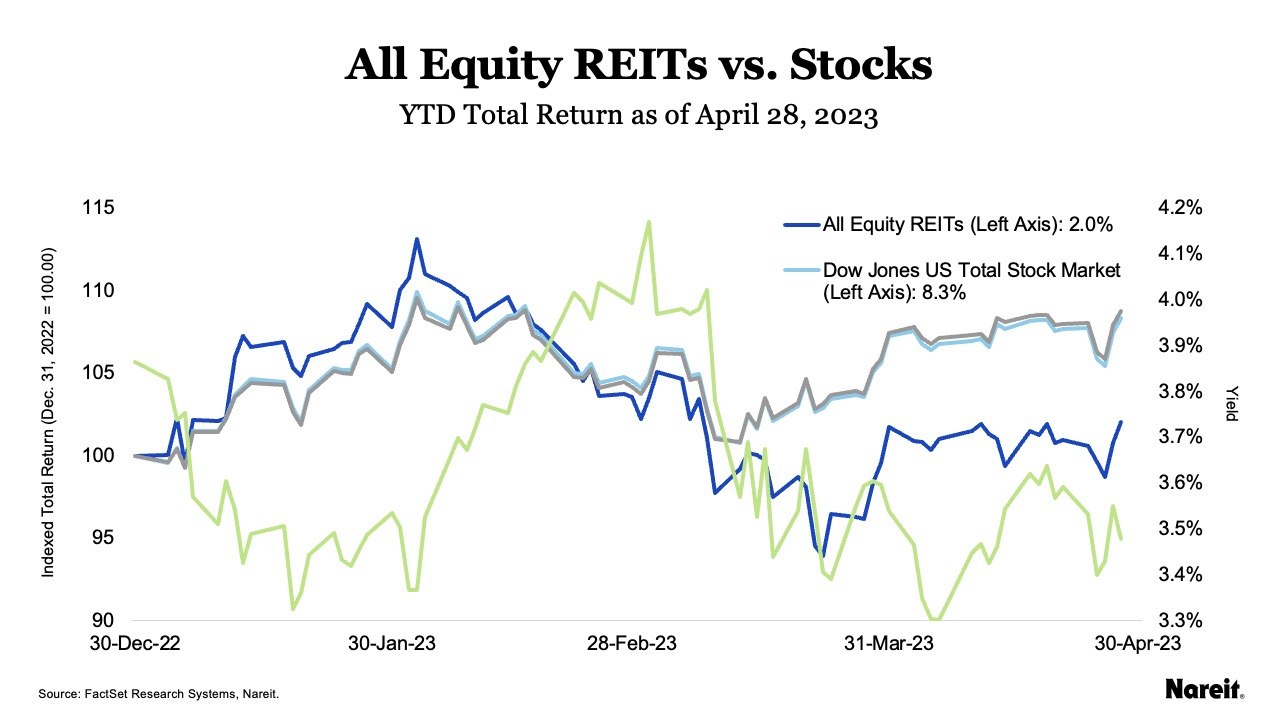

The FTSE Nareit All Equity REITs Index posted a total return of 0.3% in April and the FTSE EPRA Nareit Global Extended Index rose 1.5%. April marked a return to gains for REITs after disappointing February and March returns. Broader markets also posted narrow gains, as the Russell 1000 rose 1.2% and the Dow Jones U.S. Total Stock Market gained 1.0%. On a year-to-date basis, the All Equity REITs Index returned 2.0% and the Global Extended Index is up 2.2%. Investor sentiment has remained cautious as concerns over the potential for a widening banking credit contraction persist and the Federal Reserve continues its efforts to curb inflation. Volatility in bond markets persisted as the yield on the 10-Year Treasury fell to 3.3% before ending the month at 3.5%.

