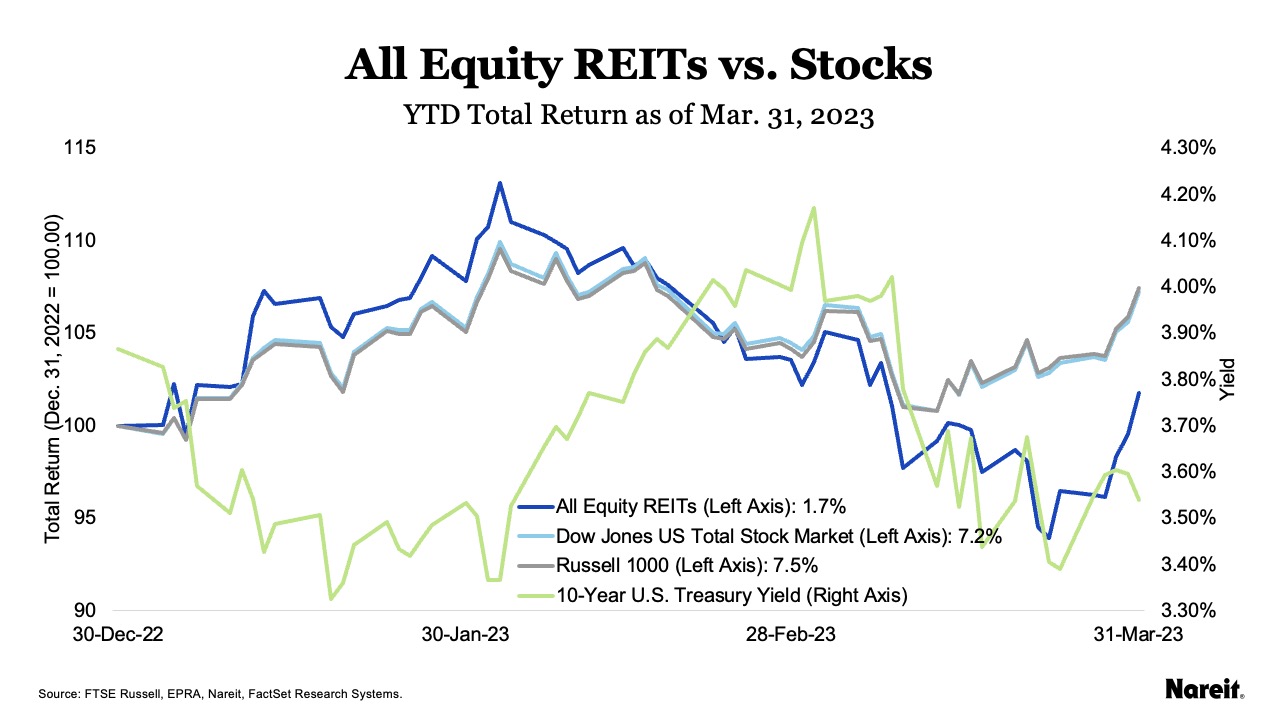

The FTSE Nareit All Equity REITs Index (pdf) ended a tumultuous March down 1.7% for the month, and the FTSE EPRA Nareit Global Extended Index (pdf) declined 2.3%. Broader markets outperformed, as the Russell 1000 and Dow Jones U.S. Total Stock Market posted respective total returns of 3.2% and 2.6%. On a year-to-date basis the All Equity REITs Index remained in positive territory with a total return of 1.7% and the Global Extended Index rose 0.5%.

March performance was defined by concerns about a credit crisis after the collapse of Silicon Valley Bank, modestly declining rates of inflation, and speculation that the Federal Reserve may pivot from its rate-hiking cycle. Through March 28, the All Equity REITs index was down 7.2% for the month, before rallying 5.8% in the final three trading sessions. The 10-Year Treasury was similarly volatile as interest rate expectations declined: After rising from 3.9% at the beginning of the year to 4.2% on March 2, the yield on the 10-year Treasury ended the first quarter at 3.5%.

