Social distancing measures to help slow the spread of covid-19 are having a major impact on economic activity. There is considerable uncertainty as to the magnitude of the effect of the unprecedented shutdown of retail stores, restaurants, travel and many other businesses, but recent news stories suggest it will be severe.

So far there have been few reports with hard data on the economic impact of social distancing measures, the most notable exception being the spike in weekly jobless claims to a record 3.28 million in mid-March. Several important data releases are scheduled in the coming weeks. Here’s what to watch:

- Employment report . The jobs report for March will be released at 8:30 a.m. on Friday April 3, and the whole country will be watching. The data for this report were gathered in a survey that ended the week prior to the spike in jobless claims, however, so the March report will not yet show the full impact of the economic shutdown on job growth and the unemployment rate.

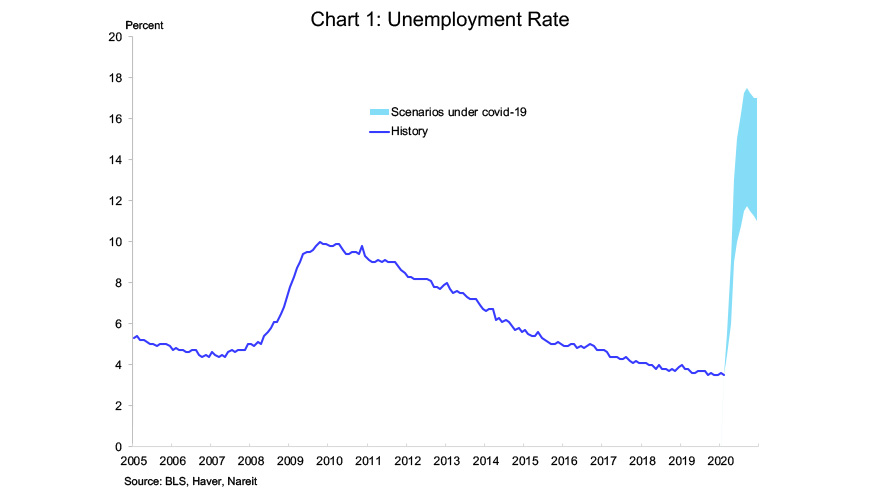

We are expecting to an increase in the unemployment rate in March, followed by much larger increases in subsequent months. The unemployment rate is likely to rise to at least 12% and perhaps approach 18% by summertime. These estimates of the possible increase in unemployment are closely related to the number of jobs in the sectors most exposed to the health crisis. For example, sectors such as hotel, food preparation, clothing and general merchandise stores, building materials, and personal care and service occupations employ approximately 21 million workers. Under the scenarios shown here, the total increase in unemployment could range from a low estimate of 12 million to a high estimate of 22 million. While not all the workers in these sectors will lose their jobs, we expect employment in other businesses to be affected as well.

- Retail sales . The Census Bureau will publish the first estimate of retail sales on April 15. It is clear that sales will show a record drop as shoppers avoided stores in March. What is not clear, however, is to what extent consumers didn’t spend or whether they shifted spending to online sources. The quarterly e-commerce report will not be published until May 19, but the monthly report in two weeks has a line for nonstore retailers, which includes e-commerce. We will be looking to see whether an increase in spending in this category offsets some of the decline in bricks and mortar sales.

- Personal income and consumption. The Bureau of Economic Analysis will publish a more complete report of consumer spending on April 30. This report also has data on household incomes and the saving rate. In addition to consumer spending, we will be looking to see how much the layoffs and job losses have reduced household income growth, and what happened to the saving rate, which was a relatively high 8.2% of household incomes in February. To the extent that spending falls more sharply than incomes, increased saving could be a source of private sector stimulus to get the economy going once the health crisis is under control.

- Commercial real estate performance. Later this month the data on vacancy rates and rent growth in commercial real estate will become available. These reports are quarterly, however, and it may be difficult to identify the impact of events in the latter half of March versus the prior 10 weeks.

- REIT earnings and guidance. REITs will begin reporting first quarter earnings later this month and continuing through May. The most important information will be in management guidance about how the crisis is affecting their tenants and rents, and what they expect in months ahead. We will publish the Nareit T-Tracker®, the comprehensive summary of earnings and operating performance for the REIT industry, a few weeks after earnings season closes.