Over the past two decades, the structure of the economy has changed dramatically, and we see this most clearly in how work, shopping, and leisure are increasingly connected to the digital economy. As the economy has changed, so too has the real estate that houses the economy.

REITs have been on the leading edge of this change and today provide investors with access to a broad range of property types. REITs are leaders in owning and operating the real estate that supports the 21st century economy including communications towers (infrastructure), data centers, and integrated logistics facilities (industrial) used in e-commerce fulfillment.

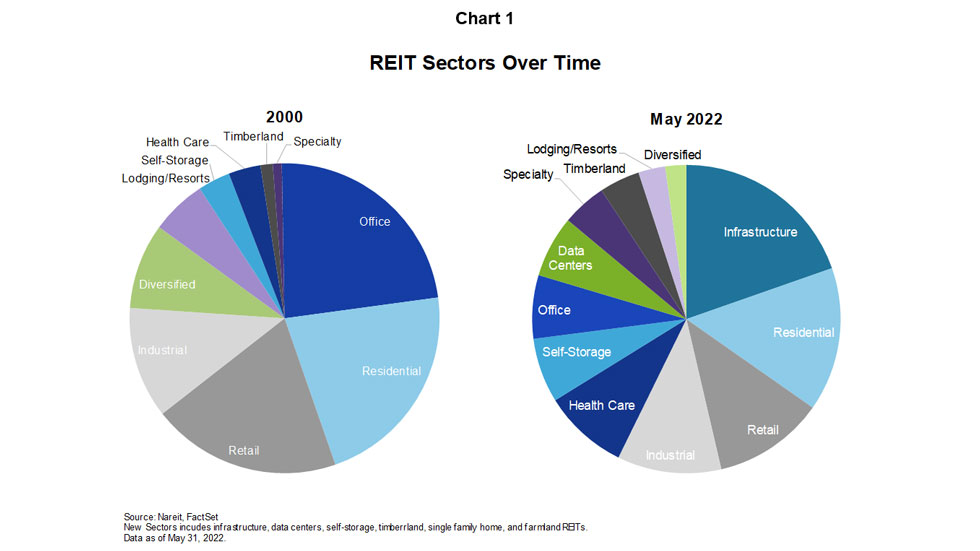

The REIT universe has expanded greatly beyond the property sectors institutional investors traditionally owned – retail, office, residential and industrial. Chart 1 shows that in 2000, these sectors comprised more than 80% of the market capitalization of equity REITs. In 2022, the sectors supporting technology and e-commerce now account for 36% of the market capitalization of all equity REITs.

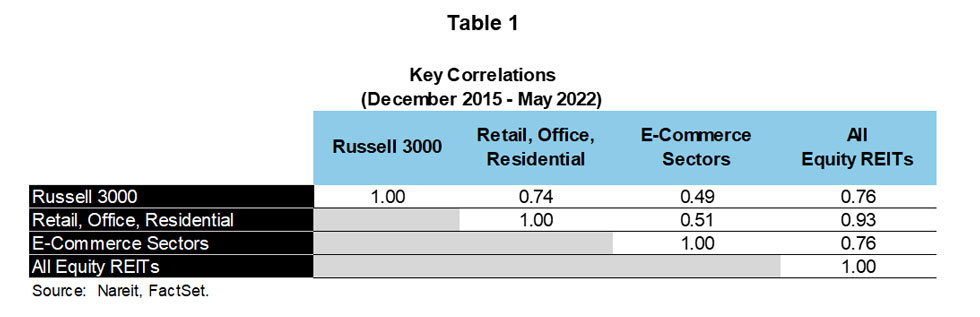

Access to new and emerging property sectors has given rise to an important new dimension of portfolio diversification, one in which REITs are well positioned. As shown in Table 1, the correlation between a portfolio of retail, office, and residential sectors and a portfolio of certain digital connected REIT sectors (communications towers/infrastructure, data centers, and industrial/logistics) is .51, while the correlation of retail, office, and residential with All Equity REITs climbs to .93.

A completion portfolio has increased returns and reduced volatility

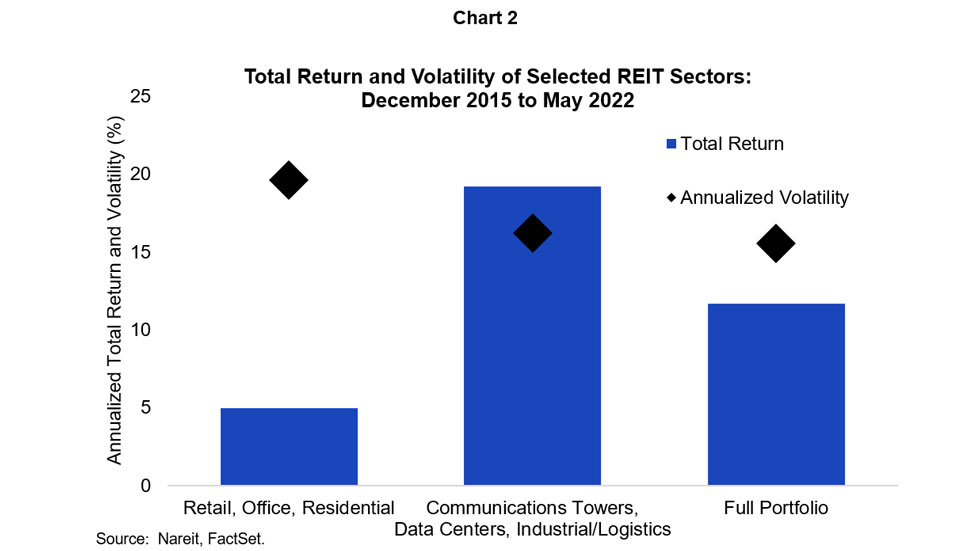

Chart 2 shows the impact of adding the e-commerce sectors to a core portfolio. Total return on the retail, office, and residential portfolio was an annualized 4.9% from December 2015 to May 2022. Over this same period, a completion portfolio consisting of the communications tower/infrastructure, data center, and industrial/logistics REITs, however, provided a total return of 19.2%. The combined portfolio of retail, office, and residential REITs plus the completion portfolio, with each weighted by market capitalization, returned 11.7%.

Including the e-commerce portfolio also has tended to reduce volatility. The annualized volatility on the retail, office, and residential REITs portfolio was 19.6%. Returns on the completion portfolio consisting of communications towers/infrastructure, data centers, and industrial/logistics REITs reduced volatility to 16.2%. Importantly, while returns rise on the full portfolio, the volatility declines slightly to 15.6%.