There are times when a disconnect between the operating performance and underlying fundamentals of an industry, compared to equity market performance, may signal an attractive investment opportunity. Such an opportunity exists right now in the REIT market.

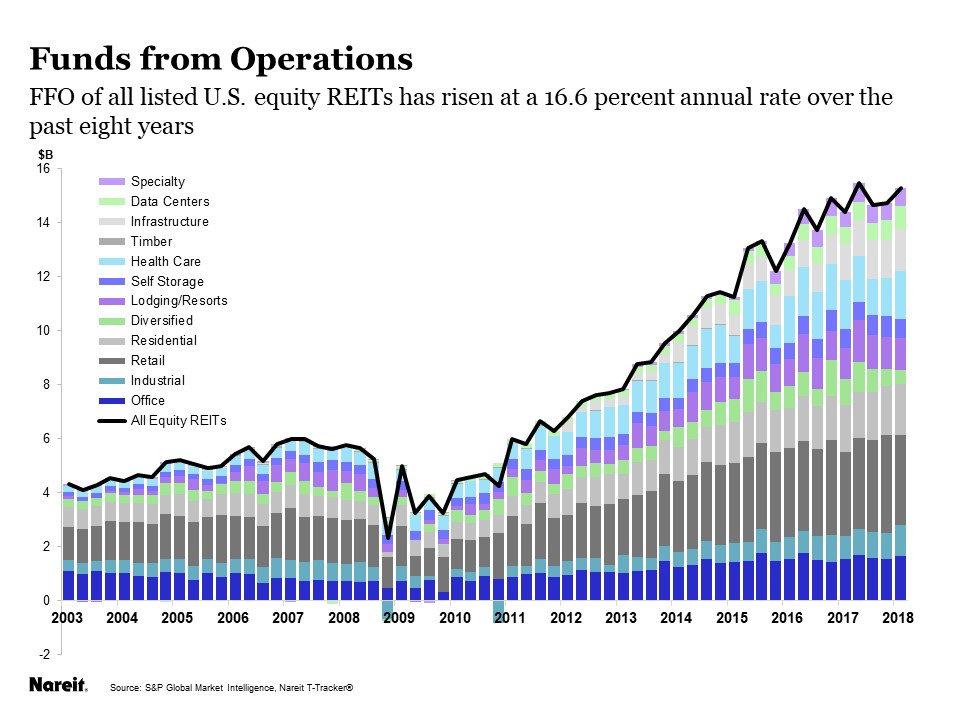

REIT operating fundamentals have improved steadily over the past eight years. Funds from operations (FFO) has risen from $4.5 billion in the first quarter of 2010, to $15.3 billion in the first quarter of 2018, an annual growth rate of 16.6 percent (chart). Several factors have fueled this impressive growth:

- Rising rental income year after year from the (same-store) properties owned by REITs;

- Acquisitions of new properties by existing REITs, as their access to capital markets and their skills at managing properties efficiently have created profitable opportunities to expand their holdings; and

- IPOs by new REITs and conversions of existing companies to REIT status, drawn by the successful track record of the REIT model as a means of owning and operating income-producing real estate.

