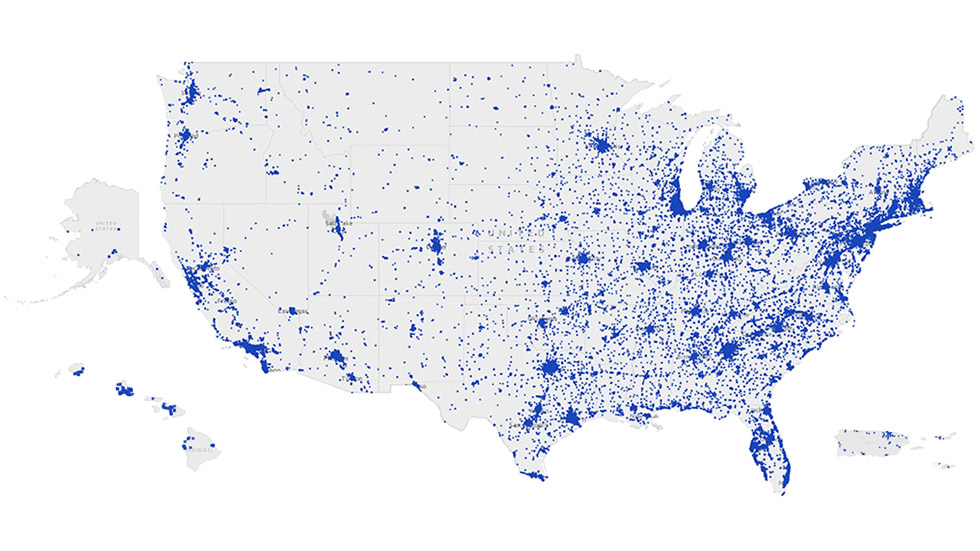

Nareit’s annual update of REIT property counts and estimated gross asset values by state and property sector is now available on the REITs Across America website . At the end of 2020, U.S. public REITs owned an estimated 502,937 properties and 15.1 million acres of timberland across the U.S. A map of REIT properties is shown in Figure 1.

Figure 1. U.S. REIT Properties

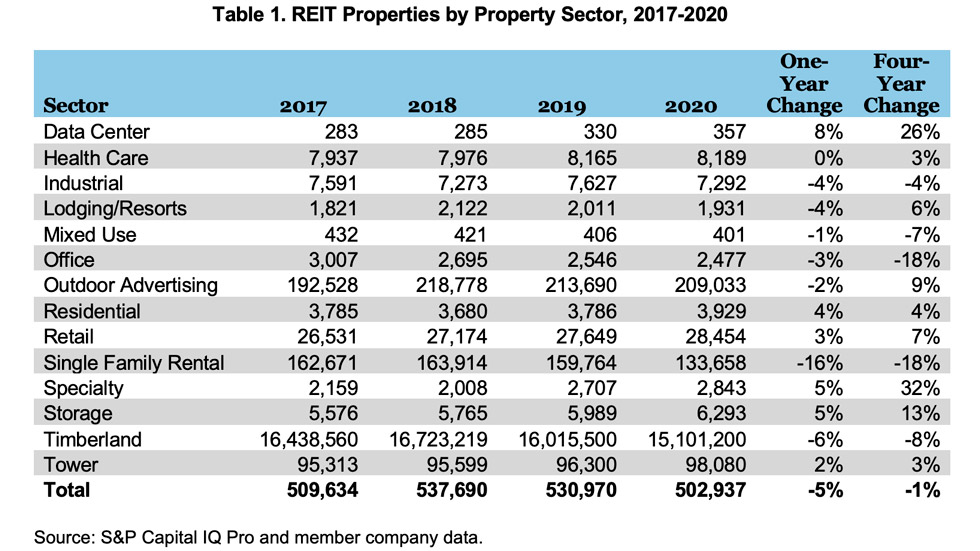

Looking back at four years of data in Table 1, REITs have updated their property portfolios reflecting capital allocation decisions of where and what to buy and sell. The relative slow growth in the number of properties also reflects the slower pace of net acquisitions over this time period as previously reported in Nareit’s T-Tracker . With net acquisitions rising in 2021 , we expect to see growth in next year’s property count.

- Specialty REITs have the largest four-year growth, up 32% since 2017 and with an increase of 5% from 2019. Specialty includes 92 casinos in 2020.

- Data centers are up 8% year over year and 26% since 2017, the second highest four-year growth.

- Even with the rise of e-commerce, retail properties show a net increase year over year of 3%.

- Lodging/resorts declined in 2020, but overall are up 6% since 2017.

- Industrial properties are down 4% in 2020, but likely to rebound in 2021.

- Office properties have been in a contractionary period from 2017 to 2020:

- Office properties are down 18%, and

- Mixed use properties are down 7%.

- Residential properties are up 4% both year over year and since 2017. Single family rental properties are down 16% year over year, mostly due to the acquisition and privatization of Front Yard Residential.

- Storage properties continue to increase every year with 13% four-year growth.

- Health care and tower property counts experienced modest growth.