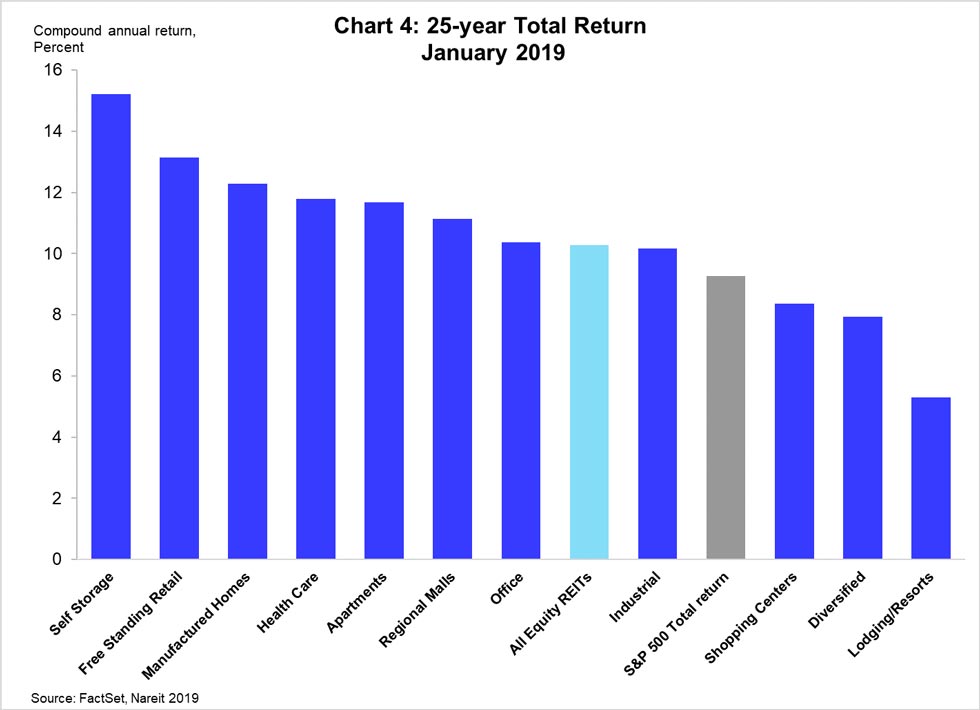

Investing in REITs helps returns in a diversified portfolio in several ways. Most importantly, REITs have delivered a long-term total return to investors that generally matches and often beats broad market aggregates. For example, the compound annual total return on the FTSE-Nareit All Equity REITs index in the 25 years through January, 2019, was 10.3 percent, one full percentage point higher than the total return on the S&P 500 over the same period.

A portfolio that holds REITs also benefits from improved diversification, as REIT returns are not highly correlated with the broader stock market. It’s easy to see how this diversification works if one examines the range of returns across different REIT property types, over both short- and long-term horizons.

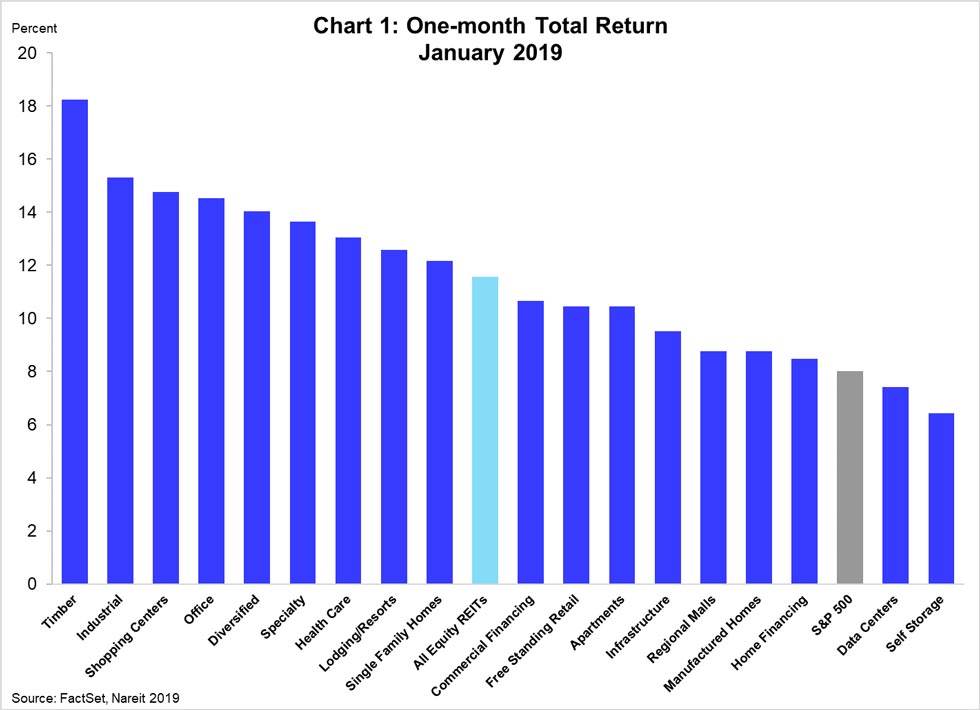

For example, REITs posted a one-month total return of 11.6 percent in January, compared to 8.0 percent for the S&P 500, while the various property sectors within the REIT industry delivered returns ranging from 6.4 percent for Self Storage REITs, to 18.2 percent for Timber REITs. In fact, 17 different REIT sectors outperformed the S&P 500 for the month.

