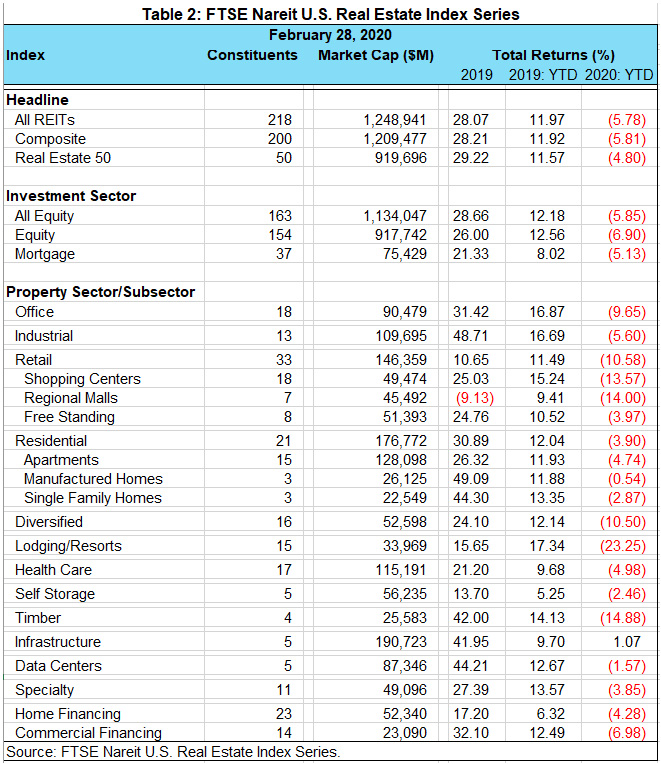

Through the year-to-date period as of the end of February, REITs outperformed the Dow Jones U.S. Total Stock Market by 2.5 percentage points, large cap S&P 500 by 2.4 percentage points, and the small cap Russell 2000 by 5.5 percentage points. Over the same time period in 2019 REITs underperformed the Dow Jones U.S. Total Stock Market by .2 percentage points, outperformed the S&P 500 by .7 percentage points, and underperformed the Russell 2000 by 4.9 percentage points.

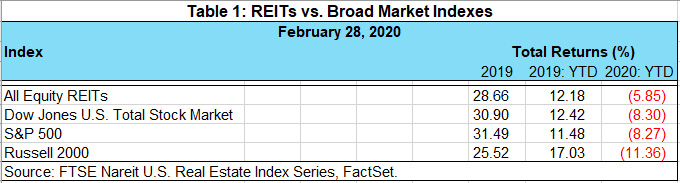

In the FTSE Nareit U.S. Real Estate Index Series, only the infrastructure sector turned in positive total return performance at +1.1%. Unsurprisingly, the travel-related fears brought on by the coronavirus hit lodging/resorts particularly hard at -23.3%, however, timberland (-14.9%), retail (-10.6%), and diversified (-10.5%) also turned in negative double-digit performance. The FTSE Nareit All Equity REITs index was -5.9%, year-to-date. Mortgage REITs posted total returns of -5.1%, with a return of -4.3% for home financing mREITs and -7.0% for commercial financing mREITs. Through Feb. 28th all sectors of the FTSE Nareit U.S. Real Estate Index Series have underperformed when compared against the same time period last year.