The chart above shows three distinct periods of Q1 performance. After rallying to begin the year, REITs and stocks pulled back on uncertainty about the stability of the banking system, followed by a rebound in March as fears abated. Total returns for Q1 were as follows:

- All Equity REITs: 1.7%

- Russell 1000: 7.5%

- Dow Jones U.S. Total Stock Market: 7.2%

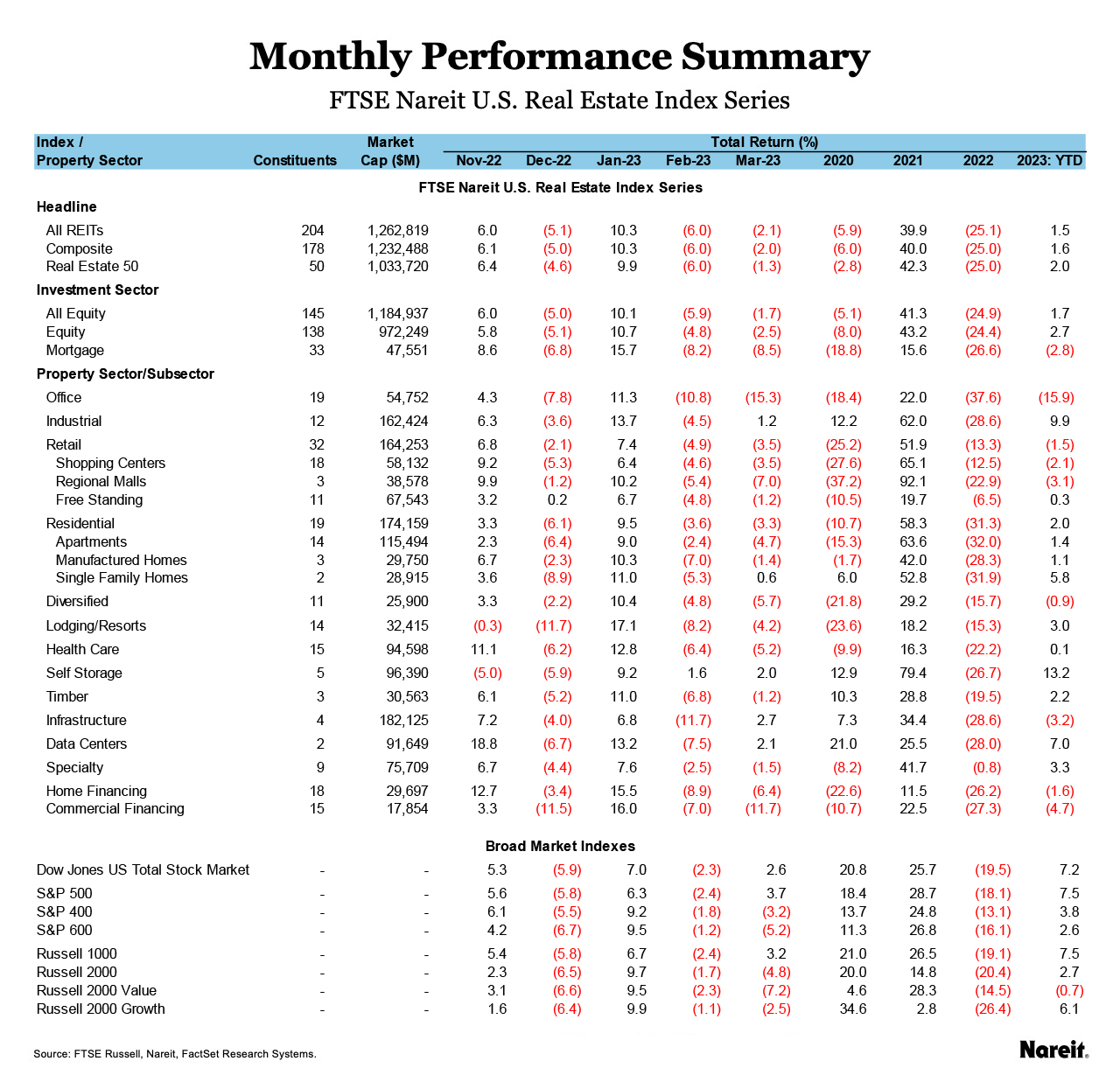

Sector returns were mixed in March, as laid out in the above table.

Infrastructure led to the upside with a total return of 2.7% in March, followed by data centers at 2.1%, and self-storage at 2.0%. Office lagged all other sectors with a return of -15.3%, trailed by diversified at -5.7%, and health care at -5.2%. Mortgage REITs were down as well, with a total return of -8.5%. Home financing mREITs were down 6.4% for the month and commercial financing mREITs declined 11.7%.