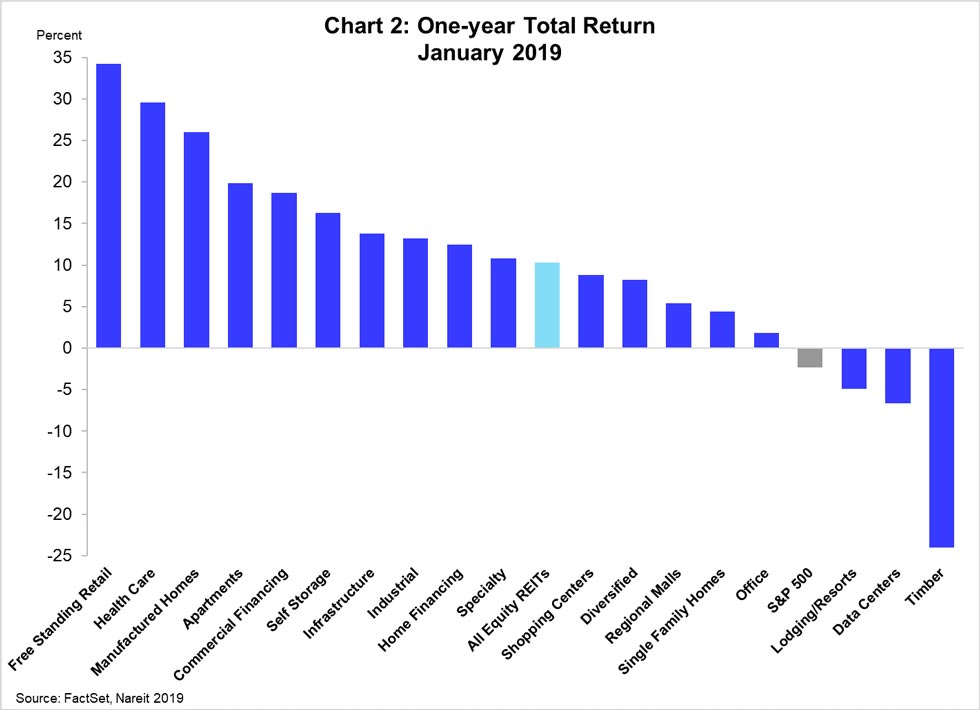

Of course, most investors are interested in holding periods longer than one month. Over the 12 months through January, 2019, REITs delivered a total return of 10.3 percent, in contrast to a 2.3 percent decline in total return the S&P 500. Ten different REIT sectors had total returns in the double-digits over this period, with Free Standing Retail topping the list at 34.2 percent.

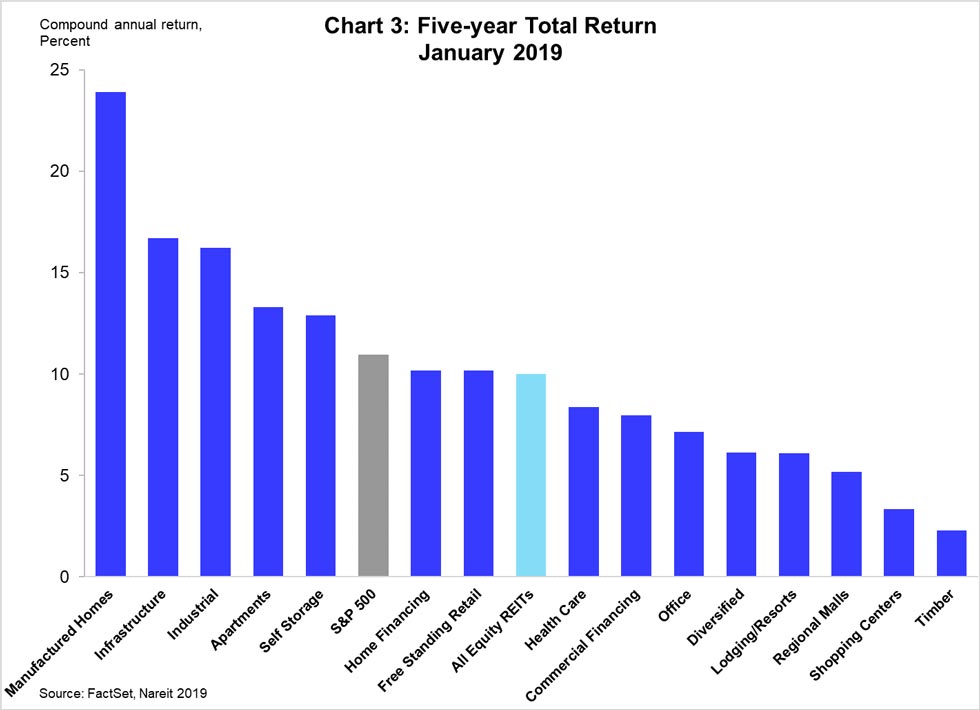

Both the high total return and the diversification benefits of holding REITs across property types hold up over longer time periods as well. Over the past five years, total returns for All Equity REITs were 10.0 percent, slightly behind the S&P 500. There were seven REIT sectors with total returns in the double-digits, led by Manufactured Homes (23.9 percent), Infrastructure (16.7 percent) and Industrial (16.2 percent).

At the 25-year time horizon (that is, since the early days of the Modern REIT Era), eight different REIT property sectors, and the All Equity REITs index, outperformed the S&P 500.