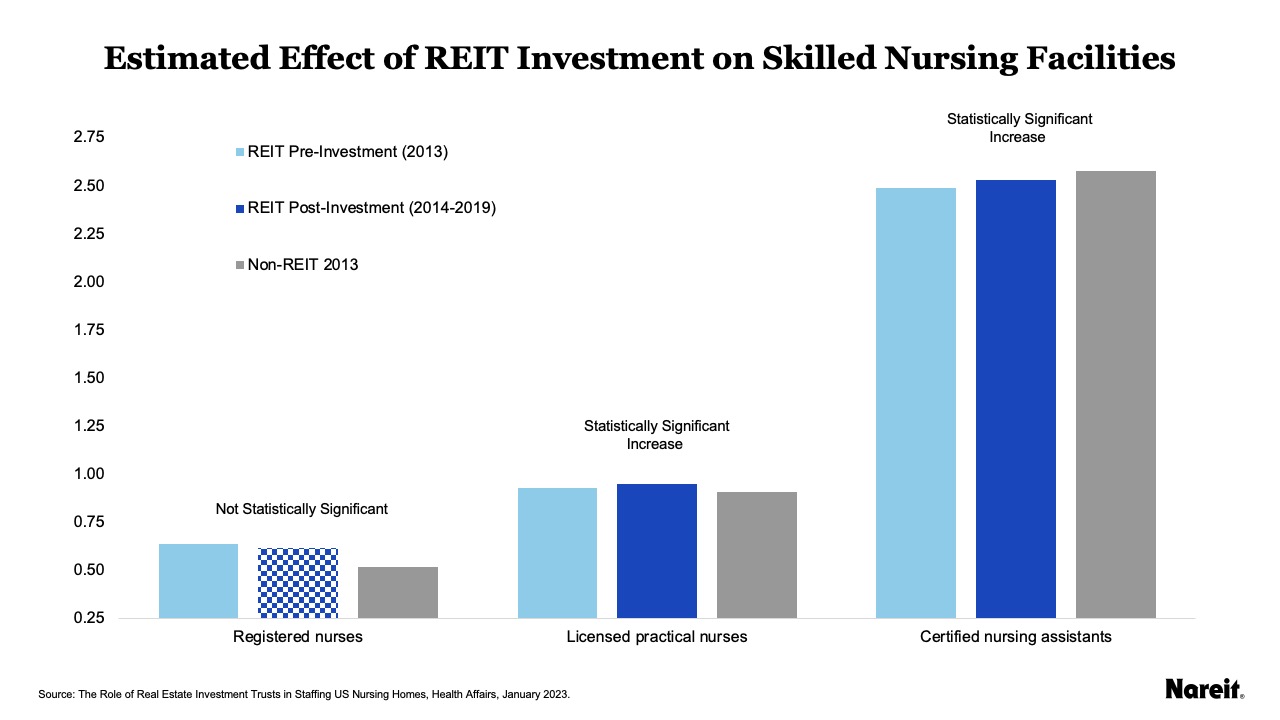

REIT Investment Is Associated with Increases in LPN and CNA Staffing Time

The study finds that if there is any meaningful causal relationship between a REIT purchasing the property that houses an SNF and quality of care, it is that REIT ownership improves overall staffing time with residents. The chart below demonstrates this relationship, by illustrating the paper’s findings that underscore this point. The paper finds a statistically significant increase in LPN and CNA hours after REIT ownership of 0.02 hours (1.2 minutes) per resident day and 0.04 hours (2.4 minutes) respectively. No statistically significant change in RN staffing time occurs over the five-year period following a REIT’s investment in an SNF.

RN Hours Fluctuate After REIT Investment

The study shows that before REITs acquired properties that housed SNFs, RNs worked more hours per resident day in those facilities than in other SNFs and there is no statistically significant change after REIT acquisition. When the authors decompose the results by year, looking at much smaller annual samples, they find all three types of nursing care fluctuate by year. The authors focus on RN staffing in particular. They find that there is no change in RN staffing in the first year of REIT investment. In the second and third years, there is a small (but statistically significant) decrease of 6%, or 2.4 minutes per hour per resident day, which then reverses in the fourth and fifth years. Notably, the overall decrease over those five years is not statistically significant and is actually smaller than the pre-existing difference of 0.12 between the two groups before REIT investment. In other words, on net, RN hours remain higher in SNFs housed in REIT-owned properties.

Further, the authors do not present a theory for these staffing fluctuations—or why this is a systematic concern and not an anomaly in the small annual samples, particularly as staffing subsequently increases and staffing was fluctuating in the years prior to the investment.

