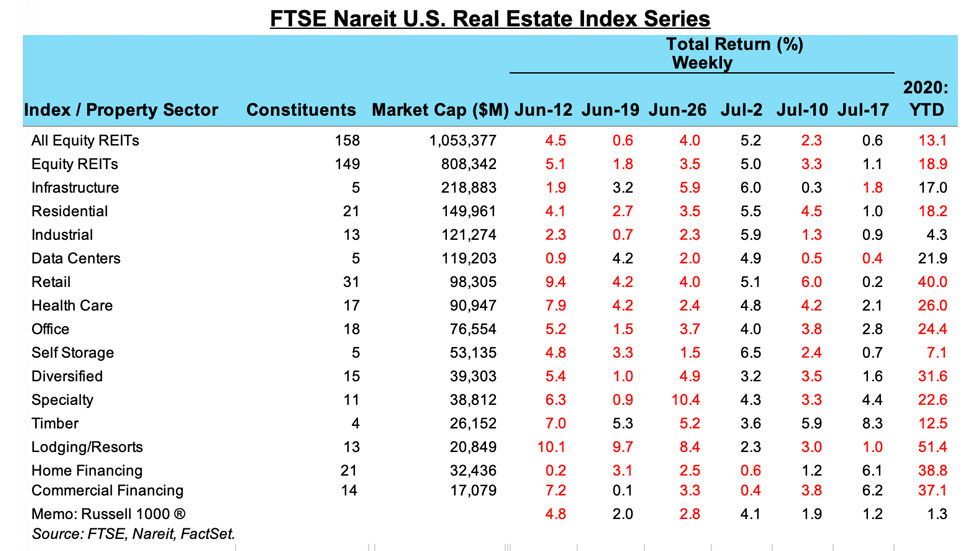

REIT share prices were little changed last week ahead of the start of reporting season for second-quarter earnings. The FTSE Nareit posted a total return of 0.6%, trimming the decline in total returns year-to-date to -13.1%.

Most property sectors recorded small gains to increases in the high single-digits, led by timber REITs (8.3% total return) and specialty REITs (4.4% total return). Infrastructure, lodging and resorts, and data centers edged lower. Both home financing and commercial financing mREITs had total returns of greater than 6%.

REITs begin this week to report earnings for the second quarter. With large parts of the economy closed for much of April and May, earnings are expected to be down considerably. Management discussion of the outlook may take on greater importance than in past earnings seasons, however, due to the potential for operating performance to move back towards pre-crisis levels if the economic reopening can continue later this year and into 2021.