As shown in the above chart, REITs continue to underperform broader markets on a year-to-date basis, with total returns as follows:

- All Equity REITs: 2.0%

- Russell 1000: 8.8%

- Dow Jones U.S. Total Stock Market: 8.3%

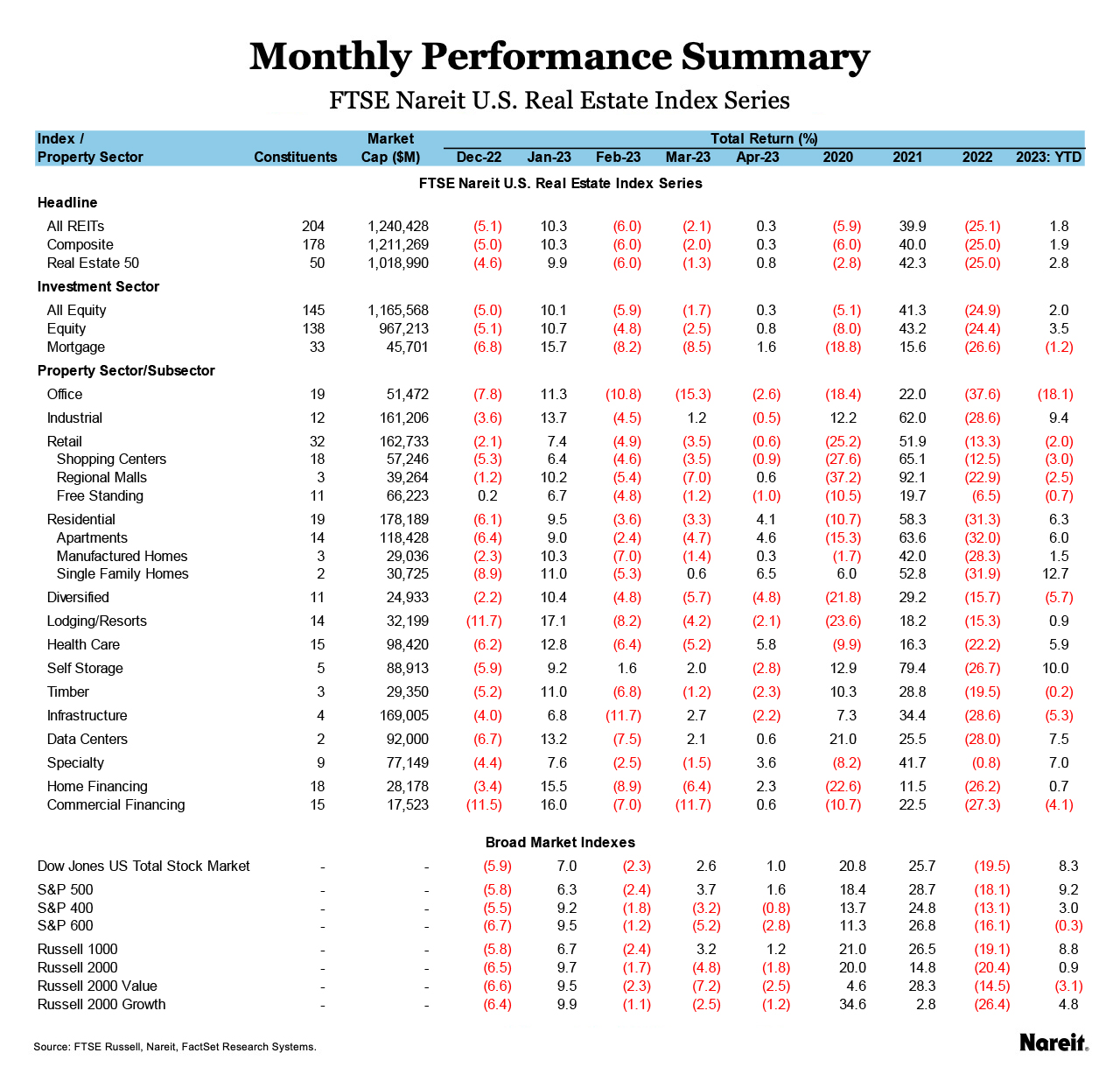

As shown in the table above, property sector performance was mixed, as health care, residential, and specialty led with respective returns of 5.8%, 4.1%, and 3.6%. Diversified lagged all other sectors with a total return of -4.8%, followed by self-storage at -2.8%, and office at -2.6%. On a year-to-date basis, self-storage and industrial have performed well, rising 10.0% and 9.4%, respectively, while office portfolios continue to face headwinds. The office sector has underperformed with a total return of -18.1%, while diversified is down 5.7% for the year. Mortgage REITs posted a narrow gain in April, rising 1.6%. Home financing mREITs were up 2.3% for the month and commercial financing mREITs rose 0.6%.