The paper does not present results for the SNFs that have been housed in REIT-owned properties for the entire period or those that are housed in privately owned or operator-owned properties to make a comparison about baseline staffing fluctuations.

REITs are Typically Landlords to Skilled Nursing Operators

Nareit’s research shows that REITs own approximately 1,800 structures that house SNFs. This accounts for about 11% of SNFs in the Medicare skilled nursing database.

Nearly 95% of the REIT owned properties are net lease arrangements where the REIT is the landlord to a skilled nursing operator tenant. In the remainder of the REIT owned properties, the REIT contracts with an “eligible independent contractor” to operate the SNF. Under the tax law, the REIT is not permitted to operate the SNF.

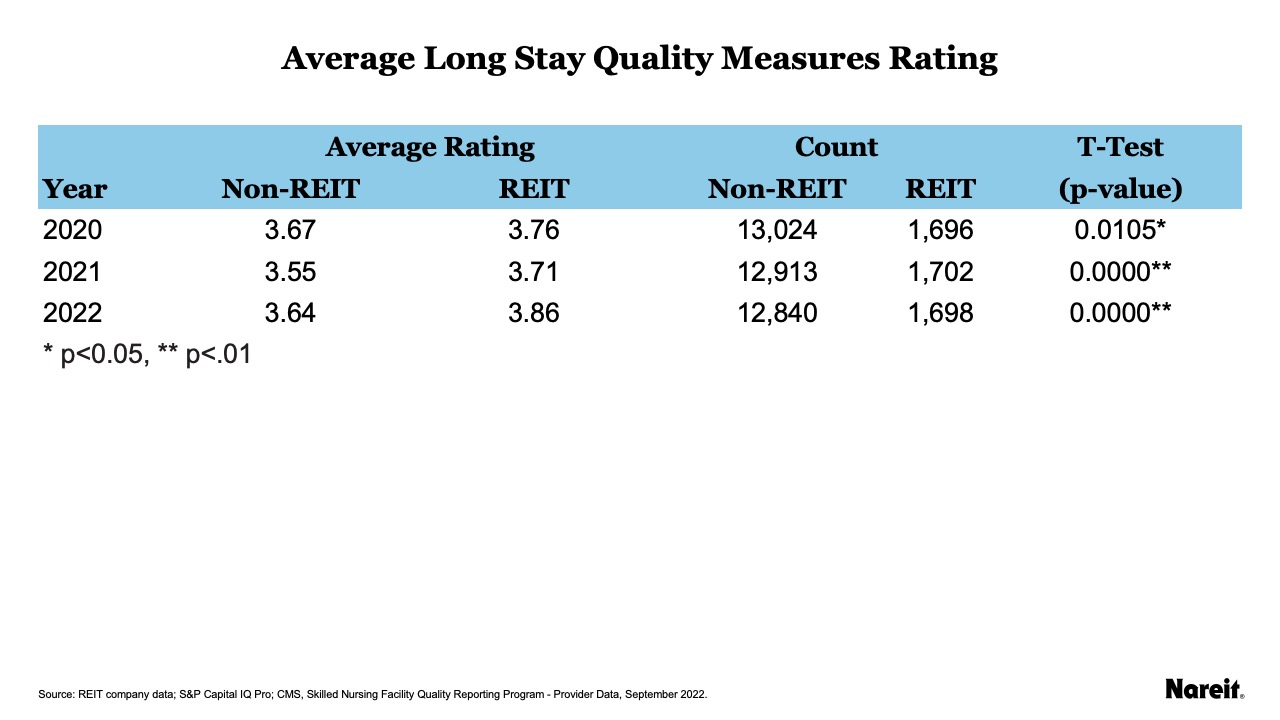

Skilled Nursing Facilities Housed in Public REITs Have High Quality Measure Ratings

Nareit’s own research on quality measures for residents receiving long-term care is shown in the above chart. Public REIT-owned properties house a higher share of four- and five-star SNF operators than the general population (65% compared to 58%) and a lower share of one- and two-star SNFs (17% compared to 23%) in 2022.

Looking across years in the table above, SNFs in public REIT-owned properties have higher average ratings for long stay quality measures in 2020, 2021, and 2022. Using 2021 and 2022 data and controlling for state and year, SNFs in REIT-owned properties have ratings for long stay quality measures that are 0.16 higher.

The evidence suggests that as long-term investors, skilled nursing facilities that are housed in public REIT-owned properties have higher quality of care outcomes than those skilled nursing facilities that are not housed in REIT-owned properties.