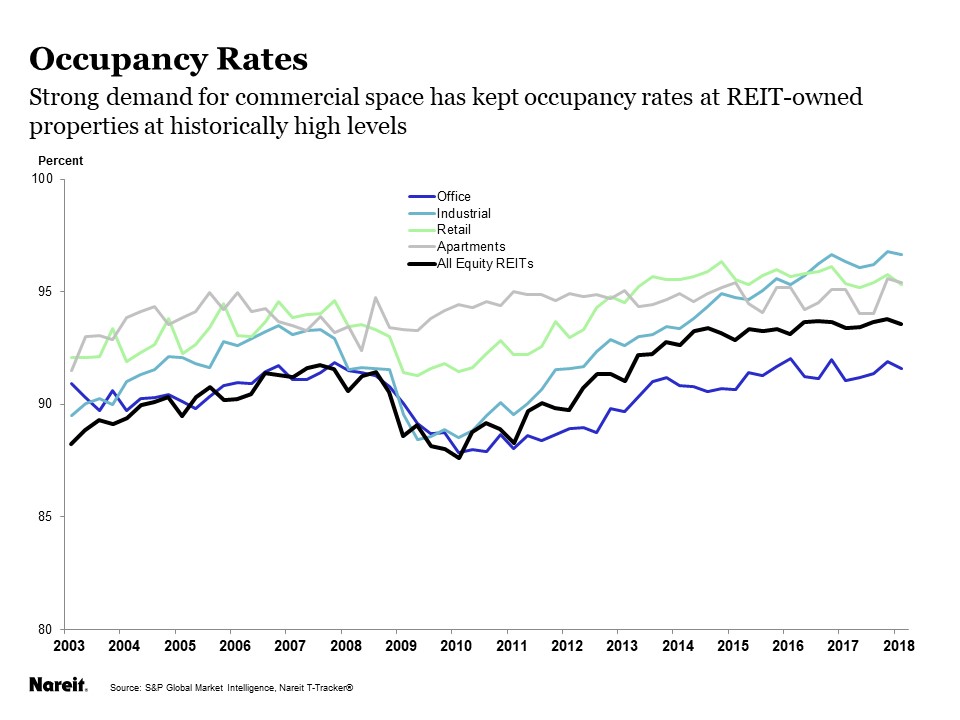

The fundamentals of the REIT industry remain on solid ground, suggesting that earnings will continue to grow. For example, the aggregate weighted average occupancy rate of properties owned by REITs was 93.6 percent in 2018:Q1, just 22 bps below the record high reached in the prior quarter (chart). Demand for commercial space continues to grow in line with new construction, and high occupancy rates are likely to continue to support rental increases and FFO growth in the periods ahead.

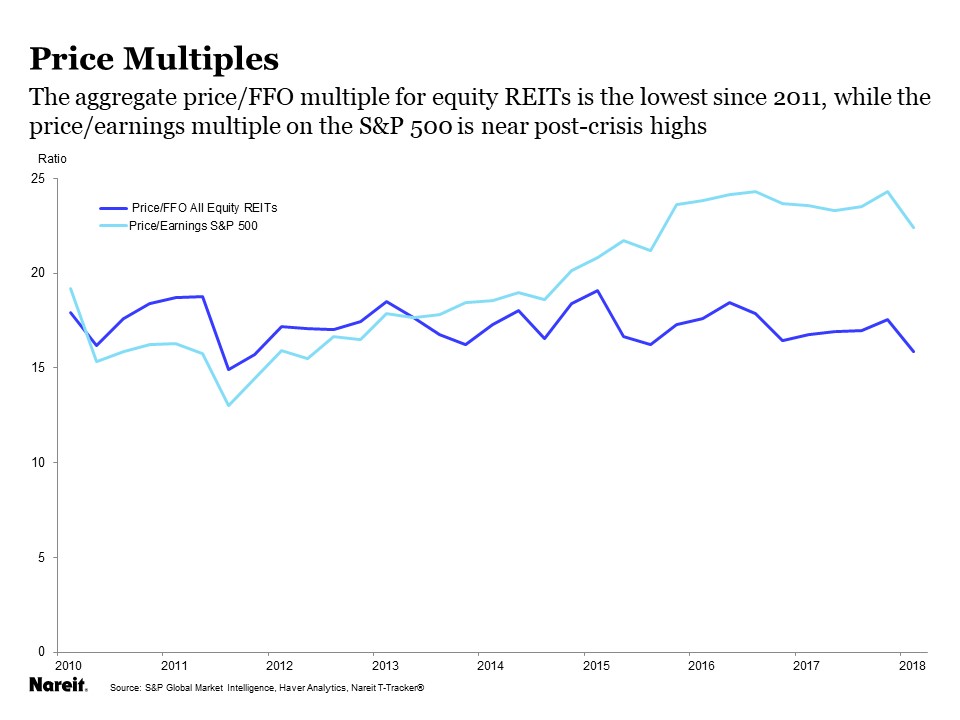

Yet, despite the sound underpinnings of the REIT industry, equity market performance of the sector has been spotty of late. The combination of steady earnings growth and mixed stock price performance has resulted in a decline in the price-to-FFO multiple to 15.9x, the lowest since 2011. That is, the price an investor pays for future earnings and dividends is currently the lowest in seven years.

Share prices of broader corporate equities, in contrast, have risen faster than company earnings, which lifted the price-earnings multiple for the S&P 500 last year to the highest level since before the financial crisis; price multiples edged back a bit in Q1, but remain elevated (chart). Some analysts have warned, indeed, of stock prices being too frothy. It’s not clear just what risks the lofty level of stock prices may pose, but one thing is certain: an investor who wants to buy a dollar of future earnings on the S&P 500 pays a lot more today than in recent history, while an investor in REITs can get future earnings for a lower price today than at any point in the past seven years1.

Investing in REITs has historically improved portfolio performance by adding total return and diversifying investment exposures. Current REIT fundamentals and equity market conditions suggest that investing in REITs will likely continue to have such benefits in the period ahead.

1The chart plots current equity prices divided by trailing earnings of the S&P 500, and trailing FFO of all equity REITs. This may differ from the price multiple on expected future earnings; estimates of forward earnings, however, are not available for all equity REITs. Despite the conceptual difference between trailing and forward earnings, FFO growth, like growth of S&P earnings, often follows recent trends (and analysts’ expectations of future earnings almost always follow recent trends). This suggests that prices on the S&P 500 appear elevated, whether compared to past or future earnings, and prices on REIT shares enjoy better support, whether measured by past or future FFO.

Data on FFO, occupancy rates and price multiples of REITs, as well as other operating and financial measures of the REIT industry, are available for download at the Nareit T-Tracker® page.