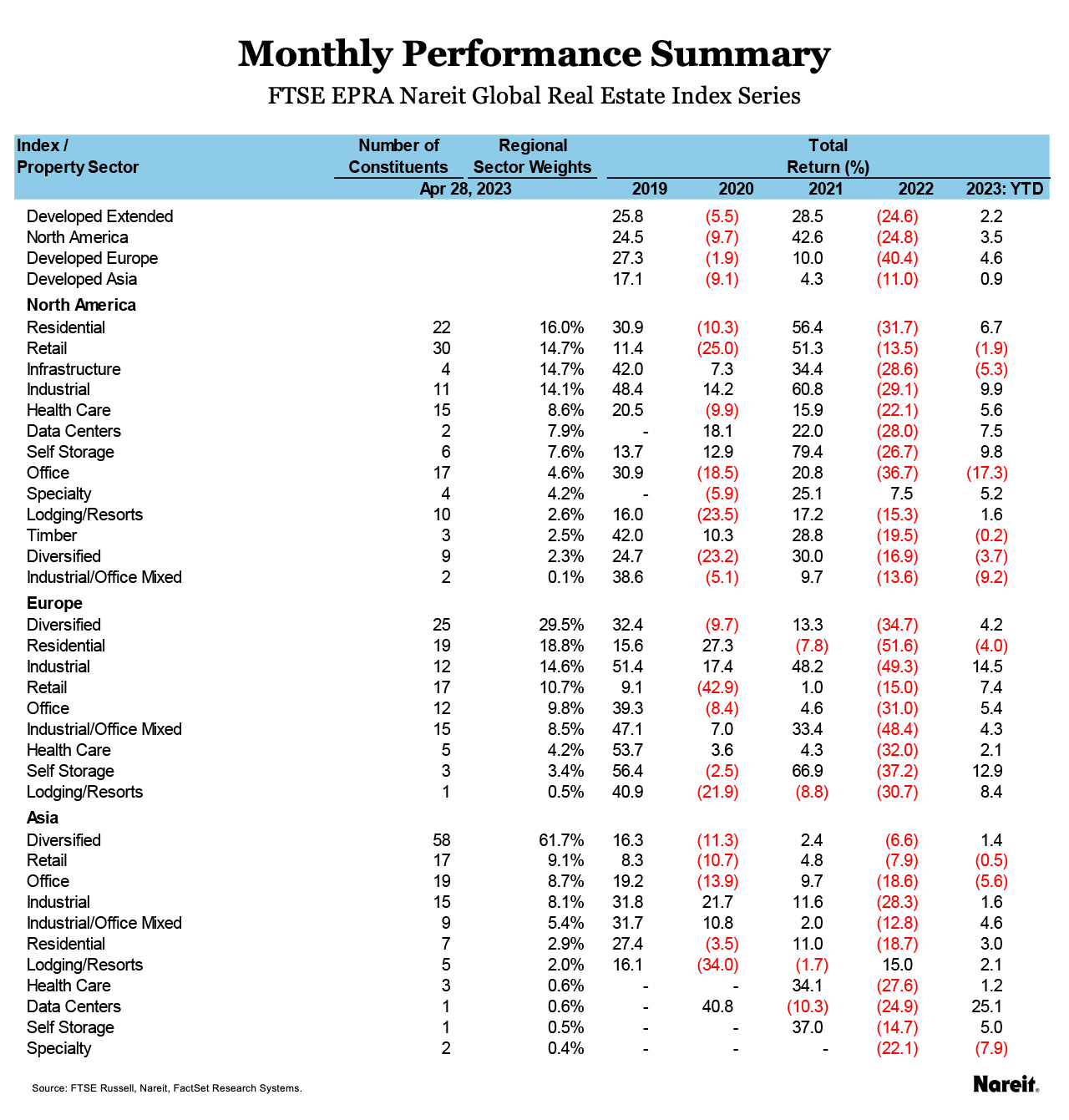

Globally, Europe leads on a year-to-date basis with a total return of 4.6%, followed by North America at 3.5%, and Asia at 0.9%. The industrial sector has performed well in Europe and North America, with respective total returns of 14.5% and 9.9%, with Asia following at 1.6%. While the office sector has lagged in North America with a total return of -17.3% and Asia is down 5.6%, the European office sector has posted a total return of 5.4% in 2023.