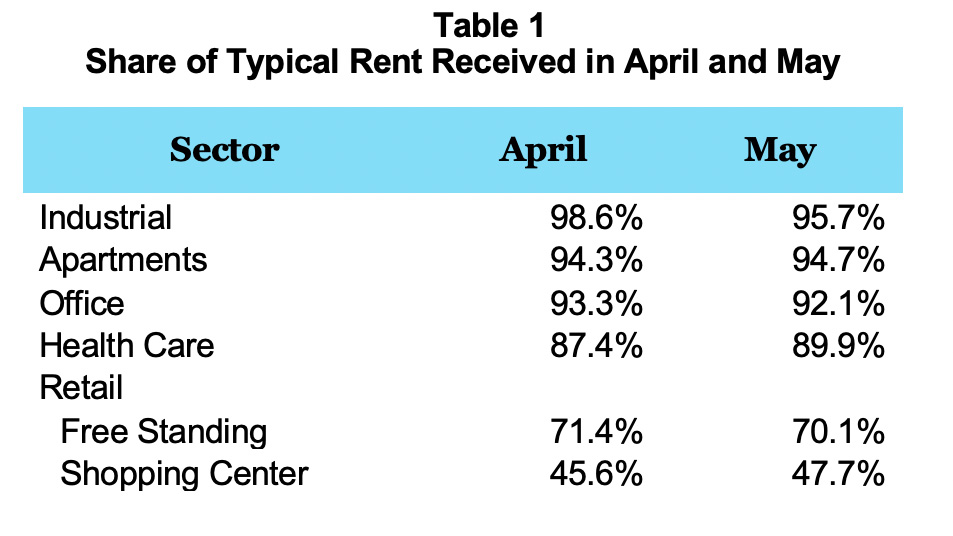

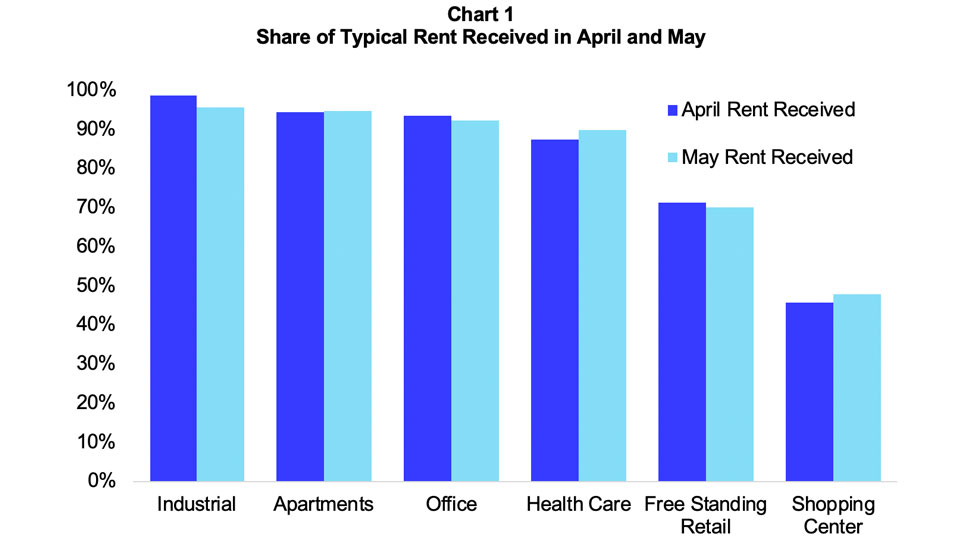

To assess rent collections in the wake of the COVID-19 pandemic and related closures, Nareit has surveyed its membership about monthly rent collections for April and May. The most recent results show that on average for REITs, the share of typical rent collected in May was largely unchanged from April.

This suggests that while REIT tenants in some hard-hit sectors continue to struggle, their ability to pay rent did not appreciably worsen in May despite the widespread shutdowns in April. Read the Research Note for a full description of the surveys and results.

Source: Equity market capitalization weighted. Nareit survey of members, public disclosures, and FTSE Nareit All REIT index equity market capitalization as of April 30, 2020 via FactSet.

There are 43 equity REITs in this sample across six property sectors (industrial, apartments, office, health care, free standing retail, and shopping centers). The data came primarily from two surveys conducted by Nareit, supplemented by public disclosures of rent collections. The sample represents 63% of the FTSE All REITs total equity market capitalization for those property sectors. Sectors are only reported where survey participation is sufficient to maintain participant confidentiality. Table 1 and Chart 1 show the estimated REIT rent collections in April and May as a share of typical rent collections. The results are displayed by property sector and are weighted by respondent REIT equity market capitalization.

Source: Equity market capitalization weighted. Nareit survey of members, public disclosures, and FTSE Nareit All REIT index equity market capitalization as of April 30, 2020 via FactSet.