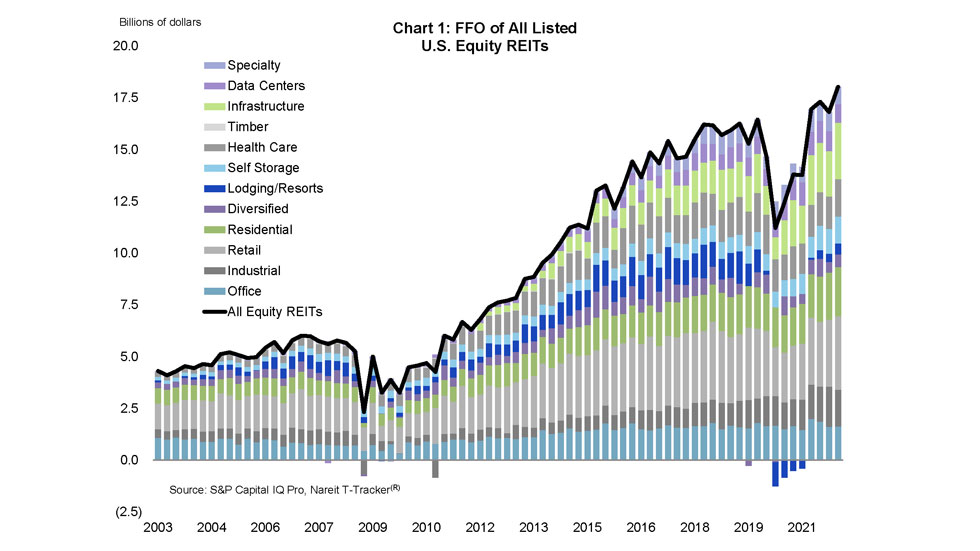

REIT earnings, as measured by funds from operations (FFO), increased 30.9% from the previous year to a record high of over $18 billion in the first quarter of 2022, according to the Nareit T-Tracker®. FFO bounced back from the slight decline in the fourth quarter of 2021 with a quarterly increase of 7.2%.

Earnings growth was strongest in some of the hardest hit property sectors by the pandemic. Free standing retail was up 37.3% for the quarter and 81.8% from the previous year, boosting the retail sector past pre-pandemic earnings for the first time since recovery began. Retail overall gained 1.4 percentage points in its occupancy rate for the quarter, rising to 96.5%. Notably, one of the sectors hardest hit by the pandemic, lodging/resorts, was up 29.7% for the quarter although still not above 2019 earnings. Infrastructure increased 24.0% for the quarter, up 47.3% over the previous year.

Several other sectors had more moderate gains, including health care and diversified, which are recovering after having been among the sectors most impacted by the shutdowns early in the pandemic. Acquisitions in the data center sector throughout 2021 led to a decline in FFO with three REITs exiting the sector as listed REITs. Adjusted for these exits, data center FFO would be up 5.0% for the quarter and 5.7% for the year.

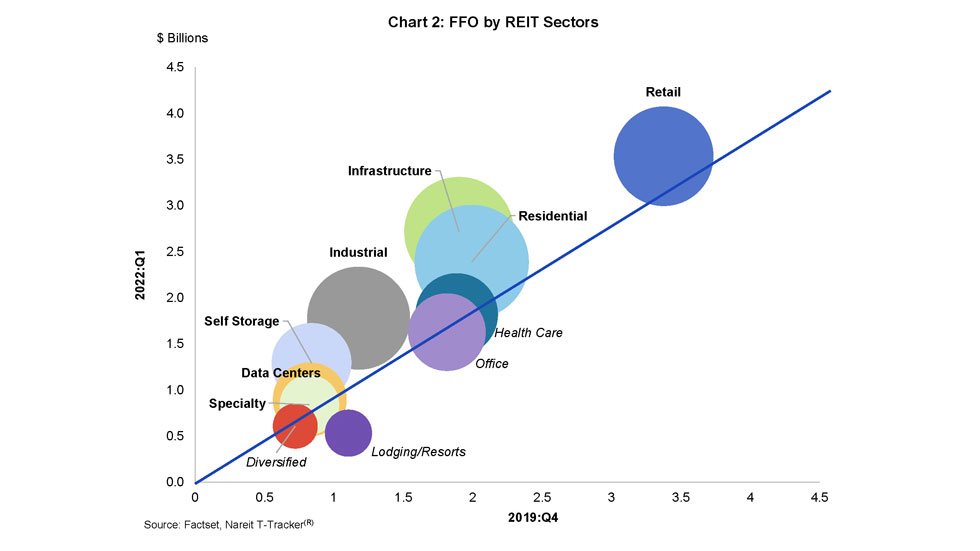

In the first quarter of 2022, FFO of all equity REITs was 9.6% higher than in the final quarter of 2019:

Property sectors with FFO exceeding pre-pandemic levels include self storage (+54.4% above 2019Q4), industrial (+51.1%), infrastructure (+42.9%), residential (+19.9%), data centers (+8.8%), retail (+4.7%) and specialty (+2.1%).

Property sectors with FFO below pre-pandemic levels include health care (-3.5%), office (-10.3%), diversified (-15.7%), and lodging/resorts (-51.8%).

For complete data available to download in spreadsheets and charts, visit the Nareit T-Tracker.